Exploring the Dynamics of India's Current Voluntary Carbon Market

As the world becomes increasingly aware of the dire consequences of climate change, countries are looking for ways to reduce their carbon footprint and meet their commitments to global climate agreements.

One market that has seen a surge in activity is the voluntary carbon market, which allows companies and countries to purchase carbon credits to offset their emissions.

In India, this market has experienced a remarkable revival, with a four-fold increase in activity in 2021 compared to the previous year, and a value of over $1 billion. This growth is part of a wider trend in the global carbon market, which has gained momentum since the Paris Agreement, and is set to accelerate ahead of COP26 in Glasgow.

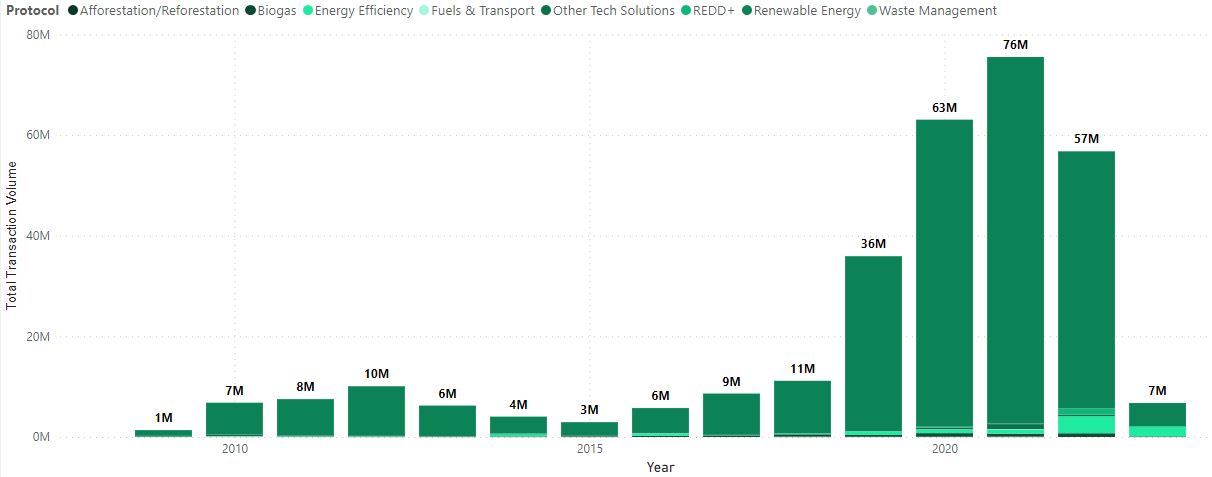

In this article, we will explore India's emergence as a leader in the voluntary carbon market and what this means for the country's future as a sustainable economy. India's Annual Issuances segregated by protocol types (2010 - 2023 Q1)

Source: Calculus IQ by Calculus Carbon

India is an important player in the Voluntary carbon market, having issued 302.63 million credits between 2010 and Q1 2023, which accounts for 15.44% of the total global supply.

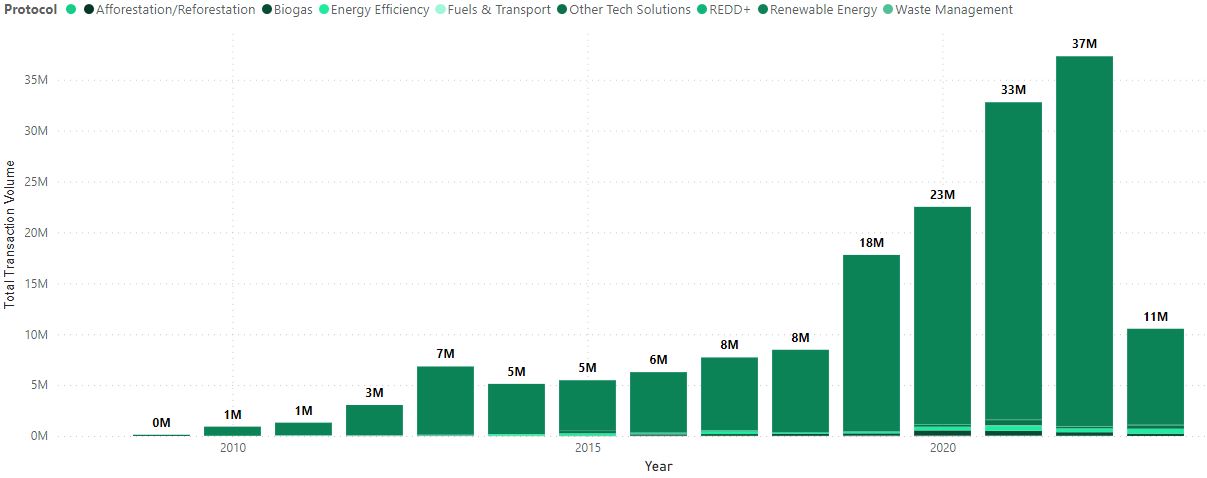

India's Annual Retirements segregated by protocol types (2010 - 2023 Q1)

Source: Calculus IQ by Calculus Carbon

The demand for carbon credits is rapidly growing, and India is becoming a major marketplace for them. Over the past decade, India has retired a significant amount of carbon credits, totaling 166.26 million dollars, which represents 17.26% of the world's total retirements from 2010 to 2023 Q1.

This signifies India's growing awareness and commitment to reducing its carbon footprint and contributing to the fight against climate change. With its large and rapidly expanding economy, India has the potential to be a significant player in the global carbon market, both as a buyer and a seller. As the world continues to shift towards a more sustainable future, India's role in the carbon credit market is likely to become increasingly important. The country's success in retiring carbon credits is a promising sign that India is taking its responsibility as a global citizen seriously and is working towards a cleaner, greener future for all.

Supply and Demand: What's Behind the Surge in Activity in the Voluntary Carbon Market?

- Over a third of the 2,000 largest publicly traded companies in the world have committed to achieving Net Zero emissions by 2050 or before, and over 4,000 companies have committed to Science Based Targets (SBTs).

- These corporate commitments cumulatively represent several billions of tons in Scope 1, 2, and 3 emissions, and require carbon offsets or carbon removals to cover the last mile.

- Achieving their net zero targets has become a top priority for countries, reflecting the growing momentum in the global carbon market following the Paris Agreement.

This has led to a surge in the global voluntary carbon market as companies seek to fulfill their ongoing carbon neutral commitments and lock-in offset supply lines for the future to meet their Net Zero commitments. Let us take a look at the Indian government's efforts to establish the country as a front-runner in the voluntary carbon market, considering the ample demand and potential supply of carbon credits.

Regulatory Framework for Voluntary Carbon Market in India: Current Policies and Laws

Energy Conservation (Amendment) Act, 2022

The regulations governing Carbon Credits in India are still in the process of development. As part of its efforts to fulfill its commitments under COP-26, India amended the Energy Conservation Act, 2001 with the Energy Conservation (Amendment) Act, 2022.

This Act has been in effect since January 1, 2023 and has granted the Ministry of Power and the Central Government the authority to establish and oversee a Carbon trading scheme, as well as issue Carbon Credit Certificates. According to Section 14AA of the Act, the Central Government is authorized to either issue or delegate the authority to issue Carbon Credit Certificates to compliant registered entities under the Carbon Credit Trading Scheme.

These Certificates may be sold to,

(i) Organizations exceeding authorized Carbon emission levels.

(ii) The Indian Government to meet its obligations.

(iii) Other countries that require assistance in meeting their commitments.

However, there is currently limited clarity on the Carbon Trading Scheme and the entity responsible for issuing Carbon Trading Certificates. Additionally, there are numerous unanswered questions, such as the creation of a trading platform, the regulation of such a platform, and other ambiguities. The Union Environment Ministry has identified a list of priority sectors to attract green investments, which includes renewable energy with storage, solar thermal power, off-shore wind, green hydrogen, compressed biogas, emerging mobility solutions like fuel cells, high-end technology for energy efficiency, sustainable aviation fuel, and the best available technologies for process improvement in hard-to-abate sectors such as aluminium, cement, chloralkali, petrochemicals, thermal power plants, and petroleum refineries. This move is in line with India's pledge to achieve net zero carbon emissions by 2070 under the Paris Agreement, announced at the United Nations climate conference COP26 in Glasgow, United Kingdom in November 2021.

In the Union budget 2023, Finance Minister Nirmala Sitharaman allocated ₹35,000 crore towards achieving energy transition and net zero objectives, with green growth being one of the government's seven priorities. These initiatives demonstrate India's commitment to transitioning to a low-carbon economy and promoting sustainable development.

Draft of Carbon Credit Trading Scheme

India's power ministry has released a draft carbon credit trading scheme for stakeholder feedback by April 14th, as part of the process to establish a carbon credit market in the country. The Energy Conservation (Amendment) Bill, which passed in December, empowers the central government to establish carbon credit trading markets in India.

The draft scheme outlines a structure for both voluntary and compliance trading, which will be governed by a board comprising secretaries and joint secretaries from various ministries. This board will frame the methodologies for voluntary carbon credit trading and guidelines for selling carbon credit certificates to overseas buyers.

The amendment bill also empowers the central government to consult with the Bureau of Energy Efficiency to specify a carbon trading scheme and accredit an agency to carry out validation and verification activities for the trading scheme.

Under the draft framework, the Indian Carbon Market Governing Board, headed by power and environment secretaries, will oversee the administrative and regulatory functions of the carbon market.

The government plans to cut carbon emissions by 1 billion tonnes by 2030 from 2005 levels and increase renewable power generation capacity to 500GW by 2030. The International Carbon Exchange was established by the Indian Energy Exchange last year to enable market participants to buy and sell voluntary carbon credits at competitive prices.

While the regularisation of the trading market, carbon credits pricing, carbon trading scheme, and inclusivity of farmers in the scheme are still works in progress, it remains the critical responsibility of the Indian government to address these challenges.

Indian Tax Policies:

The Indian government has been increasingly prioritizing sustainable development and taking steps to combat climate change. One of the measures it is undertaking to achieve this is the implementation of a tax policy that encourages the use and trading of carbon credits. The policy is designed to incentivize individuals and businesses to reduce their carbon footprint by promoting investment in low-carbon technologies, as well as by encouraging the use of renewable energy sources.

- Before November 23, 2022, issuance of carbon credits by the National Environment Agency (NEA) is exempt from GST, while issuance, transfer or sale of other carbon credits is taxable.

- From November 23, 2022, issuance, transfer or sale of any carbon credit (including NEA-issued) is an excluded transaction and is not subject to GST.

- As a result, carbon credits purchased from overseas suppliers will not be subject to GST.

- Related services such as carbon exchange, brokering and legal services remain standard-rated unless it qualifies for zero-rating.

Overall, the tax policy introduced by the Indian government is expected to encourage the use and trading of carbon credits, thereby promoting investment in sustainable technologies and reducing greenhouse gas emissions. This is in line with the government's efforts to combat climate change and achieve its goal of reducing carbon emissions by 1 billion tons by 2030, while also increasing the share of renewable power generation capacity to 500 GW by the same year.

Operational Risks in the Indian Voluntary Carbon Market

Although Indian project developers have reasons to be optimistic, it is important to consider potential threats and risks. Unlike the Kyoto Protocol, India has significant emission reduction commitments under the Paris Agreement. With a pledge to achieve net-zero emissions by 2070 and ambitious Nationally Determined Contributions (NDCs), there is a growing belief that India should keep all emission reductions generated within the country, and therefore carbon credits should not be sold abroad. Consequently, the idea of establishing a National Carbon Market has been proposed by various government agencies and ministries, which could affect the demand and price of carbon credits. This creates a potential risk for existing forward delivery contracts with overseas buyers. There are several risks associated with the potential growth of Indian voluntary carbon markets which can be summarised into following pointers,

Regulatory Changes: Changes in government policies and regulations related to climate change and carbon credits can affect the demand and supply of carbon credits in the Indian VCM.

International Carbon Market Dynamics: Developments in the international carbon market can impact the Indian VCM. Fluctuations in carbon credit prices and the availability of cheaper credits from other countries can make Indian credits less attractive to buyers.

Volatility in Renewable Energy Sector: The success of carbon credits is linked to the success of the renewable energy sector. Volatility in the sector can impact the demand for carbon credits, which could lead to a fall in prices.

Quality and Quantity of Carbon Credits: The quality and quantity of carbon credits generated by Indian projects can impact the demand for Indian credits. If the quality or quantity is not up to the required standard, it can lead to lower prices or reduced demand.

Non-compliance: Failure to comply with the required standards or regulations can result in penalties, which can affect the credibility and demand for carbon credits.

Growth of the Voluntary Carbon Market in India

India is poised to benefit significantly from the burgeoning voluntary carbon market, with the potential to generate high-quality carbon credits that come with socio-economic co-benefits. Demand for these credits is primarily coming from outside India, highlighting the country's potential to be a leader in this area.

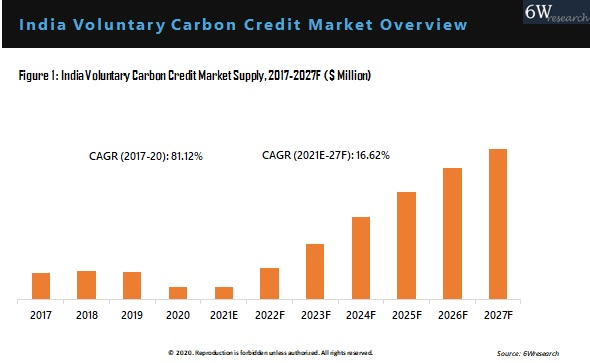

Source: 6W Research

The Indian Voluntary Carbon Credit market is projected to experience a CAGR of 16.62% between 2021 and 2027, and the supply of carbon credits from India will expand considerably in the coming years.

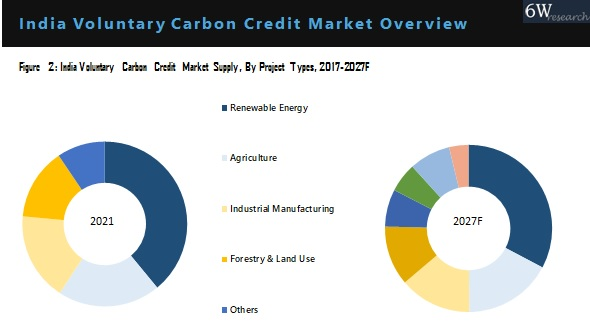

Source: 6W Research

The share of project types in the Indian voluntary carbon market is expected to remain relatively stable until 2027. Renewable energy projects are expected to continue as the leading project type, followed by agriculture and then forestry and land use.

Synopsis

India has the potential to become a leader in the voluntary carbon markets due to its ability to generate high-quality, additional carbon credits through projects that offer significant socio-economic co-benefits. The Indian Voluntary Carbon Credit market is predicted to experience a compound annual growth rate of 16.62% between 2021 and 2027, with renewable energy being the leading project type supplied. However, the lack of government initiatives to nurture the carbon credit markets and a lack of regulatory foresight pose risks to its growth potential.

Despite this, offset project developers in India are scaling up projects, executing carbon contracts with aggregators and directly with project developers, and exploring new financing options like green bonds and social bonds. Overall, India has the potential to leverage its strengths and become a pioneer in the voluntary carbon market. If you are interested in learning more about the voluntary carbon market, we invite you to interact with Calculus IQ. This tool can help you explore different aspects of the market, including project types, retirement volumes, and more.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)