Coping with Biodiversity Loss: Strategies and Solutions

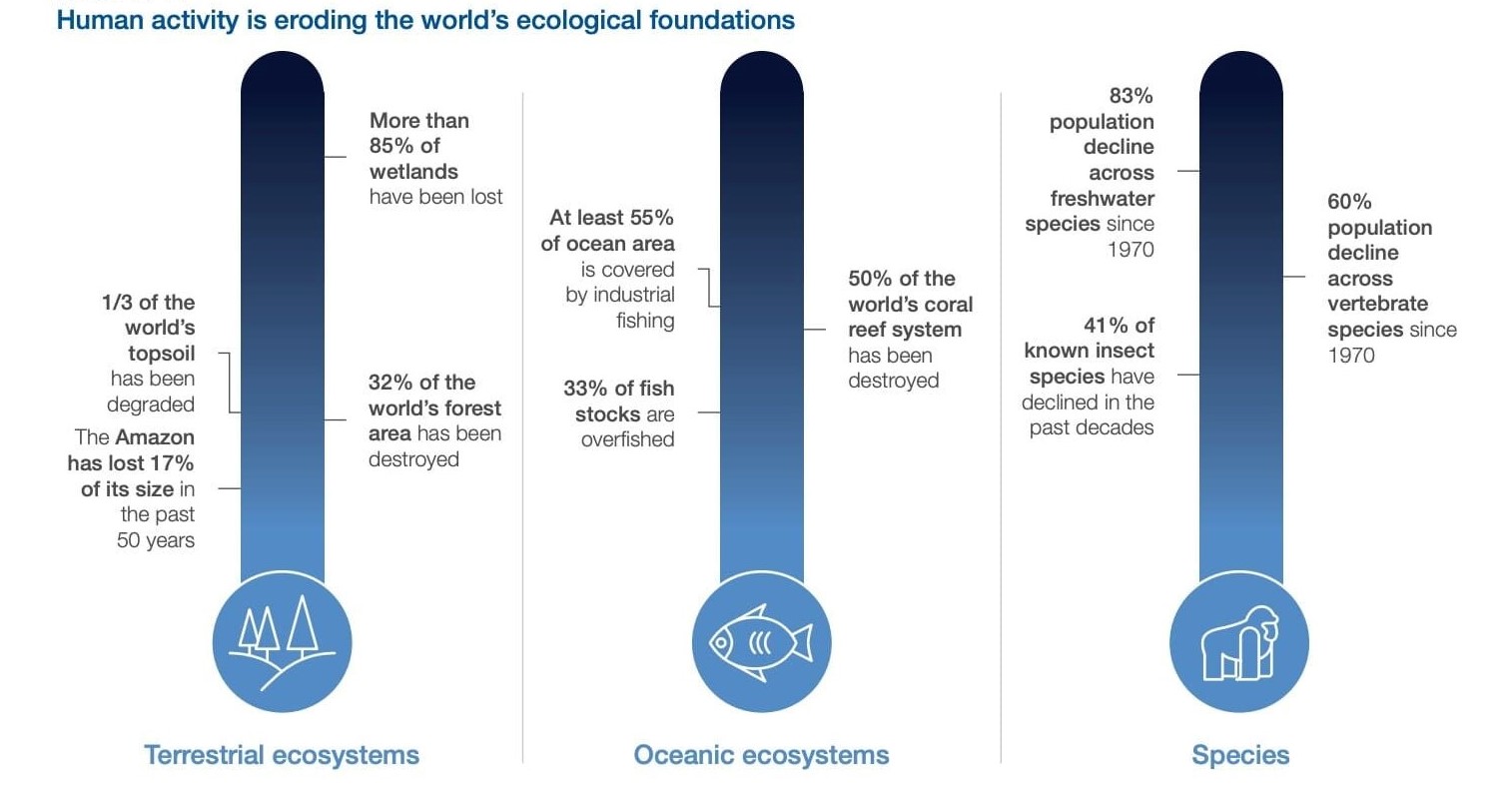

Biodiversity loss is one of the biggest dangers we face in today’s time as extinctions and destruction of ecosystems has accelerated at a rapid pace. The CBD (UN Convention of Biological Diversity) confronts the threats to the survival of species and ecosystems around the world. It dates back to the 1992 Rio Earth Summit and has been ratified by 195 countries and the European Union. Despite initiatives and policies, biodiversity loss has worsened, and none of the 20 Aichi Biodiversity targets agreed upon by Parties to the CBD in 2010 have been fully achieved.

Source: IPBES, “Global Assessment Report on Biodiversity and Ecosystem Services”, 2020

Preserving biodiversity is beneficial not only for the natural ecosystems but also for the human inhabitants of such areas. However, there exists a significant funding shortfall of around $700 billion annually to conserve and safeguard the environment. At the UN Convention of Biological Diversity in December 2022, the world agreed to address biodiversity loss, restore them, and protect indigenous people's rights resulting to the establishment of a global goal to protect 30% of biodiversity by 2030 was agreed upon.

Three critical action items were formulated to achieve the same: 1) Embed nature and biodiversity into business and financial decision making 2) Unlock public and private financing for critical ecosystems 3) Ensure an equitable and just transition

There has been a clear gap in ambition and commitment by the countries to address biodiversity loss. The economic impact due to biodiversity loss is also significant.

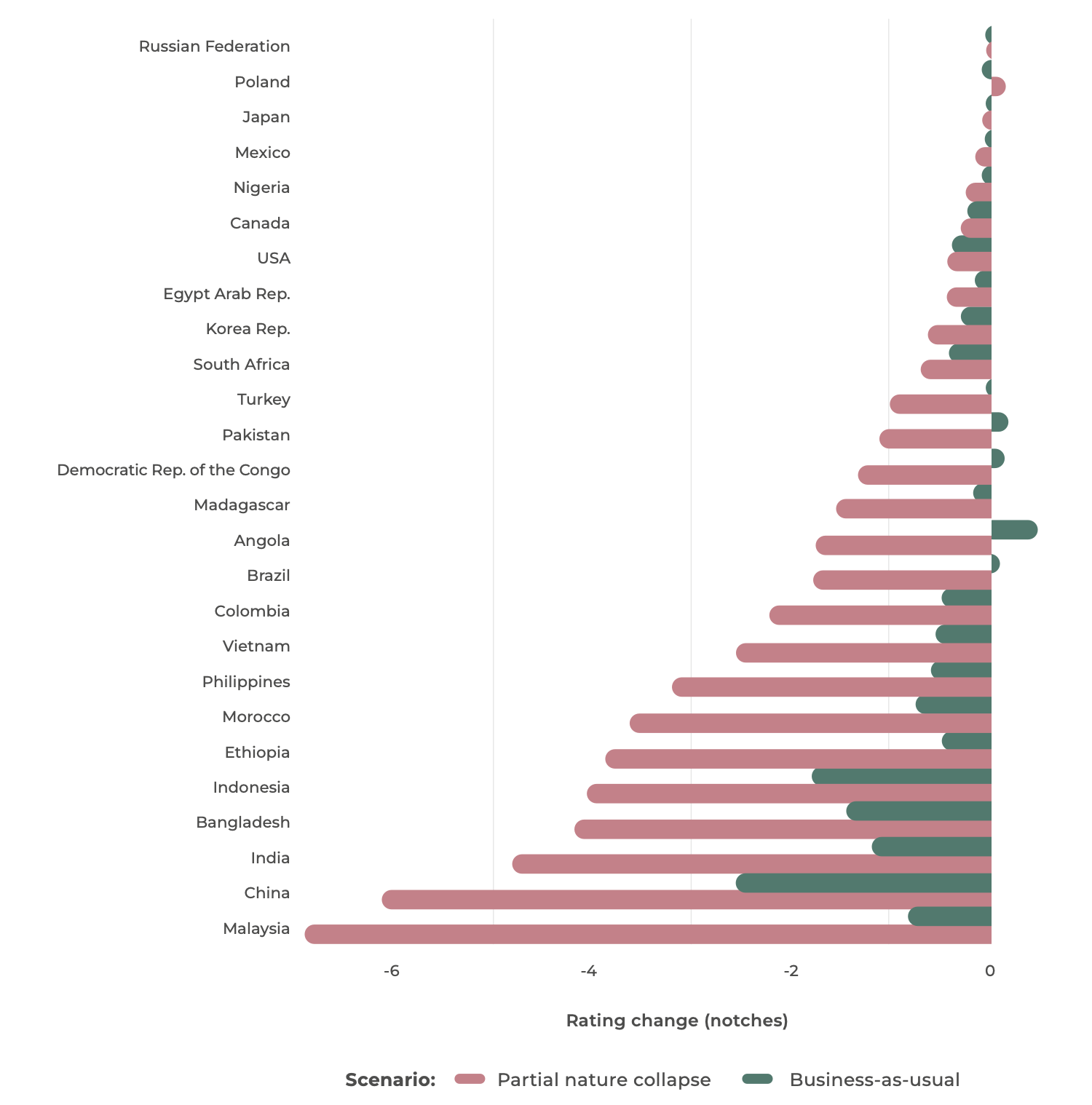

A study conducted by the University of Cambridge which has developed the world’s first biodiversity-adjusted sovereign credit ratings, their research finds that many countries are at risk of effectively going bankrupt if their credit ratings deteriorate due to ecological factors like biodiversity loss. As of now Sovereign Credits ratings only weigh geopolitical risks but soon it will change and incorporate the rapid deterioration of nature in the sovereign rating system.

As nature loss reduces economic performance, if not tackled immediately it will become harder for countries to service their debt which might force cuts in the government spending and raise inflation.

Looking at the credits rating of 26 countries studied by the University of Cambridge in their research, If parts of the world see a ‘partial ecosystems collapse’ of fisheries, tropical timber production, and wild pollination, then more than half of the 26 nations studied would face downgrades and the risk of bankruptcy would increase by 10% in the “Partial Nature Collapse” scenario.

Source: University of Cambridge

Biodiversity Credits: An Overview

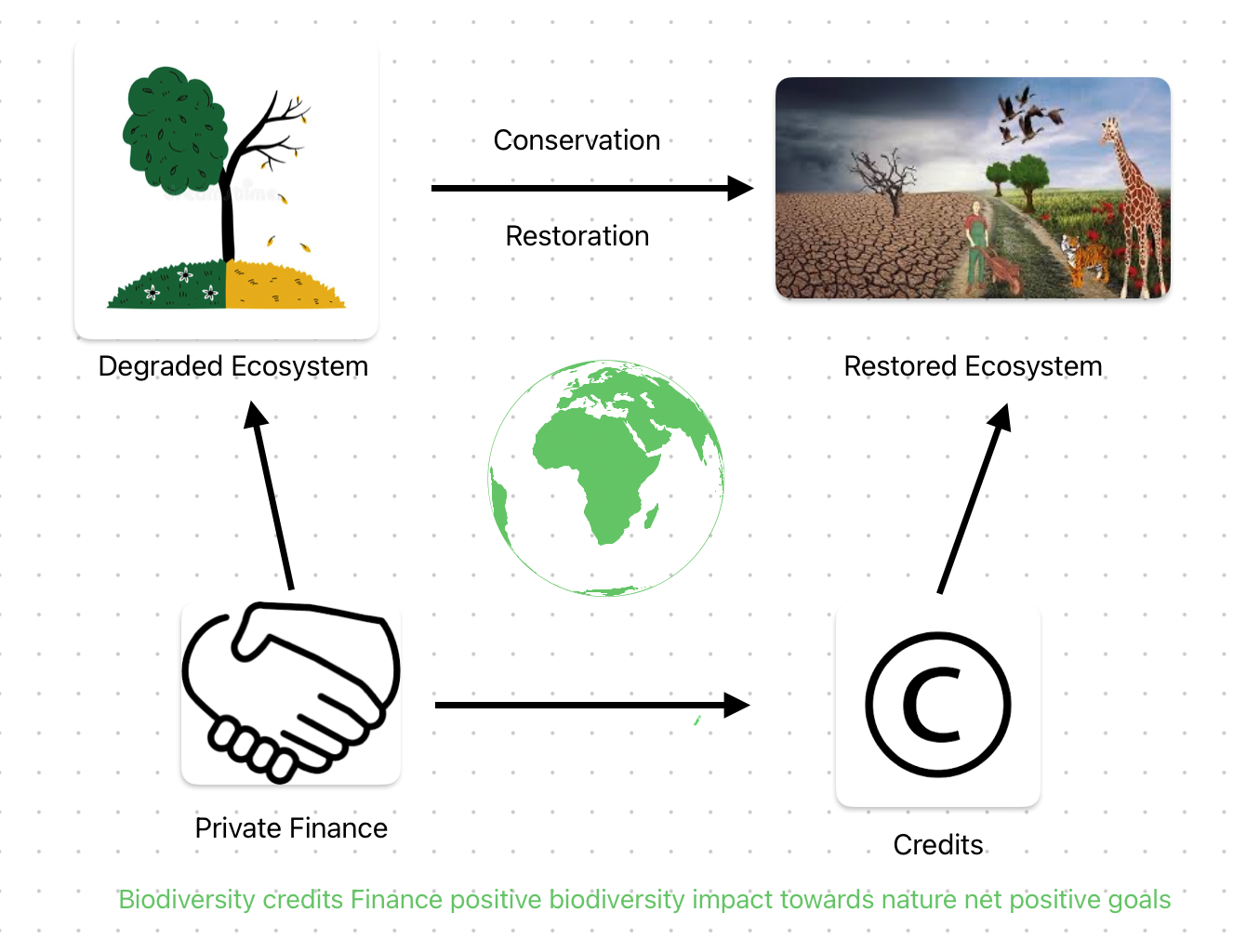

Simply put, Biodiversity credits are a standardized unit of positive biodiversity outcomes which can be acquired by those wanting to drive positive biodiversity outcomes. Biodiversity credits is a mechanism that allows individuals and companies to invest in environmental projects that contribute to a protect biodiversity.

Essentially it is a market-based mechanism that aims to put a financial value on biodiversity conservation and incentivize its preservation by linking it to economic development activities. Bio credits are designed to be bought and sold, they can direct revenue towards effective biodiversity conservation and support locally led actions and indigenous community.

When the total fund Deposit (money generated from sale of credits through biodiversity protection, used to fund the management of the site in perpetuity) is fully paid, the money from any additional sales of credits from a biodiversity stewardship site is paid directly to the owner.

Exploring the Differences between BioCredits and Carbon Offsets in the Context of Environmental Protection:

Biodiversity credits are very different from carbon offsets. Given the complexity and localized nature of biodiversity, it is difficult to draw an equivalence between positive biodiversity outcomes in one location and negative biodiversity outcomes in another. While CO2 in one corner of the planet is the same as CO2 in another, the same cannot be said for biodiversity.

Offsetting does not work for biodiversity in the way that carbon offsets can work for climate as there is an asymmetry between the climate and nature crisis. Loss of biodiversity will result in a nature crisis due to the sole basic economic principle that “Resources are scarce”.

According to science impact of climate change can be mitigated by achieving net zero by 2050 and some other targets by avoiding and capturing greenhouse gases from the atmosphere. A similar state of equilibrium cannot be achieved to save nature.

Hence, Biodiversity Credits focus on Nature Positive outcomes and shift away from offsetting claims.

Why are Biodiversity Credits crucial?

Biocredits provide a promising solution to combat the potential risks associated with biodiversity loss. By investing in conservation and restoration efforts, businesses and countries can help prevent the following risks identified by the Task Force on Nature-related Financial Disclosures (TNFD):

Ecosystem Collapse: As biodiversity declines, there is an increased risk of ecosystem collapse, where vital ecosystems may cease to exist. This not only threatens the survival of countless plant and animal species but also has far-reaching consequences for human societies, including the loss of essential ecosystem services such as clean water, air, and soil.

Aggregated Risk: The loss of nature has a significant impact on multiple sectors of the economy, ranging from agriculture and forestry to mining and tourism. The interconnectedness of these sectors means that the risks associated with nature loss are aggregated, potentially leading to widespread financial and economic instability.

Contagion: Failure to account for nature-related risks could result in financial difficulties for one or more financial institutions, leading to contagion and systemic risk across the entire financial system. This could have severe consequences for businesses, individuals, and the economy as a whole.

The emergence of voluntary biodiversity credit markets represents a significant opportunity to strengthen ecosystem resilience and mitigate systemic nature-related risks by financing measurable and verifiable biodiversity outcomes through the protection and regeneration of nature.

The flow chart below describes the life cycle of credit generation through financing.

Real-World Examples of Biodiversity Credits in Action :

Several initiatives are currently being undertaken to explore the concept of biodiversity credits. New Zealand, Colombia, and Australia are among the countries that have already made strides in this area.

New Zealand, for instance, launched its own version of biocredits, called "sustainable development units," in July 2022. Facilitated by Ekos and backed by Trust Waikato, the Wel Energy Trust, and the D.V. Bryant Trust, these credits were purchased by Profile Group Limited, a supply chain business. The funds were used to support conservation efforts across 83 hectares of land at Sanctuary Mountain Maungatautari. Unlike offsets, these biocredits were issued with a focus on achieving short-term biodiversity outcomes.

Colombia, on the other hand, introduced its "voluntary biodiversity credits" (VBCs) in May 2022. Created by ClimateTrade and Terrasos, the VBCs were first issued by the Bosque de Niebla-El Globo Habitat Bank. Priced at $30, each VBC corresponds to 30 years of conservation and/or restoration of 10 square meters of the Bosque de Niebla forest, which is home to numerous threatened species.

Australia has also developed its own unique form of biodiversity credits, called EcoAustralia™ credits. Introduced in 2018 by South Pole, each EcoAustralia™ credit is a combination of one "Australian biodiversity unit" (ABU) and one carbon credit (issued by Gold Standard). Each ABU represents 1.5 square meters of habitat protection. One of the projects that issue ABUs is the Mount Sandy project, which safeguards a rare pocket of native vegetation in South Australia's Coorong region under the care of the Ngarrindjeri people. Notable buyers of EcoAustralia™ credits include Porsche Australia, the University of Melbourne, and CareSuper.

These examples illustrate that biodiversity credits are still in their infancy, but they are rapidly gaining momentum. As with carbon credits, biodiversity credits are poised to become a significant player in the fight against environmental degradation.

Challenges and Way Forward

Though the Biodiversity credits market has the potential to mobilize funds, the challenge still persists as seen in the other carbon market's market-based programs, to deliver the outcome and maintain the highest environmental integrity. This requires addressing the issues of both credit design and market architecture. To solve the challenge of quantification of the biodiversity benefits many organizations are in the process of developing a common methodology that will enable the independent assessment and verification of the real-world biodiversity benefits and certification of nature-positive investments. Additionally, independent validation and verification and the issue of biodiversity credits by a third party (just as is done currently for carbon credits) is a crucial step in market acceptance for these credits. One of the first existing third-party verifiers for biodiversity credits is an Australia-based firm Vegetation Link. The price of biodiversity credits as of now typically differs between projects and is in the range of AU$3 – AU$7 per square meter. Verra is developing a biodiversity methodology in its Sustainable Development Verified Impact Standard (SD VISta) Program. Project developers will be able to use the methodology to quantify the biodiversity benefits of their conservation and restoration activities. Once a project has been verified using SD VISta’s world-leading systems, companies can purchase the resulting biodiversity credits to invest in biodiversity and progress their nature-positive commitments. Some of the independent organisations which has already started public consultation to measure the impacts and quantify the benefits of biodiversity in terms of credits are Replanet, Wilder lands, and Biodiversity Credits.

Synopsis

Biodiversity credits offer a tangible way for businesses and financial institutions to contribute to positive environmental outcomes beyond just offsetting their negative impacts. By voluntarily investing in biodiversity conservation, they can help address the escalating threat of biodiversity loss and promote the sustainable use of natural resources.

Although the concept of biodiversity credits is still in its infancy, various initiatives are being developed worldwide to create a standardized, robust, and transparent system for assessing and trading these credits. These initiatives seek to establish a framework that can verify the ecological integrity of biodiversity credits and provide a common currency for tracking progress toward conservation goals. This would enable businesses and investors to quantify and demonstrate their contribution to conservation efforts, while also encouraging greater collaboration and investment in biodiversity conservation.

Additionally, a well-designed biodiversity credit system could facilitate the conservation and restoration of vital habitats and species, generating a range of ecological, social, and economic benefits for local communities and society as a whole.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)