The ease of production of carbon credits is often over-simplified or simply misunderstood as merely an electronic certificate recorded on a registry ledger. Backing these digital goods are however some very real physical processes, assets and risks, not unlike those that exist in regular commodity markets.

It is true that a box of underlying certificates would never be physically loaded onto a locomotive heading towards a buyer, the project investors are very much required to manage delivery, timing, policy, and counter-party risk, against a rapidly evolving regulatory landscape.

The scale demanded to meet the ambitious goals under the IPCC scenarios, requires an evolved market architecture as well as frameworks. As accurately captured in a recent working paper by Trafigura,

"Supply chain experts and commodity risk managers are uniquely suited to managing the inherent physical risks underlying the carbon removals market and to delivering solutions at scale."

This article posits that speculators are truly indispensable to the next stage of scaling in carbon markets globally, and would be absolutely crucial to the meet the gigantic net-zero targets in sight.

Providing Liquidity and Stability to Nascent markets

Across both compliance and voluntary carbon markets, developers of projects require access to a deep pool of capital to fund their emission reduction activities. Through the sheer volume of capital, that institutional speculators can raise, allocate and deploy, they help create stable liquidity and market depth.

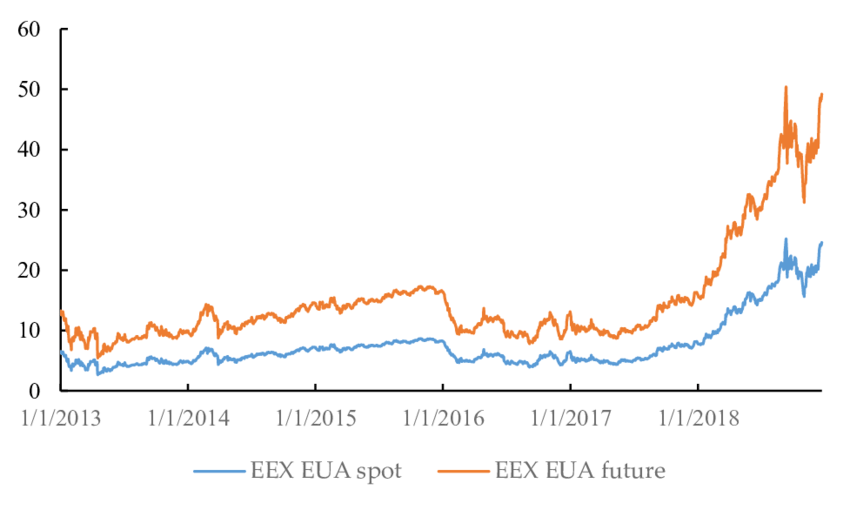

Specifically, in compliance markets, these speculators can trade carbon allowances to increase liquidity, while bridging gaps in supply and demand.

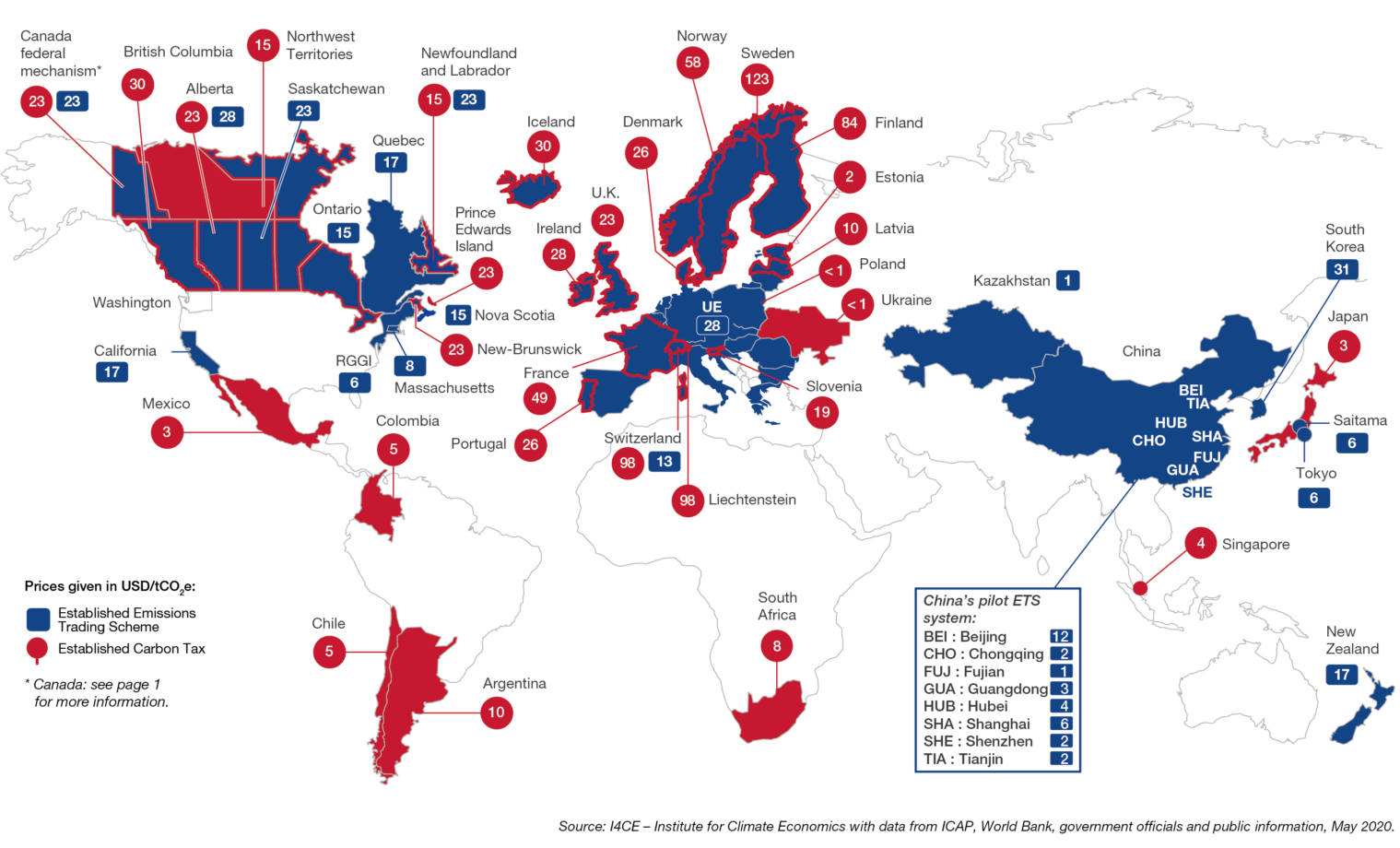

In VCMs, they are even more critical to promote global decarbonisation efforts by trading in removal or avoidance projects across geographies, either directly or through third party funds.

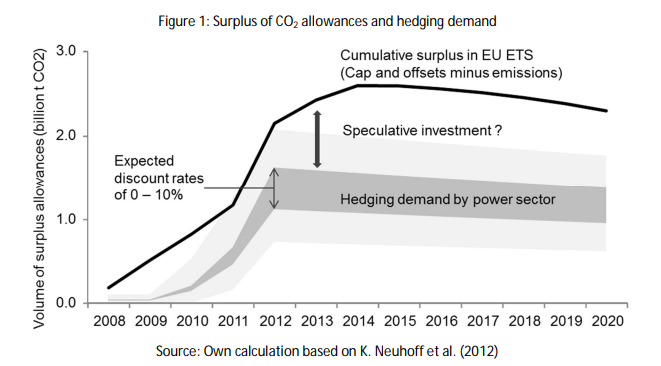

A pertinent case is made by Anne Schopp and Karsten Neuhoff in their 2013 discussion paper, highlighting how the hedgers and speculators helped absorb the demand for excess allowances in EU ETS markets, as depicted below.

Creating Informational Symmetry for Project Developers

VCMs particularly are hard to price due to lack of homogeneity and multiple factors governing their prices - location, vintage, scarcity, while not to mention the underlying qualitative parameters such as additionality, permanence, leakage etc.

This creates a huge barrier to entry for retail and institutes lacking the technical expertise, thereby curtailing the flow of capital in the VCMs. Speculators, given their far greater access to resources and knowledge of potential buyers than project developers can help facilitate better price discovery.

Developers also suffer due to their lack of ability to market to multiple buyers. A speculative investor may help in reducing this friction by pooling resources from multiple buyers and sellers across different geographies.

Transferring risks effectively

Buyers including utility companies often need to balance their future electricity sales with forward purchases instead of buying in spot markets. Auctions however like in the case of EU ETS may occur in spot markets. This has a tendency to create an imbalance between spot supply and forward demand.

Speculators can skilfully alleviate this imbalance by forward selling carbon credits, while hedging their exposure dynamically. In this process, they serve to minimise transaction costs and enable hedging against price risks for such energy companies.

While the above is an instance from the compliance market, even in VCMs speculators help corporates much predictably design their net-zero strategy by locking in a futures offset price, being a counter-party to maintain a balance between spots and futures markets.

Conclusion

There is plenty of inefficiency that exist in carbon markets across the world, more so in nascent compliance markets and VCMs which are all siloed, illiquid, volatile and opaque. In such a setting, speculators can create a massive impact through the means discussed above and help proliferate this asset class globally.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)