Intro to ESG Investing.

Over the past decade, the prevalence of ESG (Environmental, Social, Governance) issues has led to a significant shift towards socially responsible investing. Discussions around climate change, social justice, and investor demographics are all driving a change in business values, resulting in an increase in the adoption of ESG investment strategies.

Morningstar reports that the number of sustainable funds available to US investors has grown by 30% in 2020 to almost 400, marking a fourfold increase in the last decade.

Although there are still skeptics, more public and private equity firms are acknowledging that investing conditions have undergone a significant shift. Environmental concerns such as pollution, loss of biodiversity, deforestation, social inequality, labor rights, and water shortages pose concrete dangers to economies, livelihoods, companies, funds, investors, and consumers.

ESG investing is now viewed as not only a means of promoting social good but also a way to improve returns and minimize risk. This is excellent news, as ESG may soon become a mandate rather than an option for public companies and investment funds.

Global Market Trend of ESG Investment

The assets categorized under Environmental, Social, and Governance (ESG) are anticipated to surpass $50 trillion by 2025, accounting for over one-third of the predicted total global assets under management, which is expected to be around $140.5 trillion.

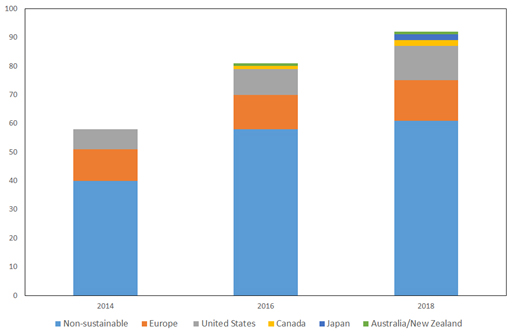

Despite an increase in sustainable investing, it still lags behind non-sustainable investment. Figure 1 illustrates the difference between the two and a comparative country-wise breakdown of sustainable investment from 2014 to 2018.

Figure 1: Sustainable Investment by Major Economies and Non-Sustainable Investment ($ trillion) Source: ADB Institute

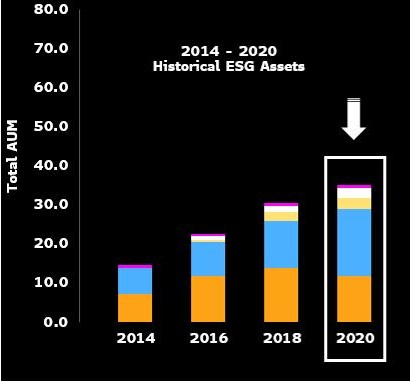

The Global Sustainable Investment Association reports that ESG assets have been steadily increasing, reaching over $35 trillion in 2020 from $30.6 trillion in 2018 and $22.8 trillion in 2016, accounting for a third of the total global assets under management.

If ESG assets continue to grow at a rate of 15%, which is half of the growth rate seen in the past five years, they are expected to exceed $50 trillion by 2025. The ESG ETF market will reach $1 trillion, and the ESG debt market will reach $11 trillion by the same year. ESG ETF and ESG debt are the fastest-growing strategies within ESG investing.

Figure 2: ESG Global AUM by Country (Source: Bloomberg Intelligence)

ESG criteria have become increasingly significant, transforming from a niche to a mandatory practice due to mounting scrutiny from regulators and market sensitivity to ESG-related news. The pandemic and the race to net zero carbon emissions have also played a vital role in this shift. Financial reporting now includes ESG as part of its fundamental structure, and asset owners are appointing managers based on ESG criteria across asset classes.

As seen in Figure 2, US's growing ESG asset industry is a critical factor in the global ESG market, accounting for nearly half of the $35 trillion in ESG assets under management. While historically Europe has led the way in ESG assets, the US has seen over 40% growth in the past two years, reaching $17 trillion. Europe's ESG mutual funds and ETFs make up around 25% of all European products in 2020, serving as a barometer for the global market.

Pros and Cons of ESG Investing

Investing in ESG (environmental, social, and governance) principles can be an effective strategy for addressing climate change. By putting money into corporations that prioritize sustainability, investors can support businesses that are making a positive impact on the environment. Here are some key ways in which ESG investing can help combat climate change:

- ESG-focused companies tend to have better operations, cost savings, lower employee turnover, innovative products and services, talent retention, compliance costs, and risk management. This can result in increased shareholder value, with research showing that ESG funds have tended to outperform traditional funds in the medium to long term. ESG funds have also shown resilience during periods of market volatility.

- Investing in companies that follow ESG principles can help manage investment risks by promoting better governance practices and ethical business practices. This can be particularly important in industries that rely heavily on nature, as biodiversity and nature loss can impact the economy and investments. Initiatives like the UNPRI and stock exchange ESG reporting requirements seek to incorporate ESG factors into investment decisions.

- ESG-oriented investments can help combat climate change and promote sustainability. Green bonds, sustainable energy sources, carbon offsets, and responsible forestry are all examples of investments focused on environmental goals. By supporting these initiatives, investors can help protect the planet's wildlife and habitats and increase natural capital.

- Companies with sustainability plans are more likely to meet long-term investment goals, as they are better prepared to adapt to changes related to ESG. Investing in ESG-focused companies can encourage sustainability and support the transition to a greener economy.

- Encouraging social responsibility and giving back to the community can improve employee productivity, mental health, and reputation. ESG investing places a high emphasis on social benefits, such as protecting employee welfare and establishing meaningful relationships between businesses, shareholders, and communities. Companies with diverse executive teams have been found to be more profitable.

While the above pointers state a good case for ESG investing to become a mandate but there is still room for improvement on several fronts. We have mentioned below the main pointers below,

- ESG ratings are based on "single materiality" and do not consider a company's impact on the earth and society.

- Marketing materials for ESG funds may promise social or environmental aspirations, but the actual goal is to assure shareholder profits.

- ESG ratings confuse investors since they are based on comparative rankings of industry peers, not universal standards.

- ESG funds invest in securities that trade in secondary markets, which makes it difficult to measure their impact on the environment and society.

- No study has conclusively proven that ESG causes higher returns, and recent research has called into doubt the link between ESG and outperformance.

- ESG products are associated with higher fees.

While ESG investing has gained popularity in recent years, it is important to recognize its limitations and address them in order to move towards more impactful solutions. These shortcomings include challenges in measuring and comparing ESG metrics, potential inconsistencies in company reporting and lack of standardization in the field. Additionally, some critics argue that ESG investing may not necessarily lead to real-world impact, as it allows companies to be labeled as socially responsible without actually making significant changes in their operations.

However, acknowledging these limitations is not a reason to abandon ESG investing altogether. Instead, it is important to critically evaluate its effectiveness and explore alternative ways to drive meaningful change. One potential approach is impact investing, which seeks to generate measurable social and environmental benefits alongside financial returns. Another strategy is to engage in shareholder activism, using investments to influence company decision-making and drive positive change from within.

Ultimately, it is important to recognize that there is no single solution to addressing environmental and social challenges. Rather, a range of approaches, including ESG investing, impact investing, shareholder activism, and advocacy efforts are needed to make progress toward a more sustainable and equitable future.

Net Zero & ESG Investing

ESG investing and net zero targets are interconnected, as net zero falls under the environmental aspect of ESG investing. In recent years, there has been a growing commitment to reaching net zero targets, with forty-three Net Zero Asset Managers committing $16 trillion to reach net zero investment by 2050.

Some of the large asset managers, including Schroders and Lazard, have joined the initiative to make the ESG fund management market more transparent and credible.

Here are five major pointers on how net zero and ESG investing are related:

- ESG investing is a good way to tackle climate change, as it helps investors put their money into corporations that are doing their part to fight the environment.

- Achieving net zero targets is a specific commitment that falls under the environmental aspect of ESG.

- While ESG investments and public consciousness are making it more likely that net zero targets will be reached by 2050, there is growing concern that companies and asset managers are greenwashing their net zero claims.

- RepRisk, an authority in ESG data science, published an article concluding that ESG risk incidents have increased between 2012-2022, especially in Europe and the Americas. An ESG risk incident predicts how likely a company greenwashes future sustainability claims, including net zero strategies.

- The solution to achieving net zero by 2050 is through transparency and accountability. Companies need to move away from the tick-boxing mindset and show the ins and outs of their behaviors on net zero strategies compared with their messaging.

Synopsis

The future of ESG investing looks promising as more and more investors are becoming aware of the benefits of investing in companies that are committed to sustainability and responsible business practices. The shift towards ESG investing has already begun, with the number of ESG funds and assets under management increasing significantly in recent years.

Here are some major pointers on the future of ESG investing:

- Greater transparency and reporting: Investors are demanding more transparency and accountability from companies, and this trend is expected to continue. Companies will need to disclose more information about their ESG practices, including their carbon footprint, diversity and inclusion initiatives, and supply chain management.

- Integration of ESG factors: ESG factors are increasingly being integrated into investment decisions, and this trend is expected to continue. Investors are looking for companies that not only have strong financial performance but also have a positive impact on society and the environment.

- Expansion of ESG investment options: As the demand for ESG investments grows, the range of investment options is likely to expand. This will include new ESG funds and products, as well as the integration of ESG factors into traditional investment strategies.

- Regulation: The regulatory environment is also expected to become more supportive of ESG investing. Governments and regulators are increasingly recognizing the importance of sustainability and are implementing policies to encourage ESG investments.

- Combating greenwashing: With the increase in ESG investments, there is also a risk of companies exaggerating their ESG commitments. This is known as greenwashing and is a significant concern. To combat greenwashing, investors and regulators are likely to demand more transparency and accountability from companies, which will ultimately benefit the ESG investing industry.

Overall, the future of ESG investing looks positive, with the shift towards sustainable and responsible investing likely to continue. The integration of ESG factors into investment decisions, the expansion of ESG investment options, and the increased regulation of ESG investing are all trends that are expected to drive the growth of the ESG investing industry in the years to come.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)