The latest carbon market study, undertaken by BloombergNEF, posits that offsets could potentially be a $1 trillion market by 2037, driven by the need for companies to reach their net zero targets. However, the article also admits to the critical need for upending the current market structure to sustain and channel the imminent growth driven by the colossal increase in demand.

Carbon offset market faced initially with the challenge of establishing credibility over the supply, has so evolved to now witness a more treacherous second order challenge of having limited to no "credible" supply. The emergence of a handful of institutions that serve as the key source of credibility for any supply in voluntary carbon market, has created a tremendous backlog in visibility of such a credible supply for the buyers.

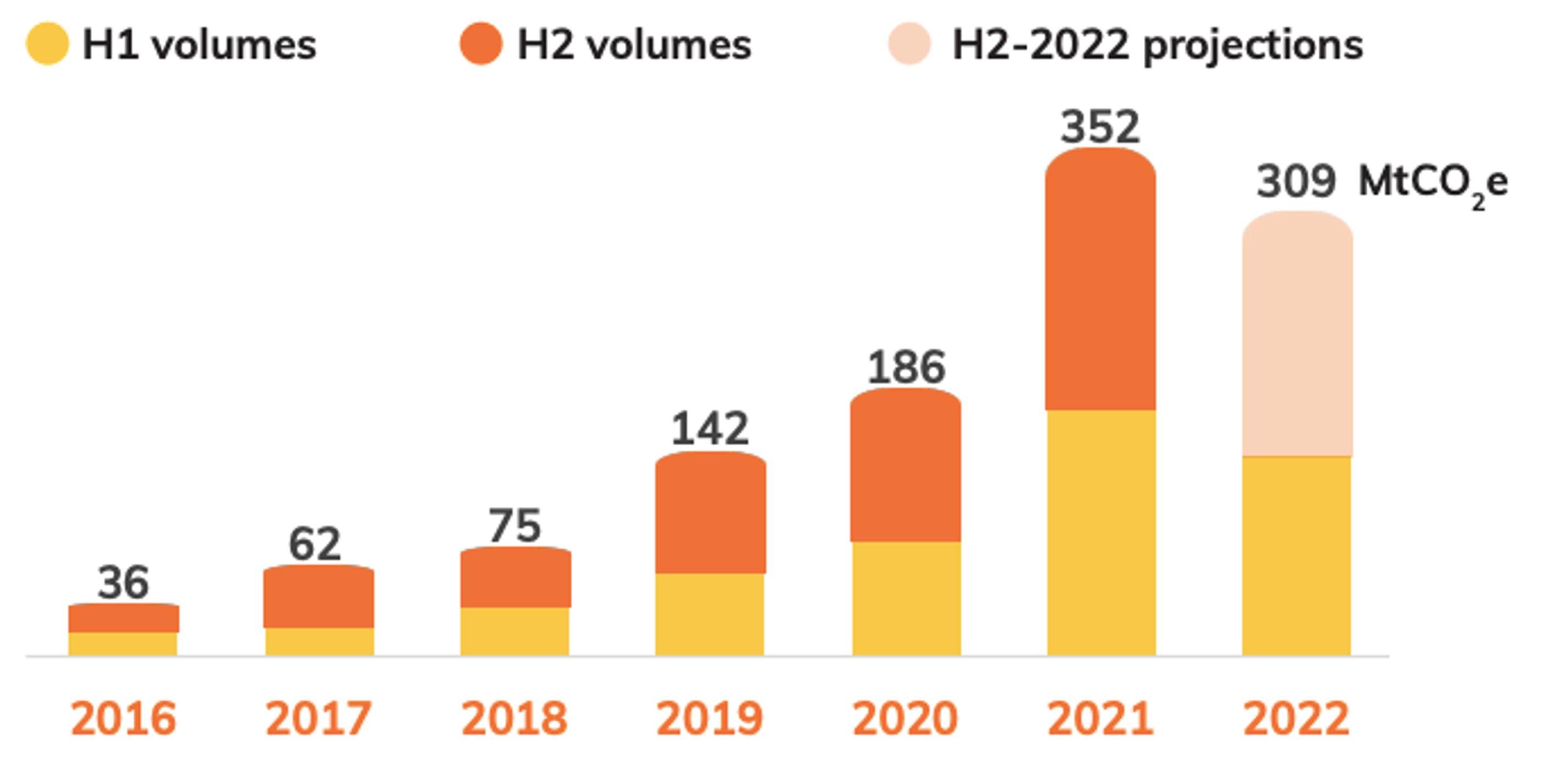

Slow down in issuances of new carbon offsets (Source: Climatefocus)

The slow down is visible in the trend above, depicting the total issuance data till H1 2022. As can be seen, the H1 2022 figures saw a dip compared to the H1 2021 data.

Verra, which now issues over 80% of the voluntary carbon offsets has a huge backlog of projects awaiting its approval, by its own admittance. A recent report by Thallos even attempted to quantify the extent of the losses facing the carbon market participants, attributable to verification bottlenecks, estimated to $2.6 billion or 4.8 Gt, by 2030.

A likely way to not solve this problem is via registries laxing their approval and issuance guidelines. Treading down that dark path would undermine a decade or two of learnings and the snail paced clawback of investor's confidence in the carbon markets, post the CDM debacle of Kyoto protocol.

A logical next alternative then is to shift towards sort of a forward contract structure, which provides for an advanced visibility of financing to the developer but maintains verification as a condition precedent for the disbursement of a large majority of the buyer's funds.

Moving up the Risk-Return curve

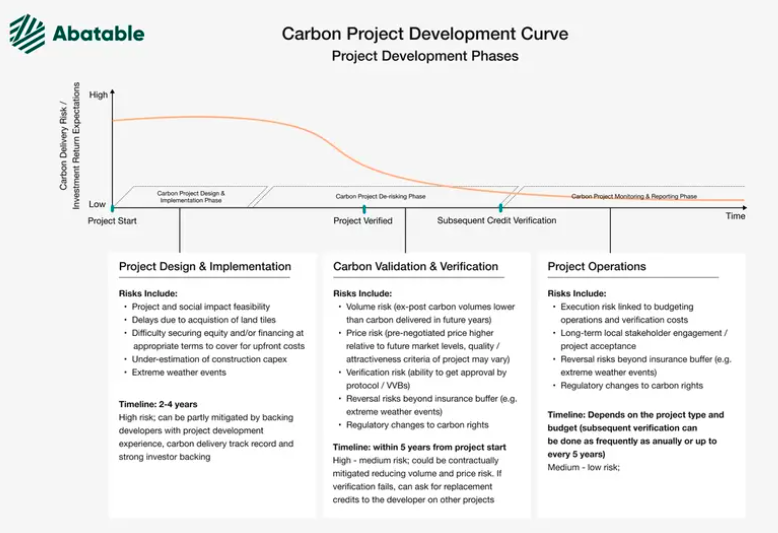

A great way to think about such a financing structure for both the buyers and sellers of carbon offsets, is by visualising the risk-return model for a carbon project development. Maria Eugenia Filmanovic of Abatable earlier last year, wrote a piece on just the same.

Carbon project development curve (Source: Abatable)

As can be observed, development of a carbon project broadly occurs over 3 phases. Below is a quick layout of the respective phases and their corresponding risks.

1) Project Design and Implementation- Carbon project developers using equity or small grants to finance carbon feasibility studies.

Risks- Carbon Delivery, Project Implementation, Reversal events, Regulatory setbacks

2) Project Validation and Verification- Project gets verified and approved by a carbon standard.

Risks- Project Implementation, Reversal events, Regulatory setbacks

3) Project Monitoring and Reporting- Project goes about its carbon operations, while monitoring and reporting upon its activities to receive carbon credits.

Risks- Reversal events, Regulatory setbacks

As is evident, the risks inherent in the project drop with each phase for the investor/buyer of offsets. Consequently, the later they come in into a project, their returns suffer correspondingly via buyers having to shell higher prices for these offsets.

However, the huge backlog of projects stuck in between phases 1) and 2), has resulted in a stark divergence in the prices of offsets from projects on either side of this chasm.

Driven by the massive oversupply of projects stuck at phase 1) and consequently, an increasing dearth of projects that go past phase 2), has resulted in a disproportionate increase in the prices of validated and verified projects. This in turn nudged the buyers to explore newer pastures by venturing into projects at phase 1) in the project development curve.

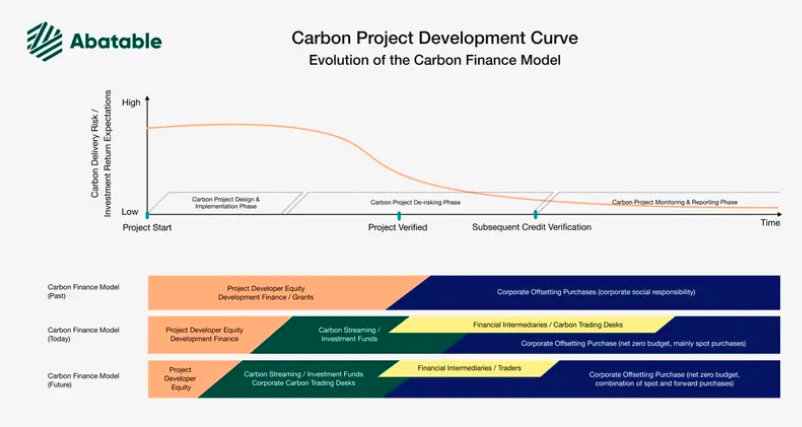

Evolution of investments along the Risk-Return curve

A growing number of carbon trading desks of corporates, alongside dedicated investment funds have ventured into the early stages of project development i.e. phase 1). Project developers no longer need to wait for approval by a carbon standard, to market their project for investments.

This serves to create a mutual win-win for the developers as well as the buyers.

While the developers can save on the upfront equity they need to invest in the project, the buyers through partial equity in the project, dramatically reduce the cost of their future retirement.

The critical takeaway is that such an investment in phase 1) of a project doesn't absolve the project developer of their need for approval by a carbon standard. It in fact creates a strong mutual alignment b/w the buyer and seller of these credits, who now both participate in the upside from the project being approved by a carbon standard, by virtue of their equity stakes.

Conclusion

A caveat however is in the need for evolution of carbon trading desks at buyer corporates and institutional investors, to be able to adapt to this shift in their roles.

The "trading desks" in the current market structure would need to be replaced by project management teams in the pre-financing era, given the enhanced scope of responsibilities and risks of the buyer.

We speculate that a growing portion of such teams would themselves require a substantial background in sustainable project development. This in turn would serve to further align the roles and responsibilities of either side, to facilitate the massive scaling of carbon projects that is needed to complement the gargantuan targets put forth by the 1.5 degree scenario.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)