Introduction to CCP

The much-awaited 10 Core Carbon Principles have been unveiled by the Integrity Council for the Voluntary Carbon Market, intending to establish a new international standard for credible carbon credits.

Although the principles provide valuable instruction on methodology, abatable remains an advocate of a project-based strategy to assess the quality and manage risk.

CCP: Focus areas & Objective

The IC-VCM has published Core Carbon Principles after three years of development. The CCPs, which are divided into three key focus areas, governance, emission impact, and sustainable development, aim to improve the credibility of the VCM by guiding investors and buyers towards high-quality carbon-credit projects.

The objective is to build trust in the market, leading to reduced fragmentation and increased capital flows toward impactful projects. Carbon-credit projects will be able to apply for a CCP label, with only those meeting the CCPs' standards being approved. The Program-Level Assessment Framework, which includes strict criteria and decision tools, operationalizes the CCPs, while the Assessment Procedure describes how the IC-VCM intends to oversee and enforce the CCPs.

CCP's Potential Market Impact

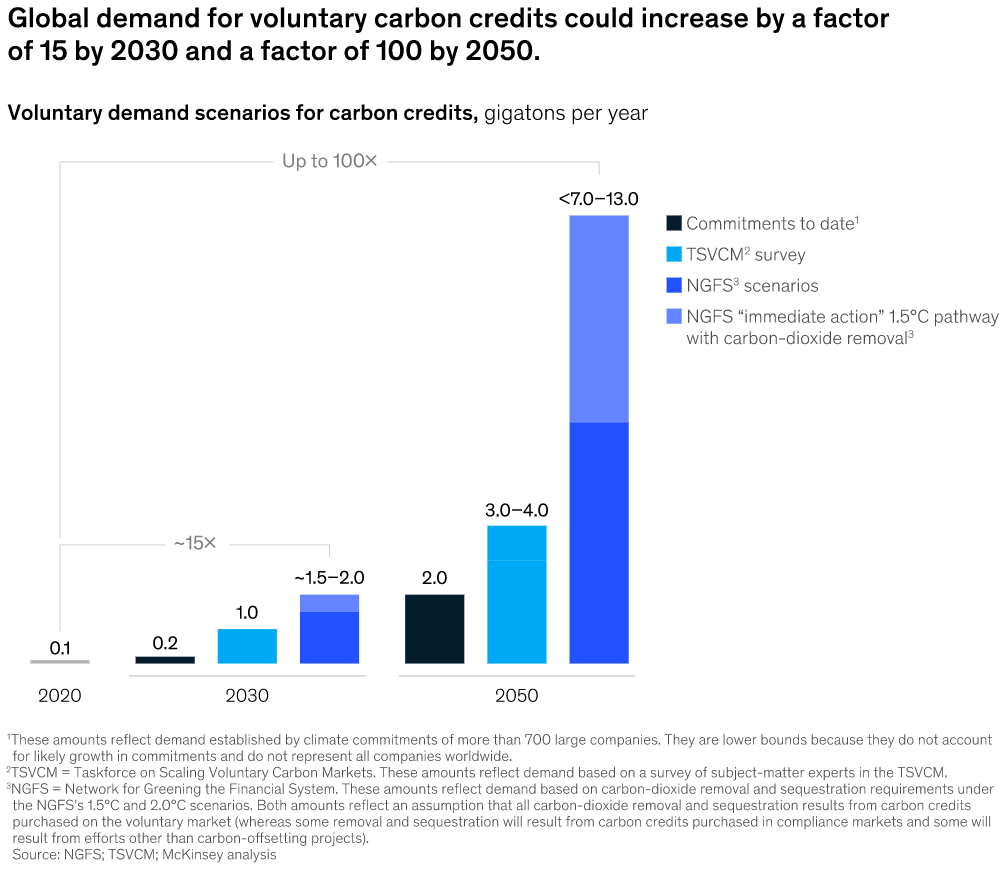

In 2021, the value of the Voluntary Carbon Market (VCM) was reported to be around $2 billion. According to TSVCM, the predecessor of ICVCM, and supported by McKinsey, the demand for carbon credits is projected to increase significantly in the coming years. Specifically, they estimate that the demand for carbon credits will increase 15 times by 2030 and 100 times by 2050.

Source: Mckinsey & Company

The Voluntary Carbon Market (VCM) has played a significant role in providing crucial funding for climate change mitigation and adaptation projects in the Global South. The market's reward system has incentivized the development of more than 550 renewable energy projects in India alone in the past two decades.

These projects have helped India reduce its carbon footprint and address its growing energy demands sustainably. Besides, the VCM has enabled many developing countries to access clean technology, which otherwise would have been challenging due to financial constraints.

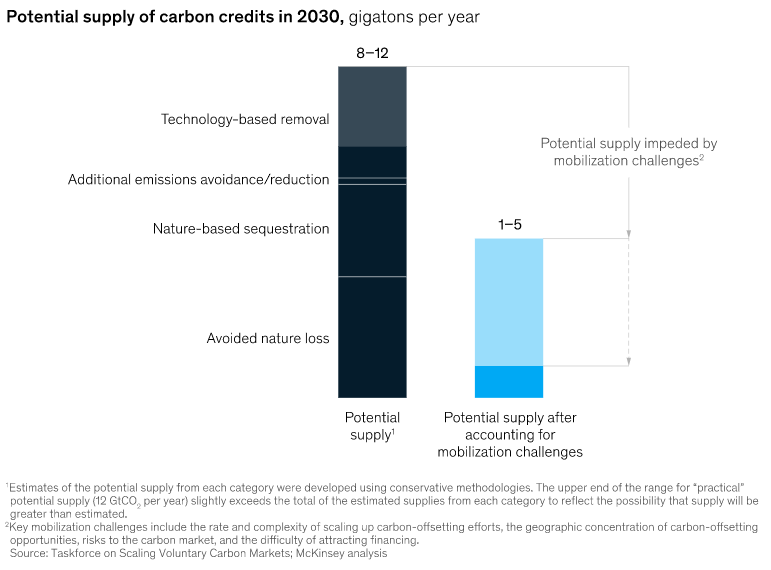

There is a projected increase in demand for carbon credits which may not outpace the potential supply in the coming years. By 2030, the annual supply of carbon credits could range from 8 to 12 GtCO2, matching the demand. These credits would fall under four categories, namely, avoiding nature loss (such as preventing deforestation), nature-based sequestration (like reforestation), avoidance or reduction of emissions (such as reducing methane emissions from landfills), and technology-based removal of carbon dioxide from the atmosphere.

Source: Mckinsey & Company

Buyers and sellers of carbon credits encounter a significant challenge as high-quality carbon credits are limited due to variations in accounting and verification methodologies and the lack of a clear definition of credits' co-benefits like community economic development and biodiversity protection. In response, the International Carbon Reduction and Offset Alliance's Voluntary Carbon Market (ICVCM) has taken a step forward by introducing the Core Carbon Principles (CCPs). These principles aim to establish strict quality standards for carbon credits and ensure environmental integrity while achieving the objectives of the carbon market mechanism.

The impact of CCPs on the market can be summarized in short-term and long-term:

Short-Term:

Reduction in Participants: The introduction of quality standards may lead to a reduction in the number of participants in the carbon market, as some participants may not meet the stringent requirements.

Initial Slowdown in Market Growth: The quality standards may lead to an initial slowdown in the growth of the carbon market, as it may take time for participants to adapt to the new standards.

Higher Costs for Participants: Meeting the quality standards may require additional investment by participants, leading to higher costs in the short term.

Shift in Focus: The quality standards may lead to a shift in focus towards carbon reduction projects that have greater environmental integrity, leading to the development of more sustainable projects in the long run.

Increase in the Demand for High-Quality Credits: The quality standards may increase the demand for high-quality carbon credits, leading to better pricing mechanisms and improved credibility in the market.

Long Term:

Enhanced Market Credibility: CCPs will raise the market's credibility, building trust and confidence among investors, buyers, and other stakeholders.

Improved Carbon Pricing Mechanism: CCPs will eliminate low-quality carbon credits from the market, leading to better pricing of high-quality credits. This will result in a more efficient and effective pricing mechanism for carbon credits.

Increased Demand for High-Quality Credits: CCPs will foster the adoption of high-quality standards and principles, resulting in increased demand for high-quality carbon credits. This will positively impact carbon reduction projects with greater environmental integrity.

Encourages Innovation: CCPs will inspire innovation in the carbon market as participants strive to meet the high standards set by the principles. This will lead to new and improved carbon reduction technologies and solutions.

Consequently, the introduction of quality standards is expected to have both short-term and long-term impacts on the carbon credit market. Initially, the prices of high-quality carbon credits are expected to rise, as it may take time for participants to adjust to the new quality standards. This could result in a temporary shortage in the supply of high-quality credits, leading to higher prices.

However, in the long term, the introduction of quality standards is expected to increase transparency in the market and improve the overall quality of carbon credits. This, in turn, is likely to increase demand for high-quality credits and reduce the price differential between high and low-quality credits.

Eventually, every carbon credit will be required to meet high-quality standards, eliminating the need for participants to choose between affordability and quality.

Voices from the Field: Participant Feedback on CCP

The impact of the ICVCM's Core Carbon Principles (CCPs) on the voluntary carbon market is still uncertain. While Verra and Gold Standard have generally welcomed the CCPs as providing a "floor of competence" for carbon-credit projects, they also have concerns. Verra had previously criticized the ICVCM's work as too prescriptive and potentially harmful to the VCM's growth. Meanwhile, Gold Standard, the second-largest registry after Verra, expressed concerns that the CCPs do not go far enough in raising the bar for ambition or quality.

Despite these reservations, the growing adoption of the Task Force on Climate-related Financial Disclosures (TCFD) framework demonstrates the potential for market-led, voluntary initiatives to serve as the basis for mandatory regulation. The ICVCM's efforts to establish an authoritative market standard, including its upcoming release of category-level guidance on CCP Eligibility in Q2 2023, could prove to be a useful tool for companies and their advisors as they develop and refine their climate strategies and navigate the evolving VCM landscape.

The successful implementation of the CCPs could boost investor confidence in carbon-credit projects, leading to increased capital flows and a reduction in market fragmentation. Furthermore, the CCPs' incorporation of sustainability principles and their focus on reducing emissions impact could encourage carbon-credit projects to adopt more ambitious climate targets, ultimately contributing to global efforts to mitigate climate change.

Synopsis:

The Core Carbon Principles (CCPs) is a positive development for the carbon markets. The CCPs provide a framework for social and environmental safeguards that aim to ensure that mitigation activities are in line with industry best practices. These principles also emphasize transparency in how carbon projects calculate benefits and share revenue with local communities, as well as measuring contributions to the UN Sustainable Development Goals (SDGs). These steps are significant for the future of carbon markets.

Despite the progress made by the CCPs, there is still a lot of work that needs to be done to make these principles actionable. Details surrounding the fundamental principles of carbon projects, such as additionality and permanence, have not yet been released. This information is critical in determining which crediting programs and credits are approved.

In the next few months, the IC-VCM will release more detailed, category-level requirements to address these issues.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)