Introduction

The adoption of the Paris Agreement during the 21st Conference of the Parties (COP-21) marked a significant global effort to address the challenge of climate change. With the aim of limiting global warming to below 2 degrees Celsius and preferably 1.5 degrees Celsius, by the end of the century, countries and companies worldwide have been actively seeking solutions to reduce greenhouse gas (GHG) emissions. Among the industries identified as particularly challenging to decarbonize, aviation stands out.

The aviation industry is responsible for nearly 2% of global GHG emissions, making it a significant contributor to the overall carbon footprint. Within the transportation sector, it accounts for approximately 11% of emissions, further highlighting its impact on climate change.

What is SAF?

Sustainable Aviation Fuels (SAFs) is a type of liquid fuel that is currently being utilized in commercial aviation. These fuels have the remarkable potential to reduce CO2 emissions by up to 80%. SAFs can be derived from a variety of feedstock sources, including:

- Waste fats

- Oils and greases

- Municipal solid waste

- Agricultural and forestry residues

- Wet wastes

- Non-food crops cultivated on marginal land

Additionally, there is the possibility of producing SAFs synthetically through a process that involves capturing carbon directly from the air. This diverse range of feedstock options offers promising pathways for the production of SAFs and contributes to the sustainability goals of the aviation industry.

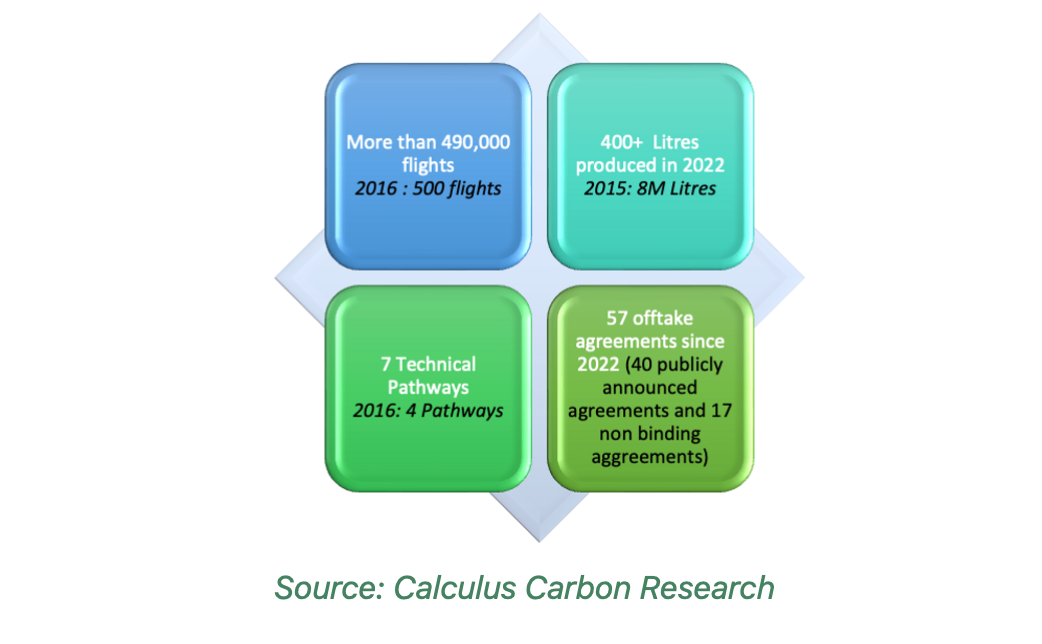

Figure 1: State of SAF in 2023

According to the table below, around 0.5B liters of SAF have been produced globally. The SAF market size stood at US$1.1 billion in 2022 from US$50 million in 2019 registering a CAGR of 115.38%. SAF is currently more costly than traditional fossil jet fuel due to technological, economical, and feedstocks constraints which make SAF prices volatile and is in the range of $2 to $4 per liter.

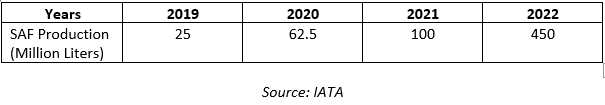

More than 100 offtake agreements totaling up to 42 Billion Litres have been signed between fuel producers and purchasers since 2013. 2022 alone saw 42 offtake agreements.

United Airlines and Delta Airlines have signed 8 and 6 offtake agreements comprising 10,513 M/litres and 3,862M/Litres respectively.

The following table depicts the SAF offtake agreements throughout the years. The table presents the number of offtake agreements for each specific year and the number of deals made on a year-over-year basis. In 2021, the number of agreements experienced a remarkable growth rate of 360%, while in 2022, it grew by 83%. Similarly, the volume of the agreements witnessed an impressive growth rate of 1,361% in 2021 and 126% in 2022.

During the 10 years period from 2013 – 2022, the SAF Offtake agreements in terms of Million liters grew at a CAGR of 81% and the Number of Agreements grew at a CAGR of 45%.

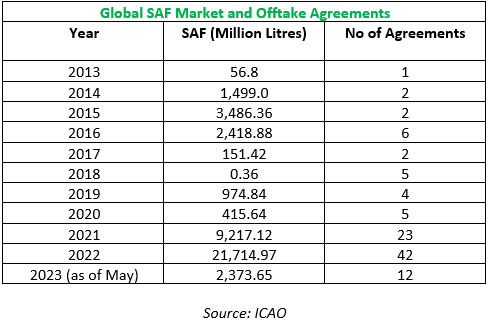

Based on publicly disclosed offtake agreements and data from the International Energy Agency (IEA), the global demand for Sustainable Aviation Fuels (SAFs) in 2022 was estimated to be approximately 0.5 billion liters. However, projections indicate that this demand is expected to experience exponential growth, reaching around 4.1 billion liters per year by 2026, as illustrated in the chart below.

Several factors contribute to this rapid increase in demand for SAFs:

- Increased demand for air travel: As air travel continues to expand globally, the need for sustainable alternatives to conventional aviation fuels becomes more pressing. SAFs offer a viable solution to mitigate the environmental impact of the aviation sector.

- Commitments to net-zero emissions: Many airlines have made ambitious pledges to achieve net-zero emissions by 2050. SAFs play a significant role in fulfilling these commitments, as they are considered one of the primary contributors towards decarbonizing the aviation industry.

The exponential growth in SAF demand signifies a strong industry-wide recognition of the importance of transitioning to more sustainable fuel options to address climate change concerns and support a greener future for aviation.

Figure 2: Annual SAF demand range over the main and accelerated cases compared with the capacity potential (Source: IEA)

How does the cost of SAF compare to traditional jet fuel?

SAF can be blended at up to 50% with traditional jet fuel and all quality tests are completed as per a traditional jet fuel. This limit on SAF blending has been imposed in order to prevent any fuel leakages in aircraft systems. The blend is then re-certified as Jet A or Jet A-1. It can be handled in the same way as traditional jet fuel, so no changes are required in the fuelling infrastructure or for an aircraft wanting to use SAF.

SAF is currently more costly than traditional fossil jet fuel. That’s down to a combination of the current availability of sustainable feedstocks and the continuing development of new production technologies. As the technology matures it will become more efficient and so the expectation is that it will become less costly for customers.

According to IATA Sustainable Aviation Fuel (SAF) could contribute around 65% of the reduction in emissions needed by aviation to reach net zero in 2050. This will require a massive increase in production in order to meet demand. Achieving net zero by 2050 will require a combination of maximum elimination of emissions at the source, offsetting and carbon capture technologies, 19% of decarbonization will come from offsetting.

Aviation Emissions Data

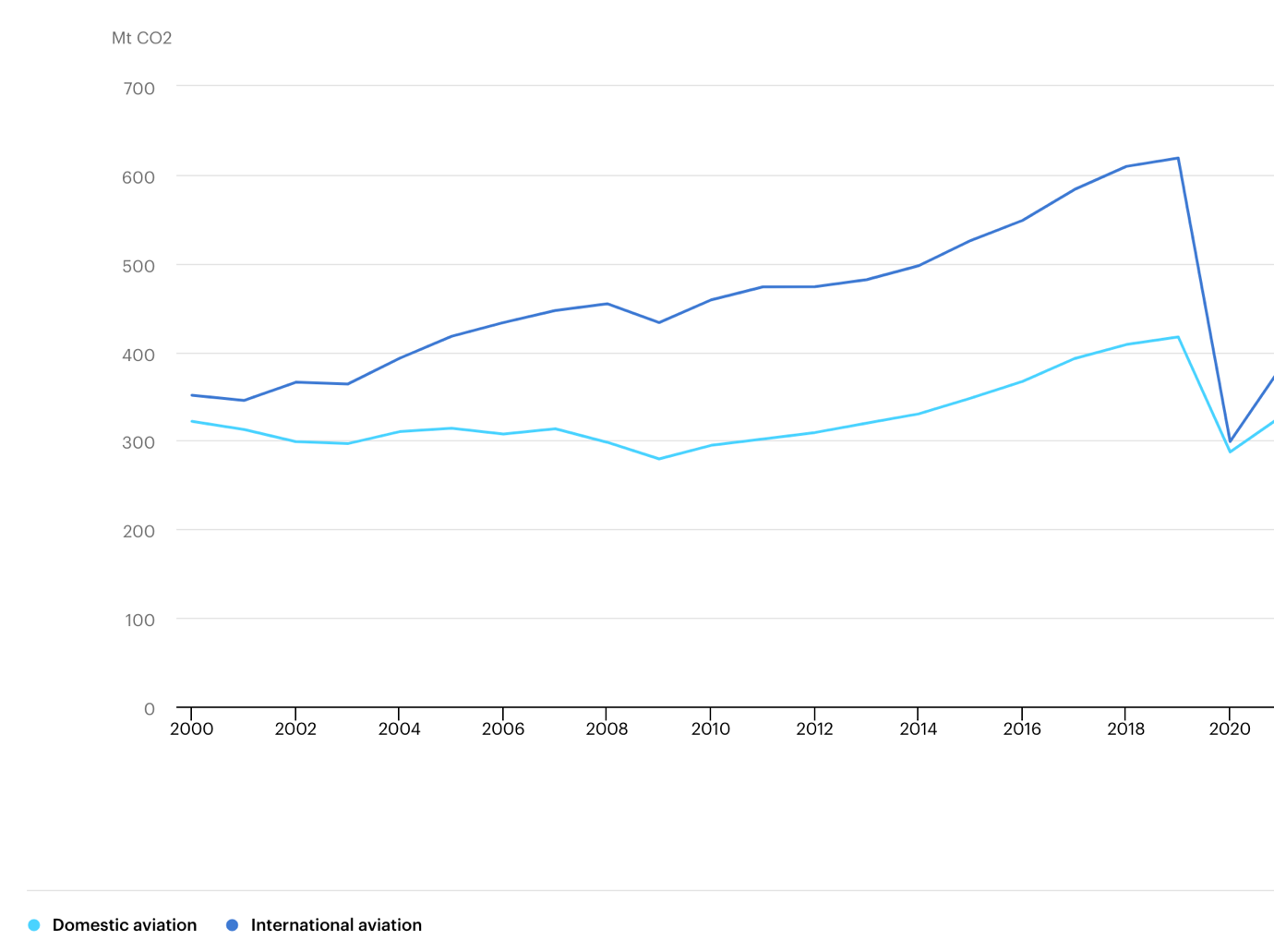

Figure 3: US Domestic Aviation Emissions and Cumulative International Emission (Source: IEA)

Global Aviation Emissions contribute more than 2% of the total global emissions. In 2018 and 2019 Global emissions (Domestic + International) was more than 1 GT CO2 emissions.

Share of India's aviation stood around 2.6% of the total aviation emissions (26M Tons of CO2 emissions). USA and China are the major contributors to global aviation emissions at 25% and 12% respectively.

CORSIA

What is CORSIA?

Emissions from international flights are not part of the international climate mechanism established by the United Nations Framework Convention on Climate Change or UNFCCC. While domestic aviation falls within the UNFCCC, international aviation does not.

The members of ICAO agreed and decided to have a global market-based mechanism for aviation emissions in 2016. This decision gave birth to what we now know as CORSIA.

“Carbon Offsetting and Reduction Scheme for International Aviation”. It is the first global market-based solution that airlines can use as a major step to reach net zero emissions by 2050. It first ran in 2021 and will be until 2035.

Reporting of emissions

- Under CORSIA, all airline operators with annual emissions greater than 10,000 tonnes of CO2 are required to report their emissions from international flights on an annual basis since 1 January 2019.

- To guarantee the accuracy of the data reported by operators, annual emissions reports will need to be verified by an impartial third-party verification body, prior to submission to the State. Verification bodies will have to be accredited under ISO/IEC 17029:2019, ISO 14065:2020, and other relevant requirements.

- Aggregated emissions will be communicated by states to International Civil Aviation Organisation (ICAO), which will publish the total emissions from individual operators, and total emissions by all operators aggregated by each state-pair.

Offsetting Requirements

Offsetting requirements started in 2021. At the end of each 3-year compliance period, operators will have to demonstrate that they have met their offsetting requirements by canceling the appropriate number of emissions units.

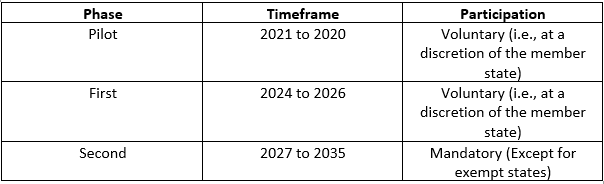

To take into account the special circumstances and respective capabilities of States, ICAO member States agreed to implement CORSIA offsetting requirements in phases.

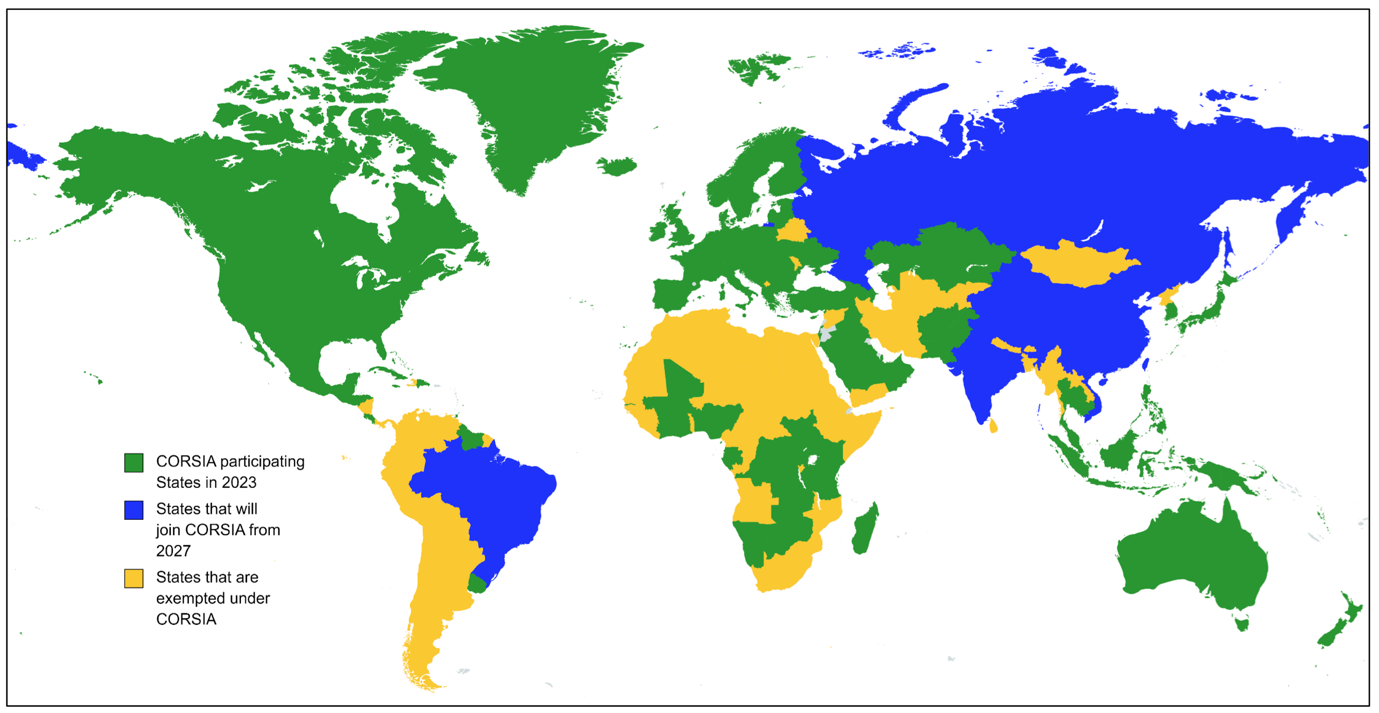

- From 2021 until 2026 (pilot phase from 2021 to 2024; and first phase from 2024 to 2026), only flights between States that volunteer to participate in CORSIA will be subject to offsetting requirements.

- From 2027, all international flights will be subject to offsetting requirements. However, flights to and from Least Developed Countries, Small Island Developing States, Landlocked Developing Countries, and States which represented less than 0.5% of the global international RTK in 2018 will be exempt from offsetting requirements unless these States participate on a voluntary basis.

Figure 4: CORSIA Participating countries

Understanding CORSIA: Offsetting Mechanism and Price Dynamics for Aviation Carbon Credits This offsetting scheme is divided into three distinct phases, with two being voluntary and the third being mandatory. The voluntary phase begins in 2021 and continues until 2026.

At the end of each 3-year compliance period, operators must demonstrate their compliance with the offsetting criteria outlined in the program. They will then proceed to purchase carbon credits from the Aviation Carbon Exchange (ACE). ACE provides aviation stakeholders with the opportunity to offset their emissions by purchasing credits from certified projects that either avoid or remove carbon emissions.

The number of offsets is not based on the airline's individual emissions, but rather calculated proportionally based on the industry's emissions growth above the 2019 levels.

To ensure the credibility of CORSIA credits, the ICAO Council has established a list of emissions units that meet the compliance criteria. These units are carefully selected to ensure that the credits deliver the promised reductions in CO2.

The ICAO Council programs and emissions units eligible for CORSIA’s 2021-2023 pilot phase are:

- American Carbon Registry

- Architecture for REDD+ Transactions (ART)

- China Greenhouse Gas (GHG) Voluntary Emission Reduction Program

- Clean Development Mechanism (CDM)

- Climate Action Reserve

- Global Carbon Council (GCC)

- The Gold Standard

- Verified Carbon Standard (Verra)

The cost of offsetting one metric tonne of CO2 varies depending on the quality of the credit and other factors. On average, prices range from $3 to $5 per metric tonne of CO2.

The Path Ahead

As the aviation industry continues its commitment to sustainability and the reduction of greenhouse gas emissions, the future of sustainable aviation fuels (SAFs) and carbon offsetting schemes like CORSIA appears promising. With increasing global awareness of the need to combat climate change, there is a growing demand for SAFs as a viable alternative to traditional jet fuels. The potential to reduce CO2 emissions by up to 80% with SAFs has garnered attention and support from both airlines and fuel producers.

The current challenges of SAF production, such as feedstock availability and technological constraints, are being addressed through ongoing research and development efforts. As technology matures, it is expected that SAF production will become more efficient and cost-effective, making it an attractive option for the aviation industry.

Furthermore, the implementation of CORSIA and its offsetting requirements demonstrates a collective commitment to reducing aviation emissions. The phased approach of CORSIA ensures a gradual transition towards mandatory offsetting for all international flight, while providing flexibility for countries with different capabilities.

Looking ahead, the exponential growth projected in SAF demand indicates a strong momentum toward decarbonizing the aviation industry. Continued investment in SAF production, innovation, and infrastructure will be crucial to meet the anticipated increase in demand and achieve the industry's net-zero emissions goals. As stakeholders collaborate and governments enforce regulations, the future holds promising opportunities for a greener and more sustainable aviation sector.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)