Introduction

In a landmark moment for global sustainability efforts, the International Sustainability Standards Board (ISSB) recently issued its first two standards on June 26, 2023. These standards, IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures, mark a significant step in establishing a universal framework to communicate an entity's sustainability risks and opportunities, particularly those associated with climate change.

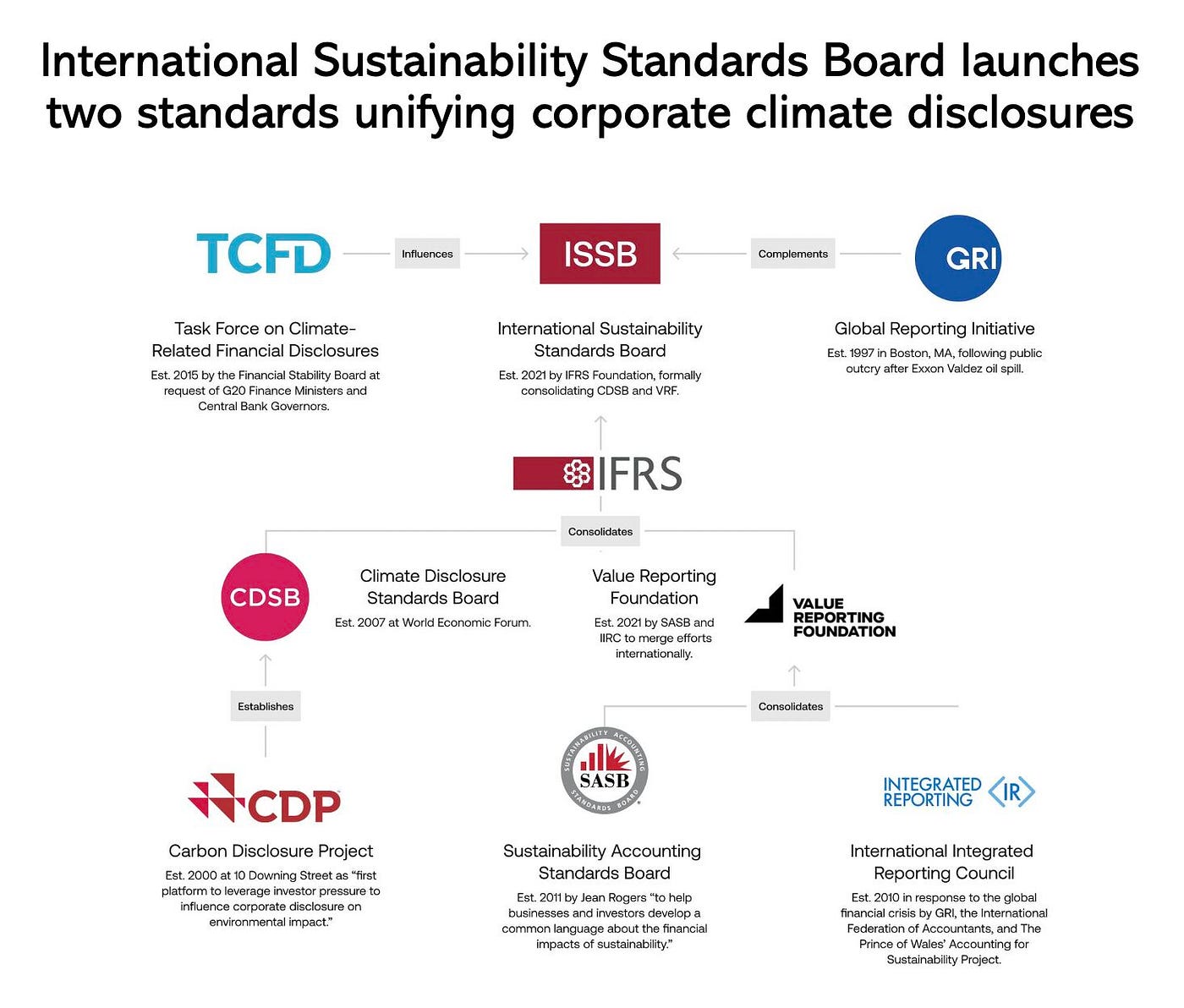

Building upon existing frameworks like TCFD and SASB, the ISSB standards leverage the widespread adoption of these frameworks, with thousands of global companies incorporating SASB Standards and numerous organizations supporting TCFD.

This article will explore how various global sustainability organizations collaborate and complement each other in advancing sustainable practices worldwide.

International Sustainability Standards Board (ISSB)

The establishment of the International Sustainability Standards Board (ISSB) by the Trustees of the IFRS Foundation was announced on November 3, 2021, during COP26 in Glasgow, in response to the growing demand from the market. With a focus on the needs of investors and financial markets, the ISSB aims to develop high-quality, globally recognized sustainability disclosure standards in the public interest.

As sustainability considerations increasingly influence investment decisions, there is a strong call for companies to provide comprehensive and comparable information on sustainability-related risks and opportunities. This demand has been reinforced through extensive consultations with market participants.

Moreover, the ISSB's formation addresses the challenge of a fragmented landscape of voluntary sustainability-related standards and requirements. By creating a cohesive framework, it aims to reduce costs, complexity, and risks for both companies and investors.

The ISSB has garnered international support, with backing from prestigious entities such as the G7, G20, International Organization of Securities Commissions (IOSCO), Financial Stability Board, African Finance Ministers, and Finance Ministers and Central Bank Governors from over 40 jurisdictions. This strong backing highlights the global recognition of the importance of developing robust sustainability disclosure standards.

Objectives:

The ISSB has outlined four primary objectives:

- Developing standards for a comprehensive global baseline of sustainability disclosures.

- Meeting the information needs of investors.

- Enabling companies to furnish comprehensive sustainability information to global capital markets.

- Facilitating interoperability with disclosures tailored to specific jurisdictions or broader stakeholder groups.

In pursuit of these objectives, the ISSB builds upon the foundation laid by market-led, investor-focused reporting initiatives. These initiatives include the Climate Disclosure Standards Board (CDSB), the Task Force for Climate-related Financial Disclosures (TCFD), the Integrated Reporting Framework by the Value Reporting Foundation, industry-based SASB Standards, and the Stakeholder Capitalism Metrics introduced by the World Economic Forum.

The ISSB seeks to establish robust and globally accepted sustainability reporting standards, by leveraging the collective expertise and insights from these initiatives.

Let us now delve into other prominent global sustainability reporting initiatives and organizations, exploring their collaborative efforts in fostering transparent sustainability reporting.

Global Reporting Initiative (GRI)

The Global Reporting Initiative (GRI) is a pivotal international, independent, nonprofit organization that offers a widely recognized framework for sustainability reporting. Founded in 1997 through a collaboration between the United Nations Environment Programme (UNEP) and the Coalition for Environmentally Responsible Economies (CERES), GRI's mission is to enable organizations to understand and communicate the impacts of their activities on people and the environment, with the ultimate goal of sustainably improving the world.

The GRI Standards: A Comprehensive Framework

Central to GRI's work are the GRI Standards, a comprehensive set of guidelines that encompass a broad spectrum of economic, environmental, and social topics. Organizations worldwide utilize these standards to report their sustainability performance and impacts. The GRI Standards consist of three main sections:

- Universal Standards: Laying the foundation for all GRI reporting, these standards encompass governance, strategy, and management approach topics.

- Sector Standards: Providing additional guidance for organizations in specific sectors, such as agriculture, manufacturing, and financial services.

- Topic Standards: Offering detailed guidance on specific subjects like climate change, human rights, and corruption.

Key Characteristics of GRI

The Global Reporting Initiative is characterized by several key features that underline its effectiveness and relevance:

Multi-Stakeholder Engagement: The development of GRI Standards is achieved through a collaborative, multi-stakeholder process that includes diverse input from organizations, civil society groups, labor unions, and academic institutions.

Comprehensive Reporting: By covering an extensive range of economic, environmental, and social topics, GRI Standards provide a comprehensive and all-encompassing framework for sustainability reporting.

Materiality Focus: The GRI Standards underscore the importance of materiality, emphasizing the relevance of sustainability issues to an organization's operations and stakeholders.

Transparency: GRI Standards necessitate transparent and accessible disclosure of sustainability performance, allowing stakeholders to comprehend an organization's impacts and progress.

Continuous Improvement: Encouraging ongoing progress, the GRI Standards prompt organizations to set goals, track progress, and continuously enhance their sustainability performance.

The GRI Reporting Process: A Structured Approach

Organizations can adopt the GRI Reporting Process, a structured approach for reporting their sustainability performance using the GRI Standards. This process involves essential steps such as stakeholder engagement, materiality assessment, data collection, drafting the report, review and validation, publication, and continuous improvement.

The Significance of GRI

The Global Reporting Initiative (GRI) plays a pivotal role in the realm of sustainability reporting, offering a standardized approach that fosters accountability, transparency, and stakeholder trust. By advocating for organizations to address sustainability risks and impacts, GRI actively contributes to driving positive change and advancing global sustainability efforts.

Furthermore, GRI's work seamlessly complements the International Sustainability Standards Board (ISSB), as it facilitates the most effective and transparent means for sustainability disclosures. Together, these organizations play a significant role in promoting sustainable practices and enabling organizations to communicate their sustainability performance with clarity and integrity.

Carbon Disclosure Project (CDP)

Established in 2000, CDP (formerly known as the Carbon Disclosure Project) emerged in response to the growing recognition of the environmental impacts of business activities, particularly carbon emissions.

CDP was founded on the belief that driving transparency in corporate environmental impact can catalyze positive change. By encouraging companies to disclose their carbon emissions, water usage, and climate-related risks and opportunities, CDP aims to foster sustainable practices and inspire sustainable investment decisions.

Objectives:

- Encourage companies to disclose their environmental data, particularly carbon emissions and water usage.

- Facilitate meaningful dialogue between companies and investors, enhancing understanding of climate-related risks and opportunities.

- Empower businesses to proactively manage and mitigate their environmental impacts.

Sustainability Accounting Standards Board (SASB)

Formed in 2011, SASB was established to address the lack of standardized sustainability reporting in financial filings, thereby enhancing decision-making for investors and companies alike.

SASB recognized the critical role that standardized sustainability reporting plays in enabling investors to make informed decisions. By providing specific industry-focused sustainability accounting standards, SASB seeks to enhance the comparability and relevance of sustainability information in financial filings.

Objectives:

- Develop industry-specific sustainability accounting standards to enable consistent and relevant disclosure in financial filings.

- Enable investors to assess the financial materiality of sustainability factors across different industries.

- Improve the quality and transparency of sustainability reporting, facilitating more informed investment decisions.

International Integrated Reporting Council (IIRC)

Established in 2010, the IIRC emerged from the need for more comprehensive reporting frameworks that would encompass both financial and non-financial information.

The IIRC recognized that conventional financial reporting does not adequately capture the broader value creation aspects of an organization. Integrated Reporting seeks to integrate financial and non-financial information to provide a more holistic view of an organization's performance and value creation.

Objectives:

- Develop the Integrated Reporting Framework to encourage organizations to provide a more comprehensive and connected view of their performance.

- Enhance decision-making and resource allocation by enabling stakeholders to understand the broader value creation aspects of an organization.

- Foster long-term thinking and sustainable practices in business strategies.

Task Force on Climate-Related Financial Disclosures (TCFD)

Launched in 2015 by the Financial Stability Board (FSB) under the guidance of Mark Carney, TCFD emerged as a response to the financial risks posed by climate change.

Recognizing climate change as a systemic financial risk, TCFD aimed to develop a framework to improve the disclosure of climate-related risks and opportunities for businesses and investors.

Objectives:

- Develop a consistent and comparable framework for disclosing climate-related financial risks and opportunities.

- Enable companies to assess and disclose their exposure to climate-related risks and the resilience of their strategies to climate change impacts.

- Enhance the transparency and understanding of climate-related risks for investors, lenders, and other stakeholders.

Conclusion: Uniting Forces for Sustainable Impact

In the pursuit of a sustainable future, various global sustainability organizations have emerged as catalysts for positive change. From the International Sustainability Standards Board (ISSB) setting the stage for universal sustainability reporting standards to the Carbon Disclosure Project (CDP) encouraging transparency in corporate environmental impact, each organization plays a crucial role in advancing sustainable practices worldwide.

The collaboration between these organizations further enhances their collective impact, promoting a harmonized approach to sustainability reporting. The Global Reporting Initiative (GRI), with its comprehensive framework and emphasis on multi-stakeholder engagement, complements the ISSB in providing a standardized and transparent means for sustainability disclosures. Likewise, the Sustainability Accounting Standards Board (SASB) focuses on industry-specific sustainability standards, empowering investors with relevant and comparable information for informed decision-making.

The International Integrated Reporting Council (IIRC) takes a holistic approach, bridging the gap between financial and non-financial reporting to provide a comprehensive view of organizations' value creation aspects. In parallel, the Task Force on Climate-Related Financial Disclosures (TCFD) hones in on the financial risks posed by climate change, empowering companies to disclose climate-related risks and opportunities.

Collectively, these organizations work in synergy, addressing the multifaceted challenges of sustainability reporting and empowering stakeholders with the information needed to make sustainable decisions. Their dedication to transparency, materiality, and continuous improvement sets the stage for a more sustainable and resilient global business landscape.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)