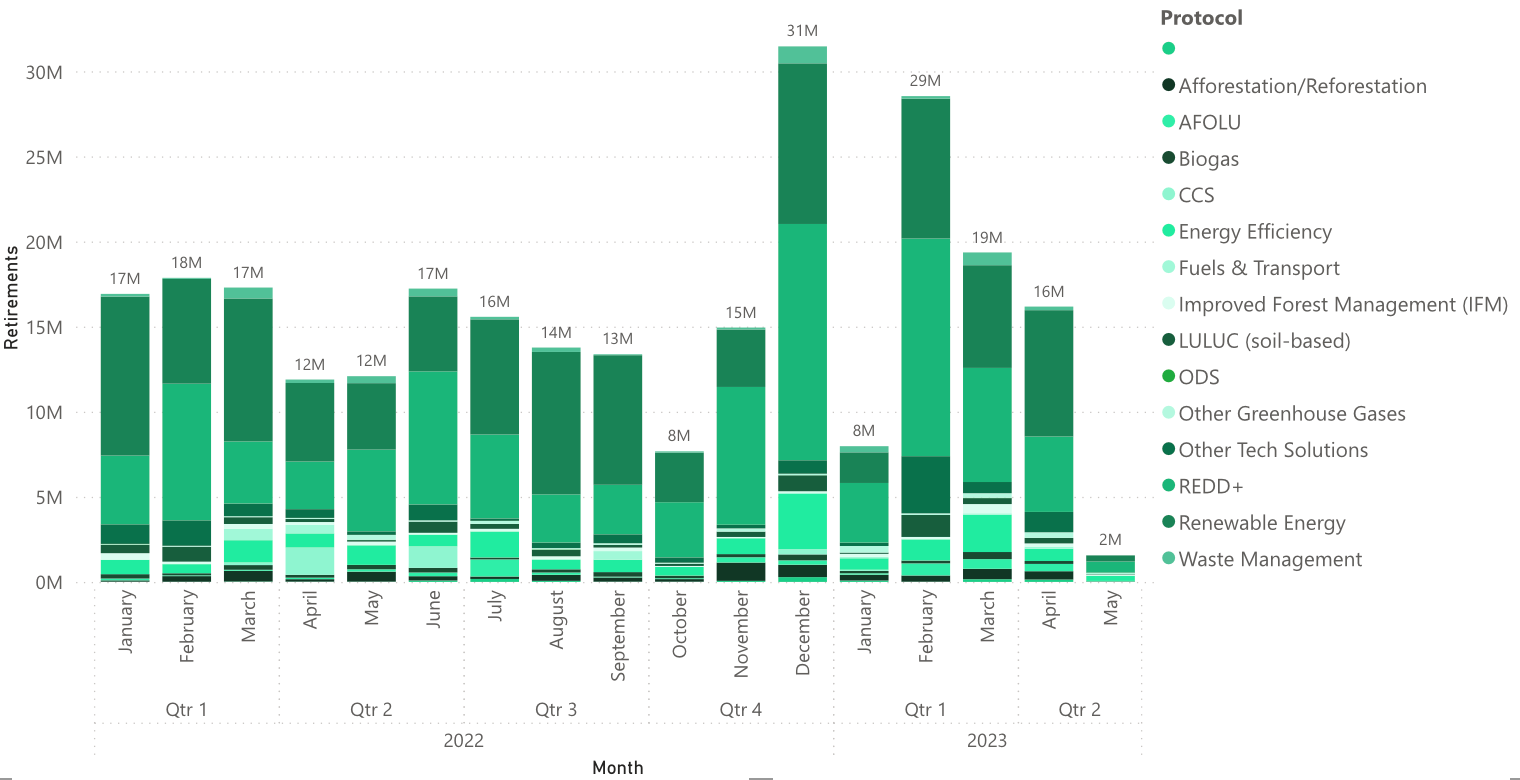

Retirements have rebounded strongly post negative press in early 2023. April 2023 has seen the highest retirement month in the VCM history at 16M, YoY increase of 33%. Upon diving deep into the quality of retirements made in Apr’23, it’s seen that RE credits retirements have increased by 23% MoM and compared to Apr’22 it has increased by 60% at 7.4M in April’23.

Whereas REDD+ credits retirements rose by 62% from April’22 at 4.4M retirements in April’23.

Figure 1: MoM retirements by Protocols, (Source: Calculus IQ)

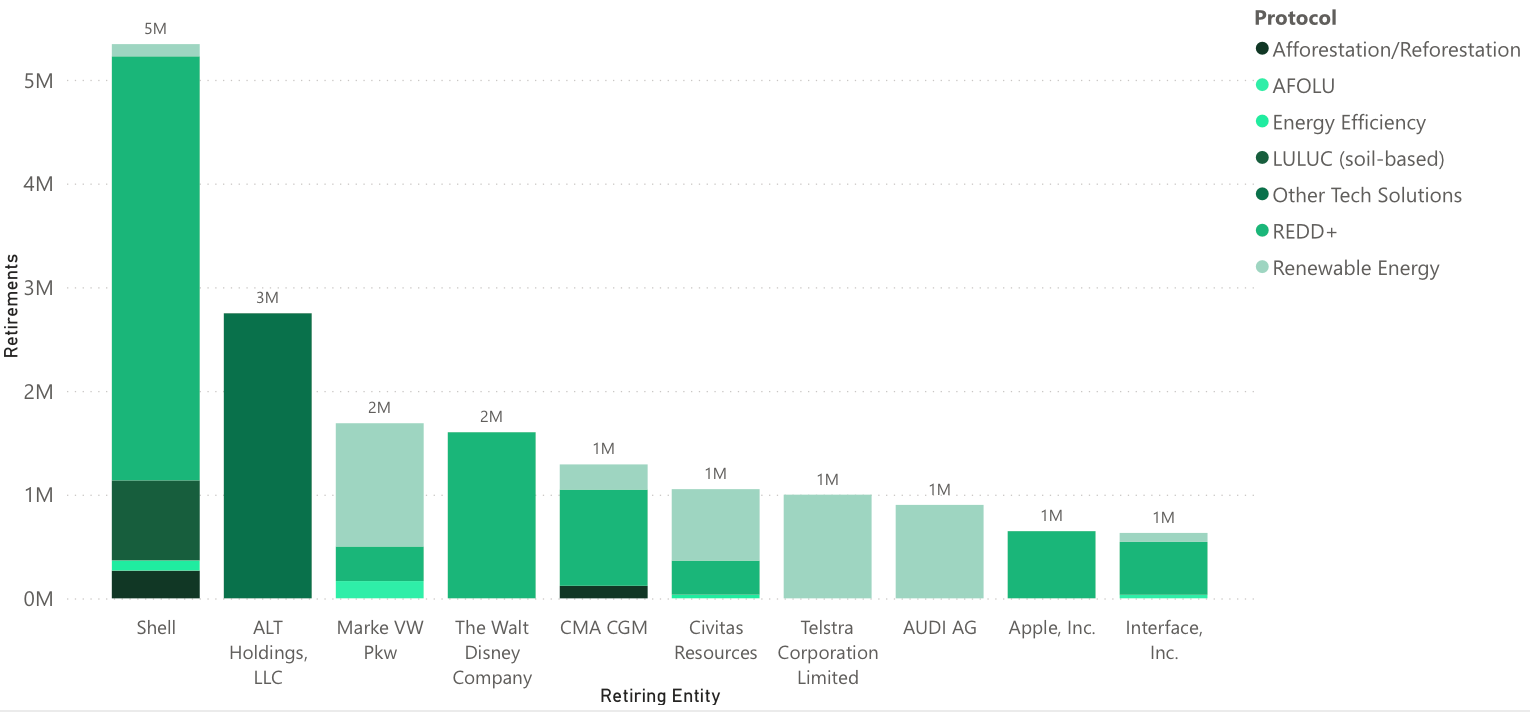

73M credits have already been retired in 2023 till date which is a 10% increase YTD (Jan to Apr). Out of the total retirements, 32M retirements was not disclosed. Amongst the disclosed retirements, Shell was the largest retiree at 5M of which REDD+ credits accounted for 80% of the retirement, followed by ALT Holdings Inc who retired 3M REDD+ credits. Large corporations' involvement is expected to result in Q2 2023 retirements surpassing those of Q2 2022.

Figure 2: Top 10 Retiring Entities in 2023 till date (Source: Calculus IQ)

Summary:

The Voluntary Carbon Market (VCM) has rebounded in April 2023, with the highest recorded retirements of 16 million, marking a 33% increase YoY. The retirements are a combination of RE credits and REDD+ credits. The RE credits have increased by 23% MoM and 60% YoY, while REDD+ credits have increased by 62% YoY. The increase in retirements is a positive step towards combating climate change, as it shows that large corporations are starting to take responsibility and invest in sustainable practices.

Shell and ALT Holdings Inc were the largest contributors to the retirements, with REDD+ credits accounting for 80% of Shell's retirements. The involvement of large corporations is expected to result in Q2 2023 retirements surpassing those of Q2 2022, indicating a trend of increased awareness and commitment toward environmental sustainability.

The historical rise in VCM retirements is a crucial step for the carbon markets, as it provides a financial incentive for companies to reduce their carbon emissions, ultimately leading to a more sustainable future.

If you are interested in learning more about the voluntary carbon market, we invite you to interact with Calculus IQ. This tool can help you explore different aspects of the market, including project types, retirement volumes, and more.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)