There is a growing global consensus among governments and corporations regarding the critical role of carbon pricing in the transition toward a decarbonized economy. Carbon pricing serves as both a revenue source for governments and a fundamental component of climate policy that drives emission reduction.

Within the business community, internal carbon pricing (ICP) emerges as a valuable tool, enabling emissions reduction and guiding investments toward more efficient and clean technologies.

Companies utilizing ICP can effectively assess climate-related risks, identify opportunities, prepare for future climate regulations, and enhance corporate sustainability. Investors can leverage ICP to evaluate the potential impact of policy on their investments, facilitating the reallocation of funds towards low-carbon and climate-resilient activities.

Introduction to Carbon Pricing

Carbon pricing is an effective strategy that aims to reduce greenhouse gas (GHG) emissions by utilizing market mechanisms to assign the financial cost of emissions to those responsible for them.

By establishing a price on carbon dioxide equivalent (CO2e) emissions, this approach provides an economic incentive for polluters to either adopt sustainable practices and reduce their emissions or continue emitting them while bearing the financial burden.

The importance of carbon pricing is acknowledged within the framework of the Paris Agreement, in paragraph 136, the “important role of providing incentives for emission reduction activities, including tools, such as domestic policies and carbon pricing”. Carbon pricing sets a tune for framing policies for both investors and key global frameworks.

With an increasing number of carbon pricing initiatives worldwide, totaling over 60, this method is widely seen as a flexible and cost-effective means of addressing the challenges posed by climate change.

Article 6 of the Paris Agreement rulebook on international cooperation through carbon markets, which was finalized at the UN climate talks at COP26, increased interest in internal carbon pricing (ICP) and means to drive innovation, investment, and economic growth.

As the international community strives to implement the Paris Agreement and achieve net-zero emissions by 2050, carbon pricing remains an indispensable tool in the fight against climate change. Internal carbon pricing (ICP) has gained significant traction as a corporate strategy for reducing emissions, managing climate-related risks, and financing decarbonization efforts. The private sector's growing commitment to achieving net-zero emissions has sparked a heightened interest in understanding carbon pricing measures, particularly ICP, and fostering participation in voluntary and compliance markets, particularly in emerging economies like India.

To gain a comprehensive understanding of carbon pricing, it is essential to explore its two primary forms - external and internal. Let's delve deeper into each concept to enhance our knowledge of this topic.

Forms of Carbon Pricing:

Carbon pricing encompasses two primary forms: External and Internal.

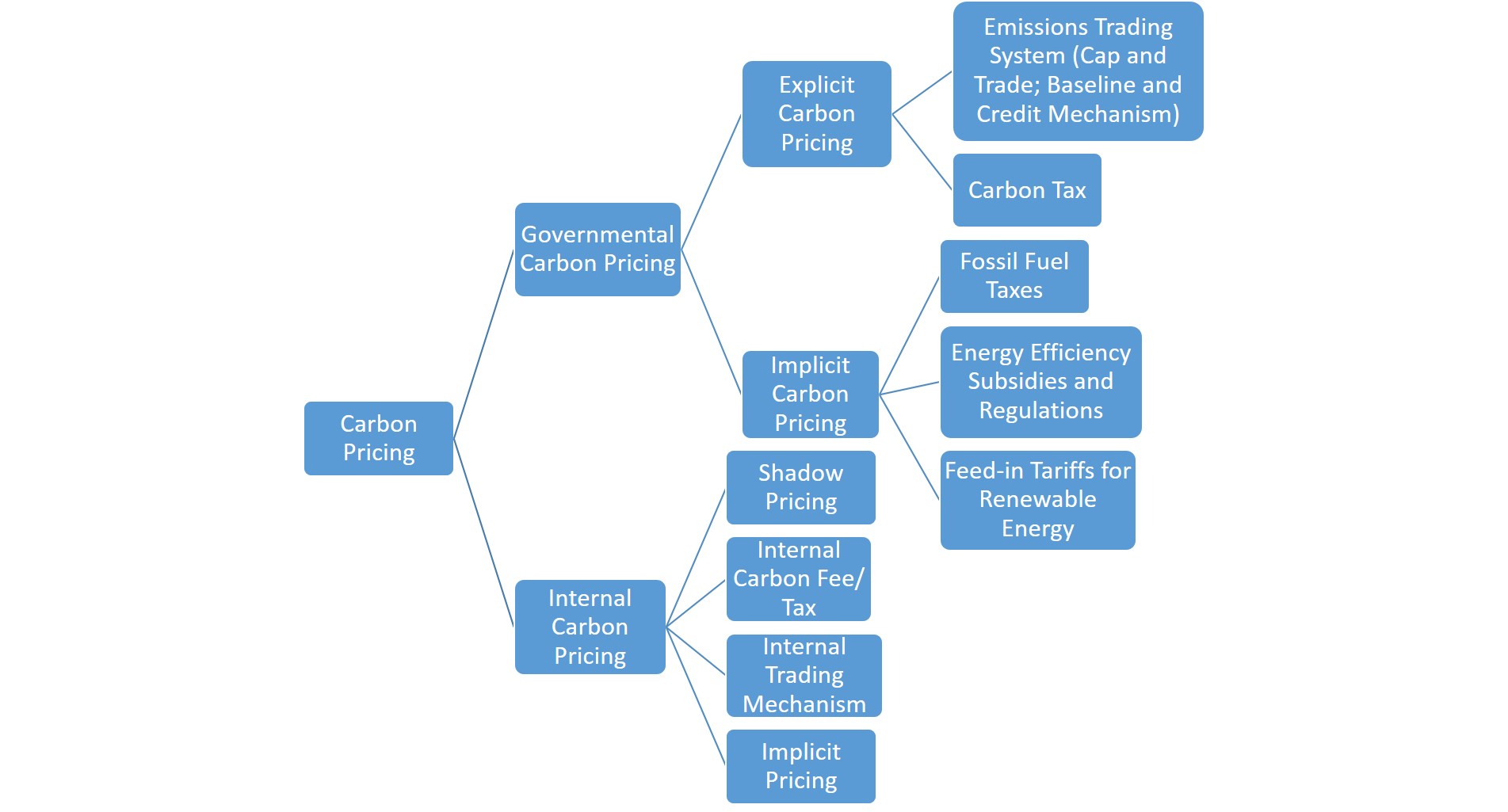

Figure 1: Forms of Carbon Pricing (Source: CEEW-CEF compilation based on UNESCAP (2020), ADB (2021), and World Bank (2022))

External Carbon Pricing:

It entails the implementation of mechanisms such as Emissions Trading Schemes (ETS) and carbon taxes.

In an ETS, greenhouse gas emissions are regulated by setting a cap on the overall emissions level. Industries with lower emissions have the opportunity to trade their surplus allowances with larger emitters, creating a cap-and-trade system.

Alternatively, carbon taxes establish a direct price on carbon emissions through government policies that promote emission reduction efforts. These policies can include energy efficiency standards, as well as subsidies for renewable energy. Carbon taxes commonly involve levying taxes on greenhouse gas emissions or on the carbon content of fossil fuels. An example of an implicit carbon tax is the excise duty imposed on petrol and diesel in India.

Internal Carbon Pricing

ICP, or Internal Carbon Pricing, is a voluntary cost that businesses associate with their own greenhouse gas (GHG) emissions to internalize climate risks and integrate them into their investment decisions. This approach holds the potential to facilitate low-carbon transitions by guiding investments towards clean technologies.

The UN Economic and Social Commission for Asia and the Pacific (UNESCAP) identifies four main categories of ICP.

Shadow Pricing: It involves assigning a hypothetical cost to each ton of carbon emissions, considering the climate risks faced by a business. This method is used to evaluate business cases, procedures, and strategies, providing insights into how emission costs can impact business operations. Financial institutions can leverage shadow pricing to make credit allocation decisions that favor low-carbon businesses. Similarly, businesses can utilize it to assess the future profitability of projects adjusted for carbon impacts.

Implicit Pricing: It is a retrospective measure calculated based on the emissions abatement achieved by the existing project(s) and the associated costs. This cost could include the investments made in achieving cumulative emissions abatement. Additionally, companies sometimes determine implicit carbon prices based on the expenses incurred for purchasing carbon offsets. Implicit pricing is considered when making new investment decisions, taking into account the carbon performance of the project.

Internal Carbon Tax/Fee: It involves imposing a charge per metric ton of carbon dioxide (tCO2) on the organization's overall emissions. The revenue generated from this internal carbon tax is then directed toward financing low-carbon projects and activities. By internalizing the cost of carbon emissions, businesses can incentivize emission reductions and allocate resources towards sustainable initiatives.

Internal Trading Mechanisms: It replicates external emissions trading systems, such as the European Union ETS. In this approach, an organization establishes a carbon emissions cap for each business unit and creates allowances accordingly. These allowances can be bought or sold between business units, promoting internal emission reductions and providing flexibility in meeting carbon targets.

Let's explore the intricacies of the concept of Internal Carbon Pricing and examine the essential considerations for companies when employing this tool.

What are the key aspects that companies should consider disclosing when utilizing Internal Carbon Pricing (ICP)?

When disclosing information about Internal Carbon Pricing (ICP), it is advisable for companies to include the following details:

- Assumptions regarding the anticipated evolution of carbon price(s) over time within tax and/or emissions trading frameworks.

- The geographic scope in which the carbon price(s) would be implemented.

- Clarification on whether the carbon price would be applied solely at the margin or as a fundamental cost.

- Identification of whether the carbon price is targeted at specific economic sectors or covers the entire economy, along with the regions in which it applies.

- Specification of whether a uniform carbon price is employed at different points in time or if differentiated prices are utilized.

- Assumptions made about the extent and method of implementing a CO2 price, whether through a tax or trading scheme, and the scope it covers.

At present, India does not have a defined external carbon price in place, and there is a lack of carbon pricing signals through proposed policies. While the coal cess has been recognized as a form of a carbon tax in the past, the utilization of the funds for carbon mitigation has been absent, resulting in the absence of any climate co-benefits.

Despite the absence of a national push for carbon pricing regulations, leading companies have voluntarily adopted Internal Carbon Pricing (ICP) and the government has implemented implicit pricing policies. Moreover, significant efforts are being made at the subnational level within India. For instance, Mumbai has recently set an ambitious target to achieve net-zero emissions by 2050, positioning it twenty years ahead of India's overall net-zero target.

The Growing Trend: Increasing Adoption of Internal Carbon Pricing

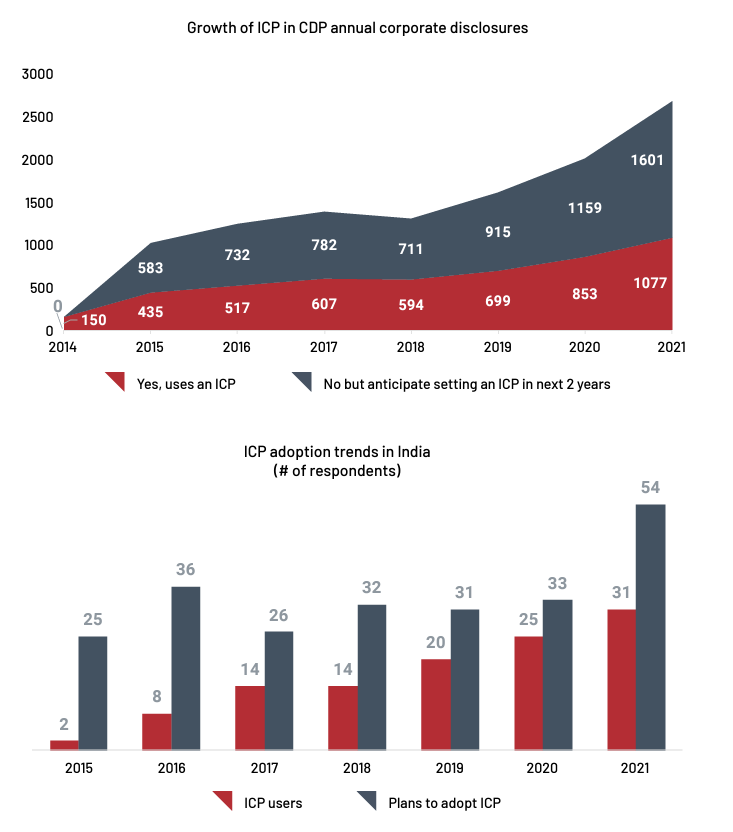

The adoption of Internal Carbon Pricing (ICP) is gaining significant momentum worldwide, as evidenced by the data collected by CDP since 2014. CDP, known for being the largest repository of information on corporate exposure to carbon pricing regulations, provides valuable insights into how companies are utilizing and perceiving ICP. In 2021, a total of 1,077 companies globally reported incorporating ICP into their strategies, while an additional 1,601 companies revealed plans to implement ICP within the next two years.

Within the Indian context, the adoption of ICP has seen remarkable growth. Currently, 31 companies in India have already integrated ICP into their operations, representing a notable 25% increase compared to the previous year. Moreover, a staggering 54 companies in the country have expressed intentions to adopt ICP in the next two years, marking an impressive 63% surge from 2020. This combined figure brings the total number of Indian companies either using or planning to adopt ICP in the near future to 85, reflecting an encouraging 50% increase when compared to the previous year's data.

These findings clearly demonstrate the increasing recognition of the importance and benefits associated with internal carbon pricing among businesses worldwide. The rise in ICP adoption signifies a proactive approach by companies to address climate change and effectively manage their carbon emissions. As the global business community continues to embrace ICP, it is poised to play a pivotal role in driving sustainable practices and fostering the transition to a low-carbon economy.

Figure 2 (Source: CDP)

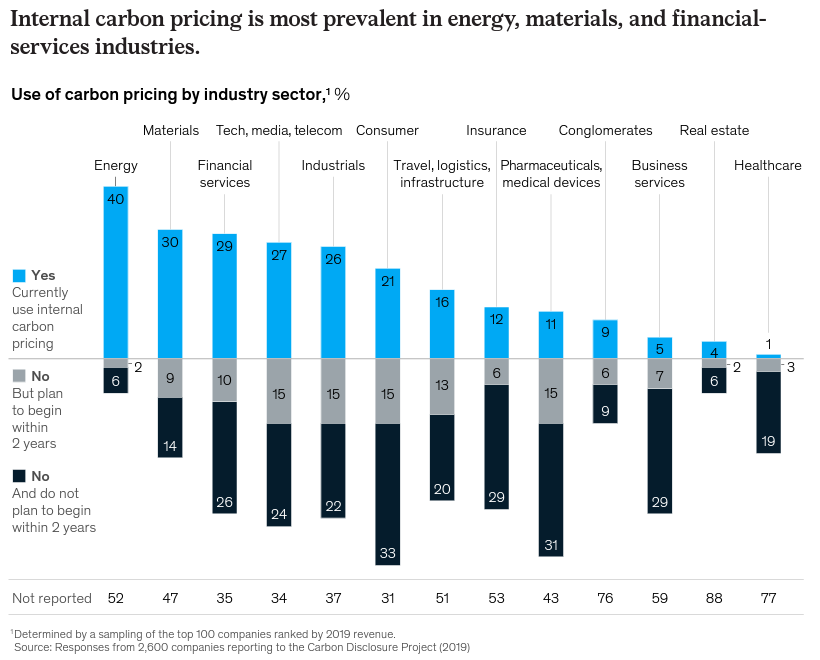

To gain insights into the utilization of internal carbon pricing and its industry-specific application, we look into the data provided by companies that have voluntarily disclosed information about their internal carbon-pricing initiatives. Specifically, 23 percent of the approximately 2,600 companies in the data set indicated they are using an internal carbon charge, and another 22 percent plan to do so in the next two years. Of the top 100 companies in our global data set (based on 2019 revenue), the ones that most frequently reported using internal carbon pricing were those in the energy, materials, and financial industries. They were followed closely by the technology and industrial sectors.

Figure 3 (Source: Mckinsey)

Efforts to establish effective pricing standards that guide companies are underway, with economists and advocacy groups proposing a wide range of potential pricing levels. The debate on this matter remains contentious, with figures ranging from a few dollars to over $100 per metric ton, depending on the discount rate applied.

The Environmental Defense Fund (EDF), an environmental advocacy group, estimates the societal cost of carbon to exceed $50 per metric ton emitted, but acknowledges that this figure might be an underestimation as it doesn't fully account for all potential externalities resulting from climate change.

In contrast, the High-Level Commission on Carbon Prices suggests that companies should set internal carbon prices between $40 and $80 per metric ton in 2020 and between $50 and $100 per metric ton by 2030 to align their emissions with the goals of the Paris Agreement. However, most companies that have implemented internal carbon pricing have set their thresholds around $40 per metric ton.

For example, Danone, a French company, publicly discloses its carbon-adjusted earnings per share (EPS) using an internal carbon price of €35 per metric ton emitted. Notably, Danone's carbon-adjusted EPS has outpaced its regular EPS, with a 12 percent growth in 2019 compared to an 8.3 percent growth in headline EPS.

Already, internal carbon-pricing initiatives have influenced 22 percent of global greenhouse-gas emissions, a notable increase from 15 percent in 2017. However, current pricing thresholds fall short of adequately addressing the potential negative externalities of carbon emissions.

Real-world Examples: Implementing Internal Carbon Pricing

These real-world examples demonstrate how companies across different sectors are successfully implementing internal carbon pricing to enhance sustainability, reduce emissions, and drive climate action.

JSW Energy: Leveraging Internal Carbon Pricing for Low-Carbon Investments

JSW Energy has embraced an internal carbon pricing mechanism with a shadow price ranging from US$10 to US$12 per tCO2e. The company has made a commitment to the Science Based Targets initiative (SBTi) to reduce its specific greenhouse gas (GHG) footprint to 0.215 tCO2e/MWh by 2030 and achieve net-zero emissions by 2050. By incorporating internal carbon pricing, JSW Energy gains valuable insights into the future impact of its emissions, allowing for better calculation and management of their long-term effects. For instance, considering the emission levels equivalent to those in 2020-21, JSW Energy estimates an additional impact of approximately INR 2500 Crore by 2030 compared to its SBTi target footprint.

UltraTech Cement Limited: Accelerating Decarbonization through Internal Carbon Pricing

UltraTech Cement Limited has set ambitious targets to reduce scope 1 GHG emissions by 27% per ton of cementitious material and scope 2 GHG emissions by 69% per ton of cementitious material based on a 2017 baseline. Internal carbon pricing has emerged as a valuable tool for UltraTech to expedite the decarbonization process across its value chain and within the company. Among the available pricing methods, UltraTech has opted for a Shadow Carbon Price of US$10. By developing various scenarios aligned with its climate goals and assigning carbon prices to each, UltraTech has determined its Internal Carbon Price. The company considers this approach instrumental in driving investments in low-carbon technologies and products.

Tech Mahindra: A Hybrid Approach to Internal Carbon Pricing

Tech Mahindra has adopted a hybrid approach to internal carbon pricing, incorporating both implicit and shadow prices of US$9 per ton of CO2e. The company employs a proportional tax on business units based on the resources allocated to projects. By calculating the total capital expenditure for green initiatives divided by emissions, Tech Mahindra determines its Internal Carbon Price. Recognizing the significance of internal carbon pricing, Tech Mahindra views it as a powerful tool for emission reduction, mitigating environmental risks, directing investments towards decarbonization efforts, and driving research and development (R&D) and innovation. To facilitate green investments and allocate funds towards climate change resilience activities, Tech Mahindra has developed an Internal Carbon Pricing tool for its facilities, finance, and procurement teams.

Paving the Way Forward for Internal Carbon Pricing

Internal carbon pricing holds significant potential for shaping a sustainable future and mitigating climate change impacts. As more companies adopt this approach, it can drive investments in low-carbon technologies, incentivize emission reductions, and encourage the transition to cleaner energy sources.

By incorporating carbon costs into decision-making processes, businesses can prioritize sustainable practices and make informed investment choices. However, there are some challenges associated with internal carbon pricing. Determining the appropriate pricing level can be complex, as it requires striking a balance between achieving emission reductions and avoiding excessive financial burdens on companies.

Moreover, the effectiveness of internal carbon pricing relies on accurate data and consistent measurement methodologies. Additionally, there is a need for international coordination and regulatory frameworks to ensure a level playing field for businesses operating in different jurisdictions.

Despite these challenges, the increasing adoption of internal carbon pricing signals a positive trend towards a greener future, where businesses actively contribute to reducing their environmental footprint and achieving global climate goals.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)