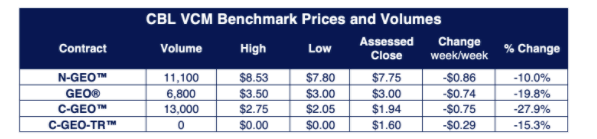

Downtrend continues in VCM prices

VCM prices continued to take a hit last week.

- The CORSIA-based GEO fell 20% and the C-GEO, which tracks a broader basket of technology credits, lost 28%.

- Nature credits were the most resilient with N-GEO prices falling 10% to $7.75.

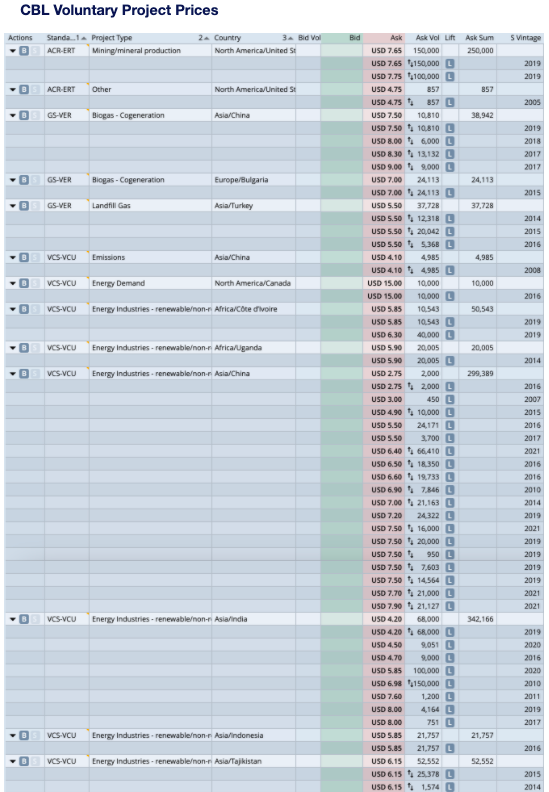

Analysing relationship b/w project prices, supply and vintage

Given the rich diversity of projects from China and India, one is able to analyse how the different underlying parameters affect (or don't affect) the price of their respective VCUs (Verified Carbon Units).

Below is a set of curious observations to be noted:

1. Discount (not premium) for scale, for newer projects in China

At 66,410 the highest ask volume is of a certain 2021 vintage project but it commanded a $6.40 price per VCU - a significant discount (~ 18%) to the $7.70- 7.90 quoted for projects supplying less than a third of those VCUs with the same vintage.

Similarly, looking at the projects of vintage 2019, the highest volume project with 24,322 units for sale is listed for $7.20 commanded a 4% discount to two projects with 14,564 and 7,603 VCUs for sale at $7.50

This anomaly is restricted to newer projects, and fades away as one looks at older projects (analyse yourself for vintage year 2016)

2. Few Indian aggregators desperate for flipping for a quick buck

It's interesting to see a 2019 vintage project offering a sizeable 68,000 VCU lot, list at the bottom of the ladder at $4.20 while much older projects from 2011 and from 2017 vintage, offering a fraction of those units being comfortably listed at an optimistic $7.60 and $8.00.

The irrational price setting may stem from a few large scale aggregators in India, paying developers a fixed fee (as low as $2.00) for registering their VCUs, which is still a cumbersome and non-intuitive process for developers in India (we spoke to one such developer last week, who had recently registered their $300+ MW project through an aggregator for a meagre $2.00 per VCU). These aggregators then go ahead and quickly flip these VCUs in the market where listing at the lowest price ($4.20 here) still ends up making them a 100%+ profit.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)