In recent years, the voluntary carbon market has experienced a significant expansion due to the increasing number of individuals and businesses striving to lower their carbon emissions and support the global fight against climate change.

Consequently, numerous carbon offsetting projects have been introduced to the market. The upsurge of the voluntary carbon market can be attributed to various factors, including heightened awareness of the significance of mitigating climate change, the emergence of advanced technologies that facilitate the tracking and validation of carbon emissions, and the creation of new financing methods that enable individuals and companies to fund carbon offsetting initiatives.

McKinsey and Company predicts that the value of VCM will increase from its current value of $2 billion in 2021 to $50 billion by 2030.

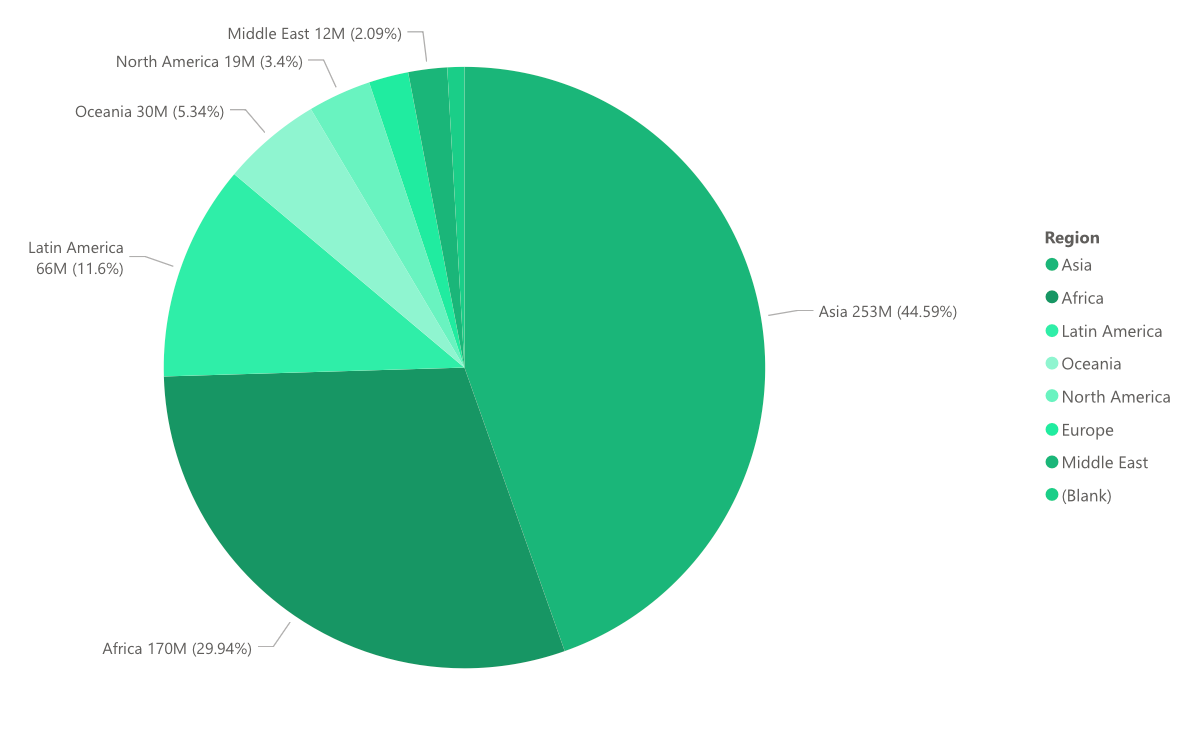

Figure 1: Percentage share of pipeline credits by Region (Source: Calculus IQ by Calculus Carbon)

According to pipeline data in Verra, 568M credits are in the pipeline across various project types. Asia and Africa together constitute around 74% of the total supply in the coming years.

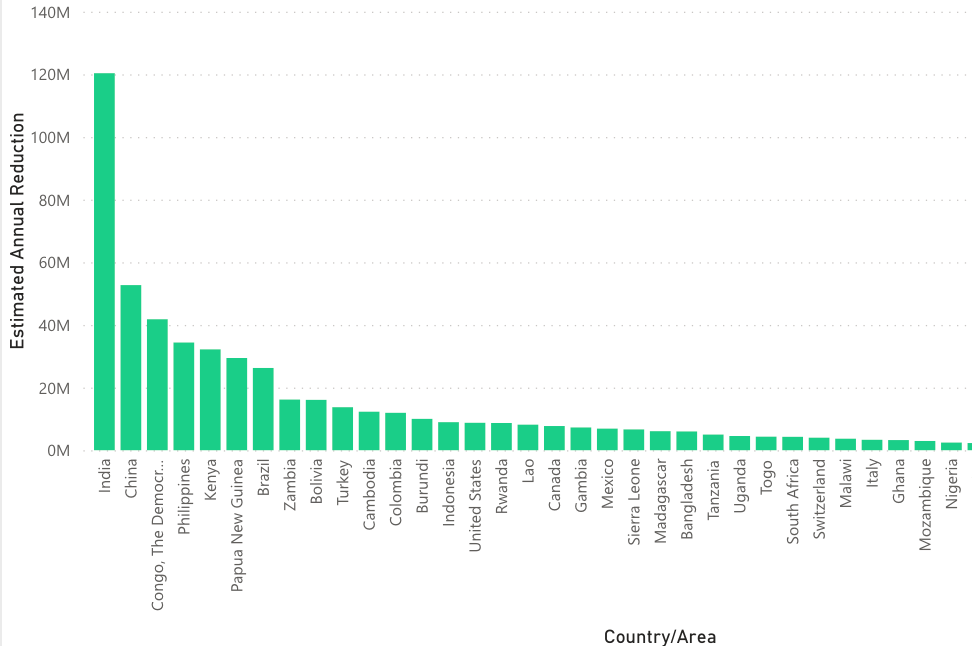

Figure 2: Estimated Annual Reduction by Countries (Source: Calculus IQ by Calculus Carbon)

India alone accounts for 1/4th (23%) of the total supply, followed by China which accounts for 9% of the total supply from Verra. India is on a path to becoming a supply bank of carbon offsets as it is also one of the largest emitters of greenhouse gases in the world, and it has a vast potential to reduce emissions through various mitigation measures. These measures include the adoption of renewable energy sources, the implementation of energy efficiency measures, and the conservation of forests.

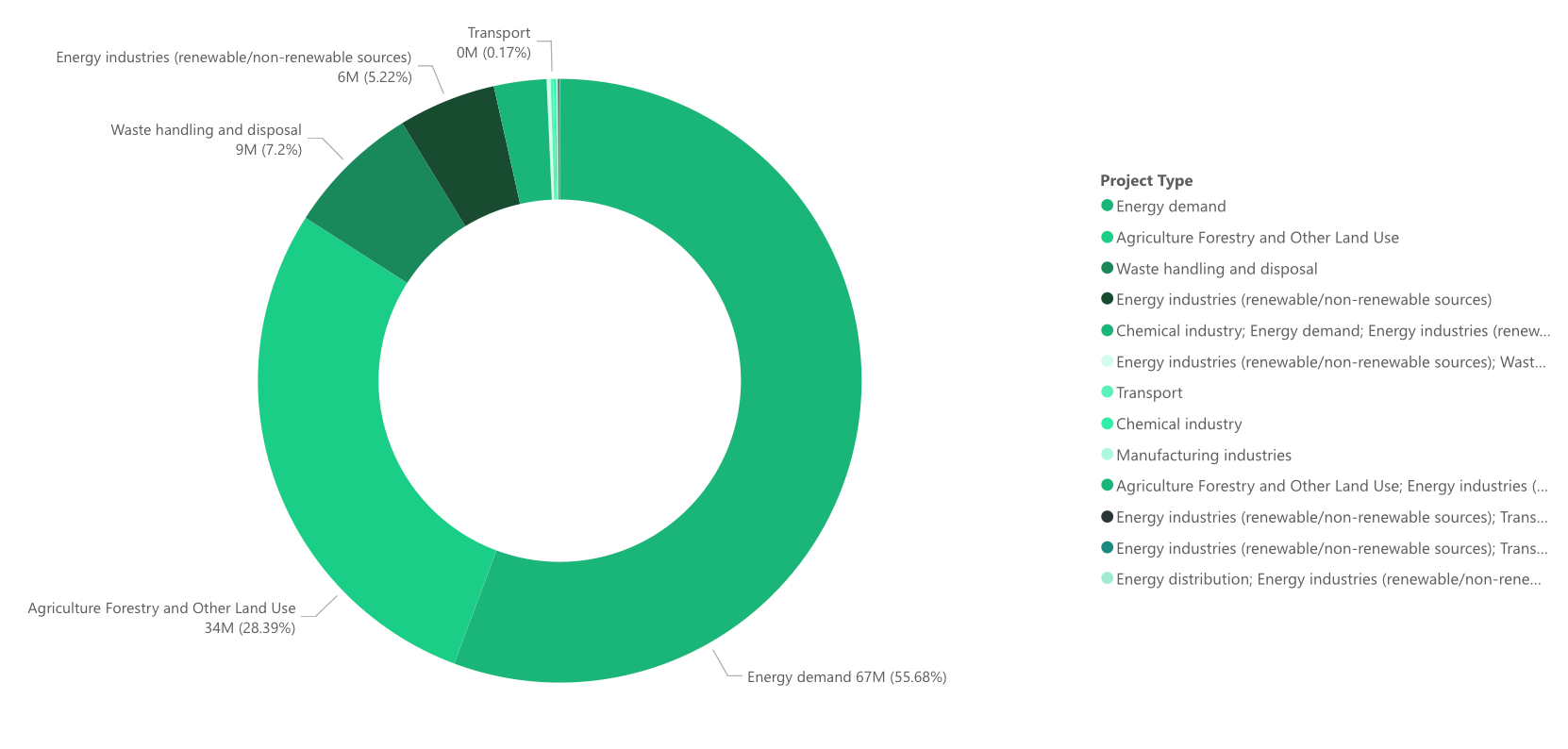

In figure 3 below, projects from Energy Demand and AFOLU together constitute around 89% of the total future supply from Verra alone. Waste handling credits are also quite significant at 7% of the supply.

Figure 3: India’s Project Types Breakup (Source: Calculus IQ by Calculus Carbon)

India has a rich history of renewable energy (RE), and the country has abundant resources for various renewable energy technologies. However, in recent times, the eligibility of RE credits for accreditation by registries has become limited based on certain criteria. This has raised doubts about the additionality of retirements of RE credits, thereby leading to an increase in retirements from other project types, such as Energy Efficiency, Energy Demand, AFOLU, and so on.

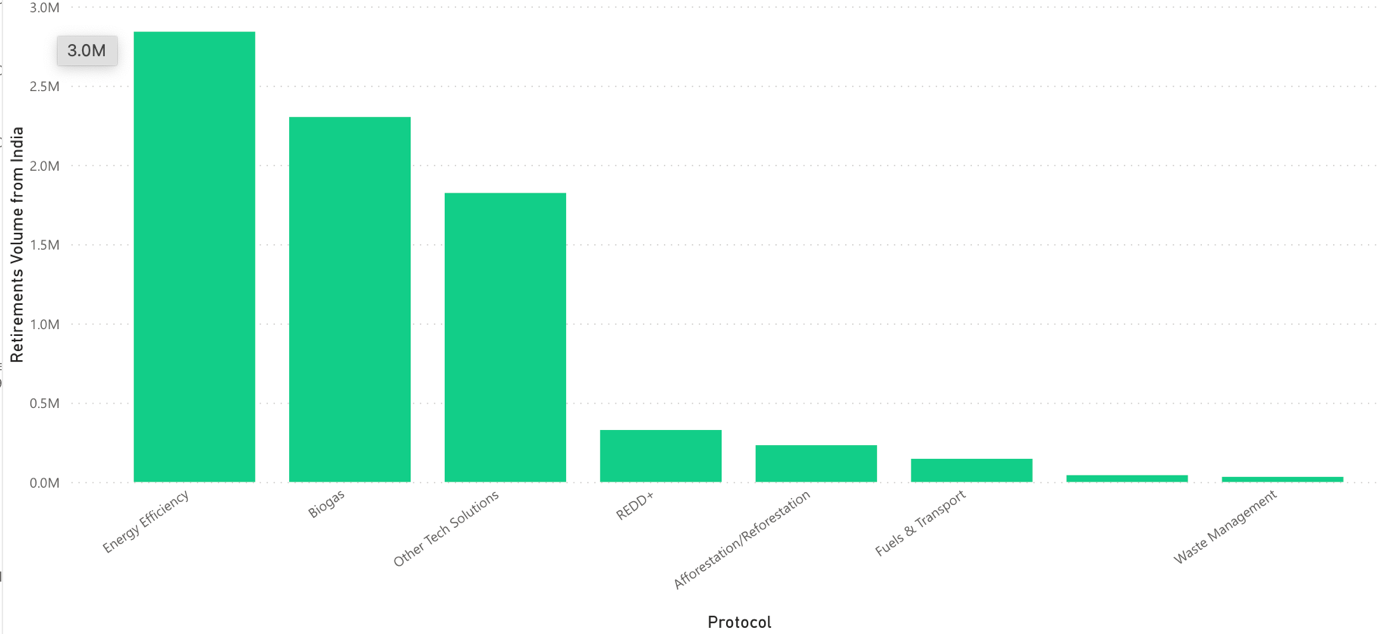

Figure 4: Retirements Volume from India (excluding RE)(Source: Calculus IQ by Calculus Carbon)

Projects in the areas of Agriculture, Forestry, and Other Land Use (AFOLU) have also gained momentum in India, as they provide a range of co-benefits, including biodiversity conservation, soil health, and livelihood improvements for local communities. Two Afforestation and Reforestation Projects are in the pipeline in Verra CCB registry. Overall, while the eligibility of RE credits has become limited, India has identified other project types that can help to achieve its emission reduction targets while also providing additional benefits. By diversifying its portfolio of project types, India can continue to support the global effort to mitigate climate change while also addressing its development priorities.

Future Outlook:

The outlook for India as a supply hub of the voluntary carbon market (VCM) is promising, given its significant share in the pipeline data of various project types.

India has a vast potential to reduce emissions through various mitigation measures, including the adoption of renewable energy sources, energy efficiency measures, and conservation of forests. With a rich history of renewable energy and abundant resources for various renewable energy technologies, India can continue to contribute to the VCM through diverse project types beyond renewable energy.

Furthermore, projects in the Agriculture, Forestry, and Other Land Use (AFOLU) sector have also gained momentum in India, providing co-benefits such as biodiversity conservation, soil health, and livelihood improvements for local communities. This diversification in project types can help India achieve its emission reduction targets while addressing its development priorities.

The growth of the VCM is expected to continue in the coming years, with McKinsey and Company predicting its value to increase from $2 billion in 2021 to $50 billion by 2030. Asia and Africa together constitute around 74% of the total supply in the coming years, and India alone accounts for 23% of the total supply, making it a crucial player in the VCM.

Overall, India's potential as a supply hub of the VCM is significant, given its vast potential for emission reduction through various mitigation measures and diversification of project types beyond renewable energy. By supporting the global effort to mitigate climate change, India can also address its development priorities and contribute to a sustainable future.

If you are interested in learning more about the voluntary carbon market, we invite you to interact with Calculus IQ. This tool can help you explore different aspects of the market, including project types, retirement volumes, and more.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)