ETS or Emission Trading System refers to the market for carbon allowances in compliance or regulated geographies. Unlike in voluntary carbon markets or VCMs, where individuals and corporations buy and sell carbon offsets to meet their self regulated net-zero strategies, allowances are provided in lieu of specific emission targets set up for carbon emitting corporations by regulators in the compliance geography. Emitters can then buy and sell these allowances in the secondary market, depending on whether they emit higher or lower than their prescribed allowance levels.

Two types of ETS:

Cap and Trade ETS

The prime example is the EU ETS, where the European Commission has set a 'cap' or limit in the emission levels for a particular period, and the allowances that make up this cap are either distributed to specific industries or companies under the purview of the ETS, or auctioned directly in the market which then sets its price. This form of ETS is thus referred to as a 'cap and trade' ETS. Established in 2005, EU ETS today also the largest carbon market in the world in terms of volume traded.

Baseline and Credit ETS

An instance of this is the China ETS, where regular emitters are allotted allowances basis their verified baseline emissions. In case they emit higher than the baseline, the emitters need to surrender extra allowances bought from the market, whereas if they reduce their carbon intensity and emit lower than baseline, they get to sell their surplus allowances to the market. China's national ETS market, started in 2021, is popularly expected to be the largest carbon market in the world.

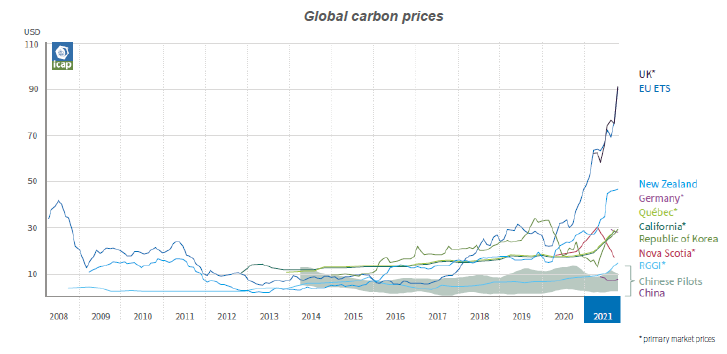

ETSs lead the way for carbon markets globally

Source: ICAP (2022)

As per the International Carbon Action Partnership (ICAP), 25 ETS systems are currently operational globally. Further 22 ETSs are under development or consideration, which translates to 17% of all global greenhouse gas (GHG) emissions being under the purview of an ETS.

Workings of the ETS

ETS works on a straight-forward principle: Regulators in a particular compliance market agree to and set a cap on the emissions in aggregate. Each entity then needs to secure allowances for each ton of CO2 emitted else pay a fine. These allowances can be bought at auction and a percentage is allotted for free.

Next, entities which have more allowances than they need, coz they were able to reduce emissions more than they bought or received allowances for, can sell those allowances to entities that emitted CO2 higher than they had expected.

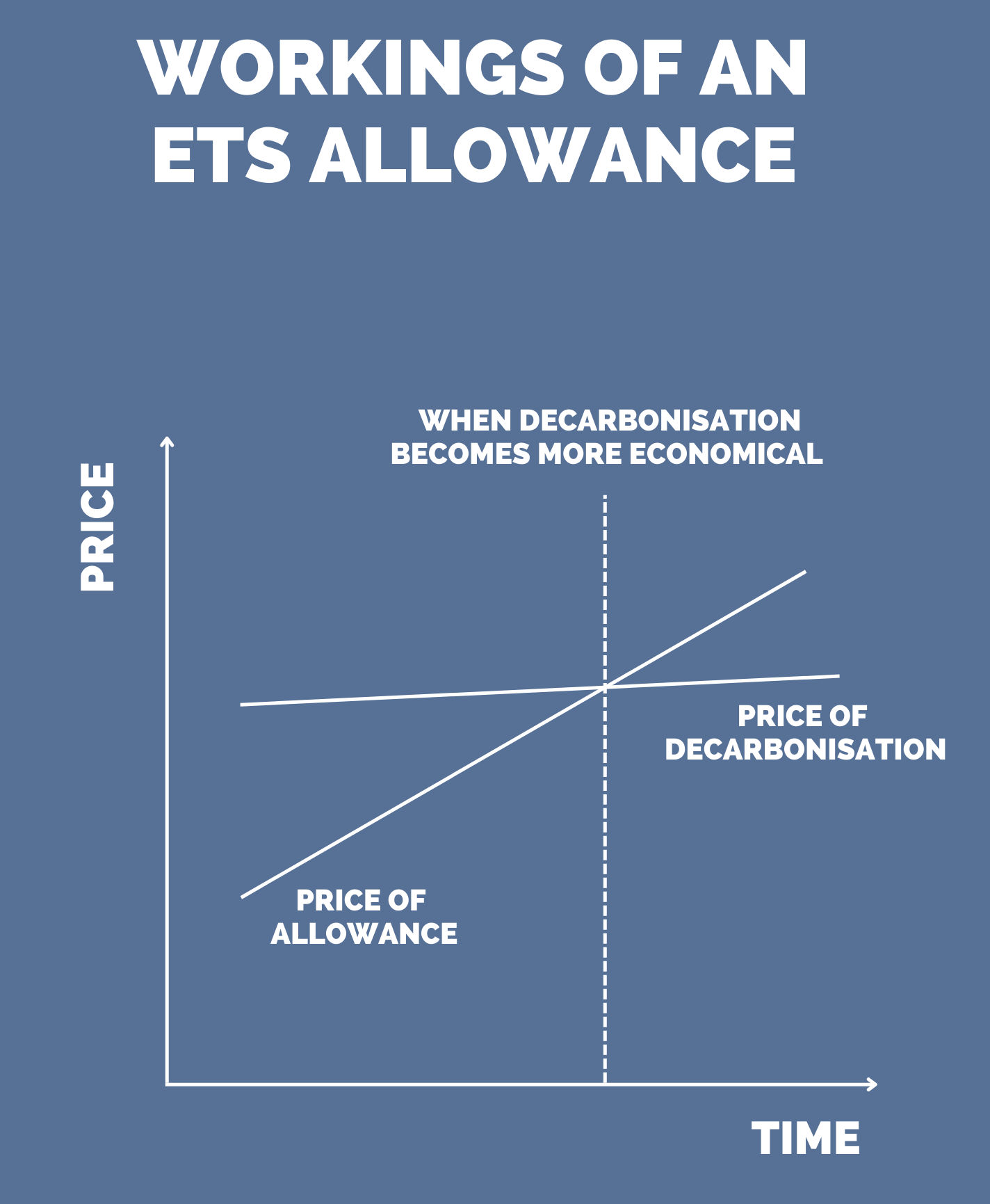

What effectively happens is that the trading in allowances attributes them a fair market price. Now, entities that are able to reduce their emissions at a price lower than the market price of these allowances, will do so and profit from the differential by selling excess allowances in the market for a profit. For entities for whom the price of decarbonisation is currently more than the allowance market price, they'll prefer to buy the latter from the market.

This in a way brings efficiency to the process of decarbonisation. Over time, as the cap on emissions is reduced and the market prices for allowances go further up, the price of decarbonisation would become relatively lower thereby incentivising them to reduce their emissions instead of having to purchase costly allowances from the market.

Additionally, ETS helps the regulators identify the sectors of the economy that decarbonise at the lowest cost. This may serve as a precedent for policymakers in other geographies without a mature compliance market to at least being to incentivise these sectors. These sectors, at least for a given time, offset the higher emissions from the costlier decarbonising sectors and are rewarded through allowance profits in turn.

Thus ETS provide a powerful economic tool at the hands of the regulators to efficiently align incentives and further the economy on the road to becoming net zero.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)