A REC (Renewable Energy Certificate) is a type of Energy Attribute Certificate (EAC) that represents the environmental attributes of the generation of a one-megawatt hour (MWh) of energy produced by renewable sources. Using EAC, end users can make claims like RE100. Producers of renewable energy can sell both the energy and the related EAC. By providing a complementary income stream, the trade of EACs can reduce the reliance on national public renewable energy support schemes for renewable energy producers seeking to ensure the economic viability of their projects.

Currently, most national EACs schemes are voluntary. For example, the schemes used in the European internal market. Mandated EAC schemes are often referred to as “compliance” markets. Generally, in such schemes, a national authority requires market participants to sell or purchase a given volume or percentage of renewable energy and prove that activity through the trade and/or cancellation of EACs. EAC compliance markets are seen in some US States, where they are the tool for meeting a Renewable Portfolio Standard (RPS)

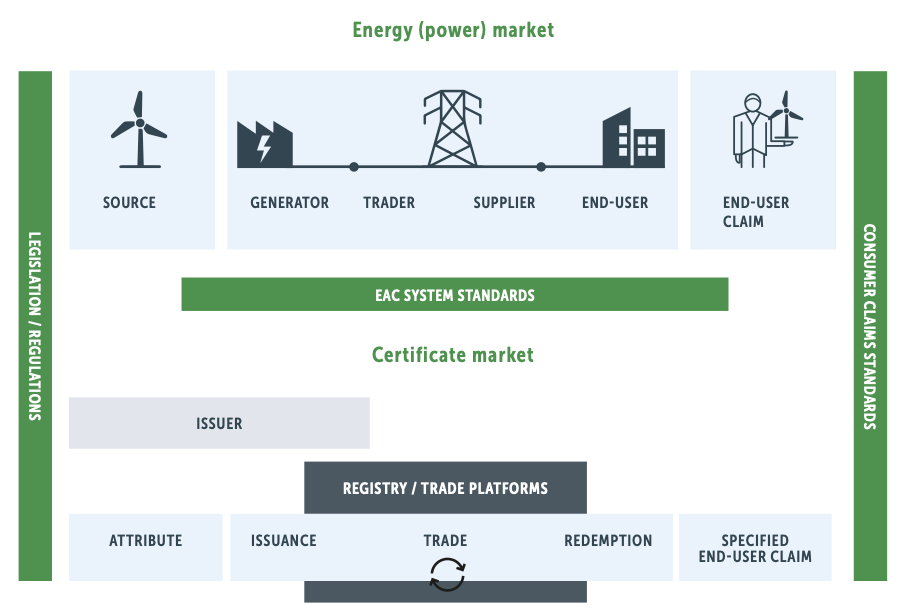

Market Mechanism

Source: i RECs Standard

The specifics of IREC issuance can vary from region to region and country to country, as renewable energy policies and regulations are established at different levels of government. In some countries there are no restrictions on iRECs issuance as in some there are. For example in India, for issuance, the project should not be claiming RECs under the domestic RECs system and additionally, the project should not have supplied power under a long-term PPA under the RPO for the period for which iRECs are claimed. Alternatively, in countries like Singapore, Sri Lanka etc, there are no restrictions to issuance. For eligibility checks, one can refer to the iRECs standard.

Attributes of a REC include, for example, the resource type, vintage of the generator, and where / when the MWh was generated.

- A producer generates a unit of energy (generally this is 1 megawatt-hour (MWh)).

- For each eligible MWh of energy produced within an EAC scheme, an EAC can be requested from the Issuing Entity.

- Such EACs can be traded between market participants through registries with the ultimate aim of selling it to a consumer (also known as an end-user).

- The end-user or their representative consumes the EAC by canceling it so it cannot be used again. Without cancellation, there is a risk that the associated claims related to attribute ownership can be claimed twice (known as double counting).

- After canceling the EAC, the end-user can claim to have consumed the attributes of the unit of energy specified in the EAC.

Market Insights and Trends

With the departure of established carbon project certifiers such as Verified Carbon Standard and Gold Standard from the renewable energy carbon credit sector in middle-income countries, numerous proprietors of renewable energy projects are redirecting their focus away from voluntary carbon markets. Instead, they are turning their attention toward the Renewable Energy Certificates market.

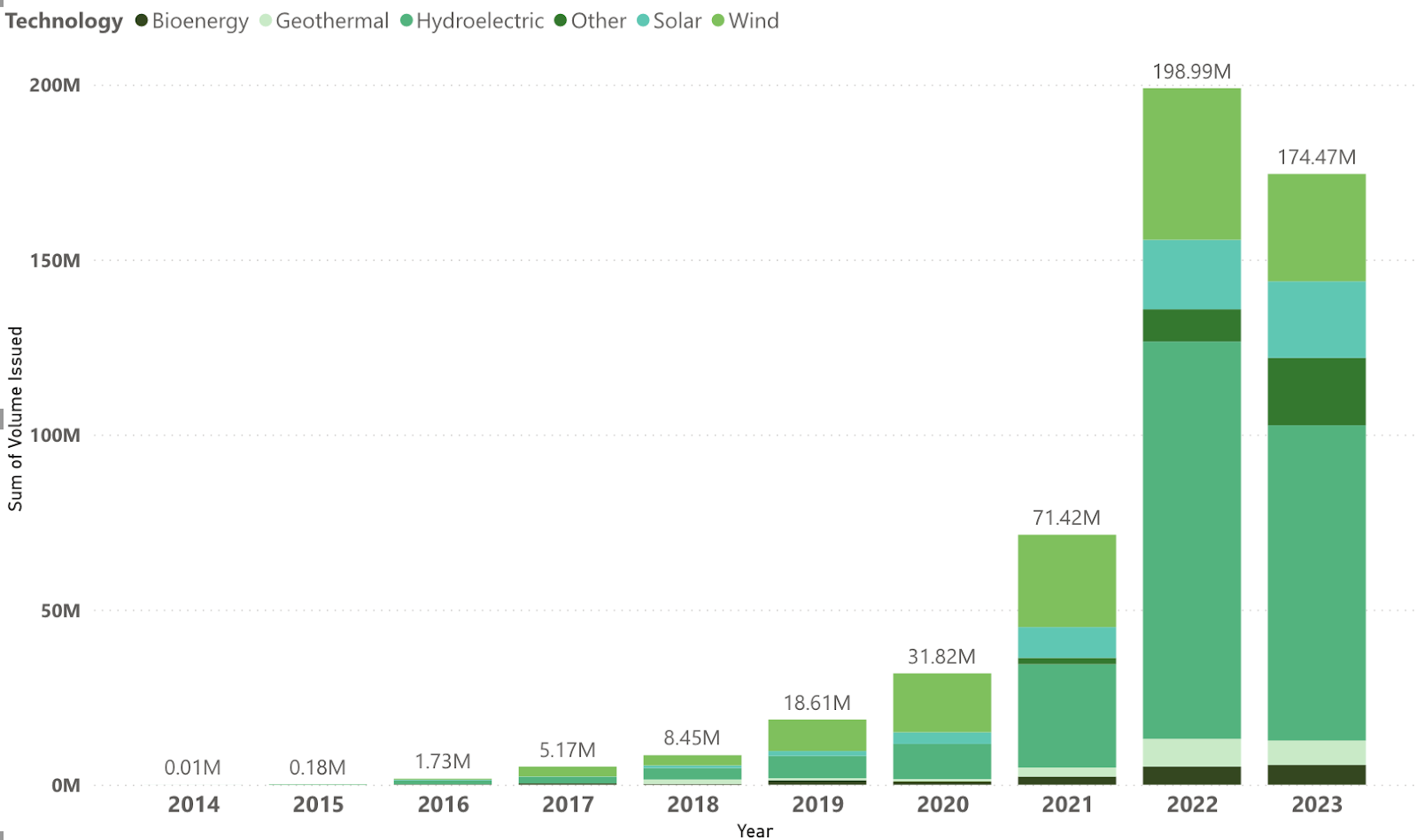

Figure 1: YoY issuances split by technology (Calculus IQ)

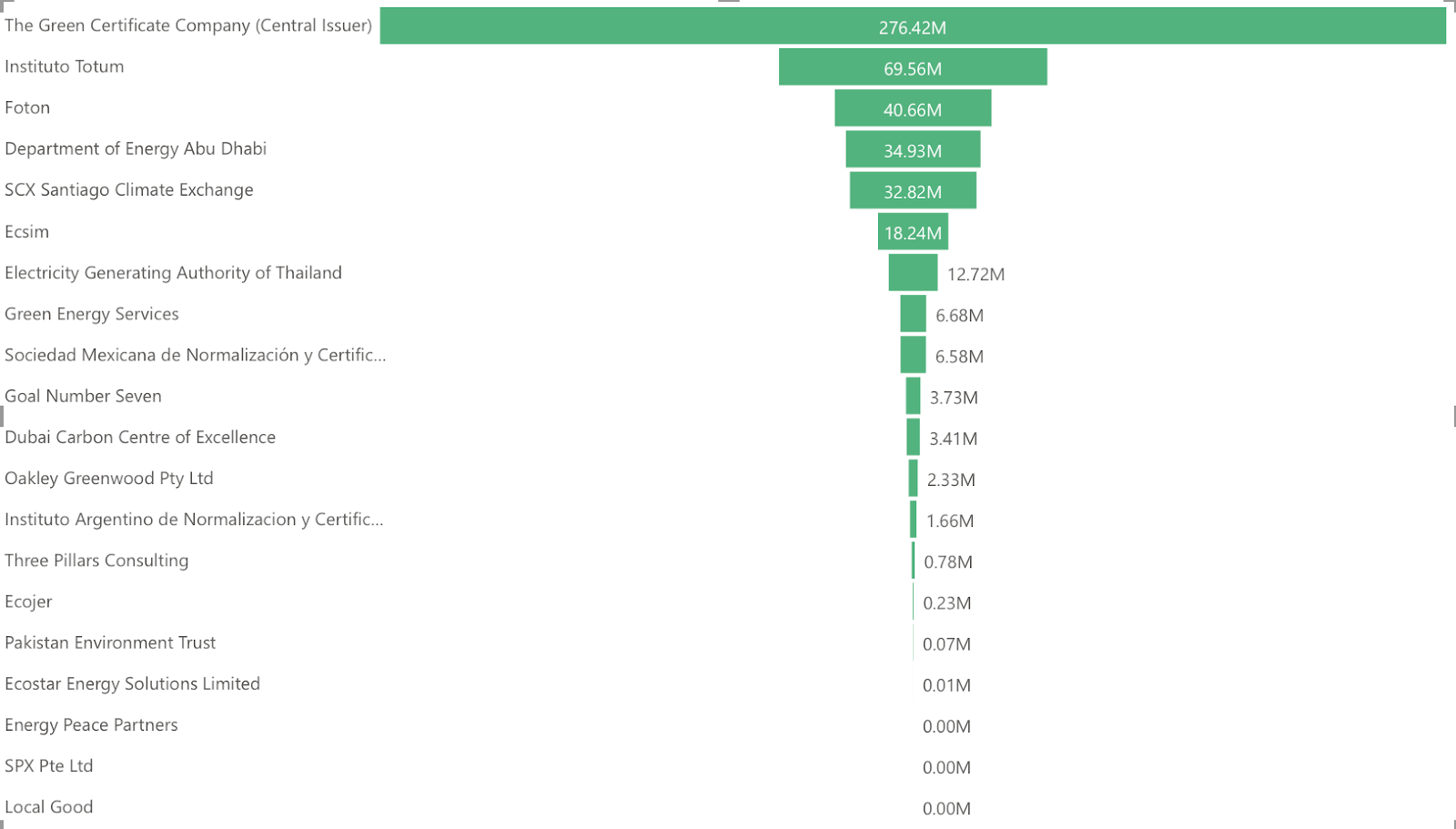

Figure 2: iRECs Issuacnes split by issuers (Calculus IQ)

To date 510M iRECs (Figure 1) have been issued via various iRECs issuers globally, the most dominant one being the Green Certificate Company (276M certificates issued till date) followed by Instituto Totum (Figure 2).

There has been an incredible increase in the iRECs issuance post-2021 (178% YoY increase between 2021 and 2022). 2023 Q2 issuances have already exceeded 2022 Q2 issuances by 35%, with this surge we can expect 2023 cumulative issuances to surpass that of 2022 by the end of Q3 of 2023.

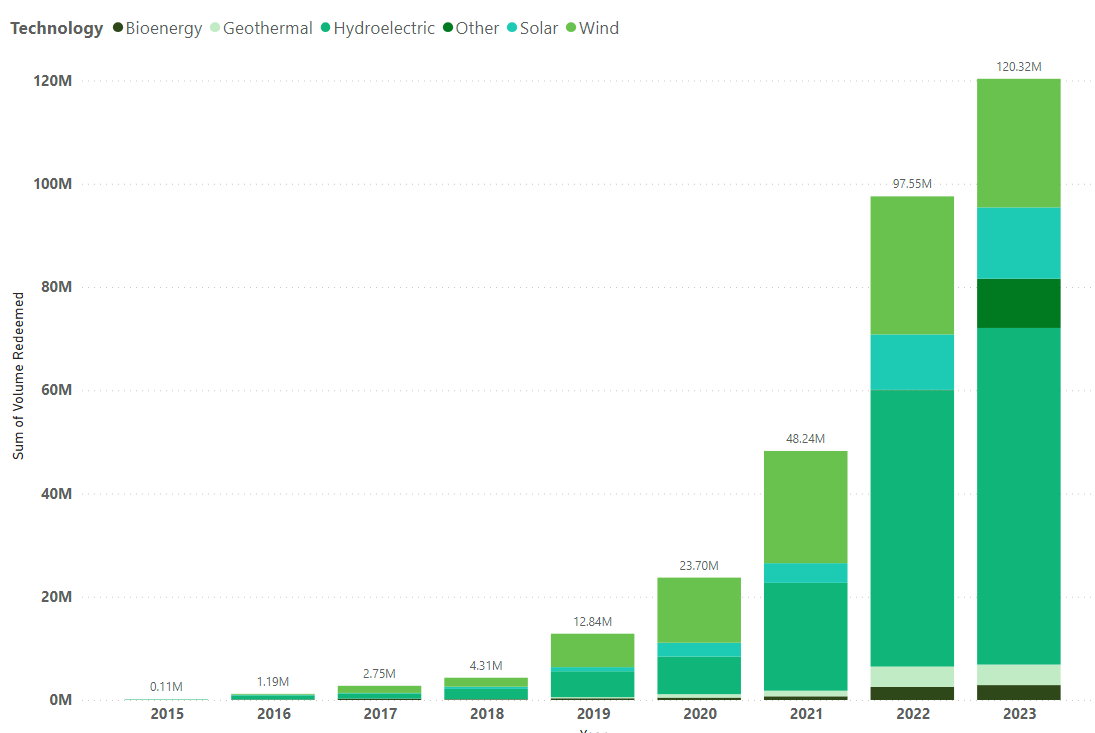

Figure 3: Certificate redemptions split by technologies (Calculus IQ)

In Figure 3, redemptions in 2023 have already surpassed the 2022 levels indicating a strong demand for iRECs. Redemption occurs when the entity that holds the IRECs decides to use the value associated with these certificates to demonstrate their commitment to renewable energy or to comply with renewable energy mandates, goals, or regulations.

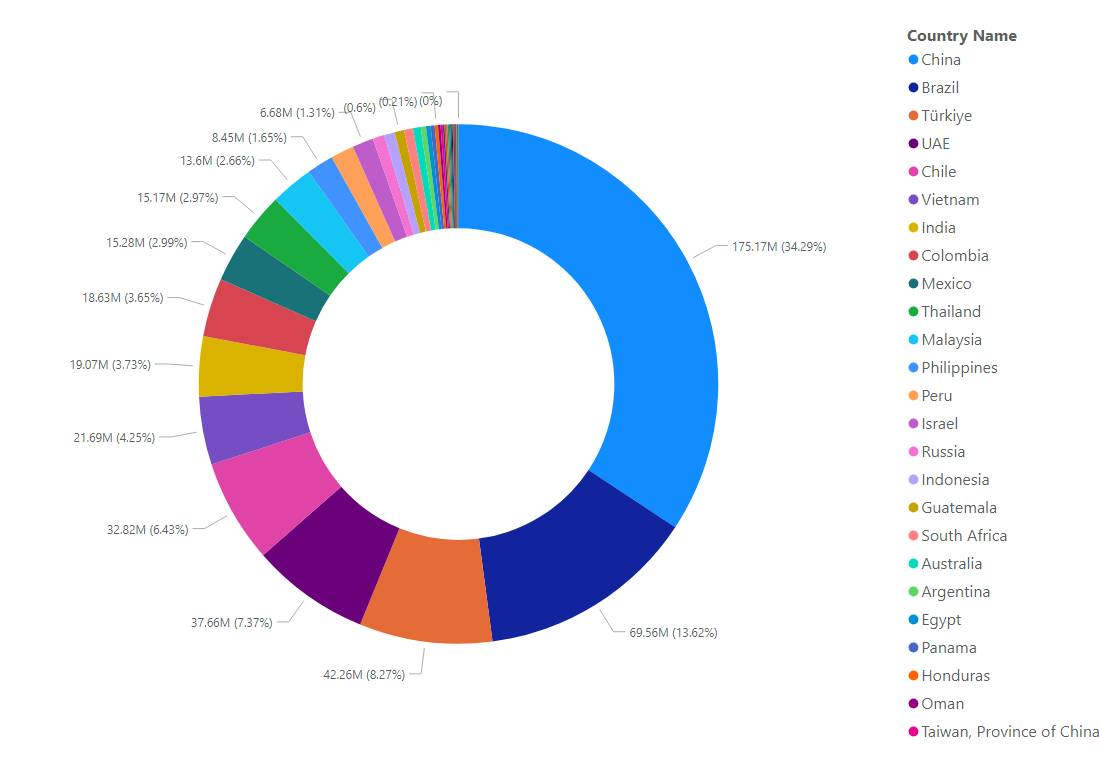

Figure 4: Certificate issuances split by countries (Calculus IQ)

The leading country in the I-REC market is China, with almost 175 million certificates issued to date capturing 34% of the market, followed by Brazil. These countries have a huge installed capacity of hydro and wind power, with the potential to expand I-REC certification even further.

The Price Differential & Impact on Market Dynamics

Most of the IREc market is oversupplied as Renewable energy targets are growing globally and corporations are increasingly making commitments to purchasing RE to meet their energy needs which often leads to the purchase of certificates indicating support for Renewable Energy generation even if they can use RE energy directly themselves. iRECs market currently has a surplus of 200M certificates. While the market is at a nascent stage, demand comes mainly from the voluntary commitments of corporations to 100% renewables consumption accounted for in Scope 2 emissions as provided by the GHG Protocol. The most common schemes driving demand are the CDP for climate disclosure and the RE100 for renewable energy usage.

There is a vast difference in prices of RE carbon credits and iRECs, for example, RE carbon credits from countries like Turkey trade between $1-$5/mtCO2 whereas iRECs trade at almost $1/MWh. Prices of RE carbon credits have fallen recently as prominent registries like Verra and Gold Standard have stopped accepting RE projects from 2019 due to additionality concerns. However, the Global Carbon Council (GCC) registry is accepting RE projects for Carbon Credits but the demand for these credits remains to be seen. This might have an impact on the iRECs prices positively as some of the projects will migrate to GCC putting a constraint on the supply of IRECs certificates.

Another important aspect to consider is the registration fees of the projects, it is more expensive to register on the Global Carbon Council than to issue I-RECs. iREC can take less than a month to have a plant registered/able to issue certificates and the cost of account opening and project registration adds up to roughly 3500 Euros whereas registering a project for credits is an expensive and tedious process, and costs can add up to 8 to 10 times the cost of iRECs registration.

In summary, stricter regulations within the competitive voluntary carbon market prompted numerous renewable energy manufacturers to transition to the I-REC sector as a viable avenue for income generation. Apart from this, one of the main drivers pushing the uptake of the I-REC market worldwide is the apparent integrity and robustness and relative simplicity for asset owners to register their energy devices, trace their electricity production and trade such attribute certificates with market players. Throughout 2023, there has been a notable surplus in supply matched by sturdy demand for iRECs.

If you are interested in learning more about sustainability markets, we invite you to interact with Calculus IQ. This tool can help you explore different aspects of the market, including project types, retirement volumes, and more.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)