Scrutiny in the Voluntary Carbon Market: Understanding the Concerns

At the beginning of 2023, the credibility of VCM projects, particularly Nature Based projects accredited by Verra, came under intense scrutiny. Researchers and the press questioned their integrity and additionality, dismissing forest protection as 'worthless' among other factors.

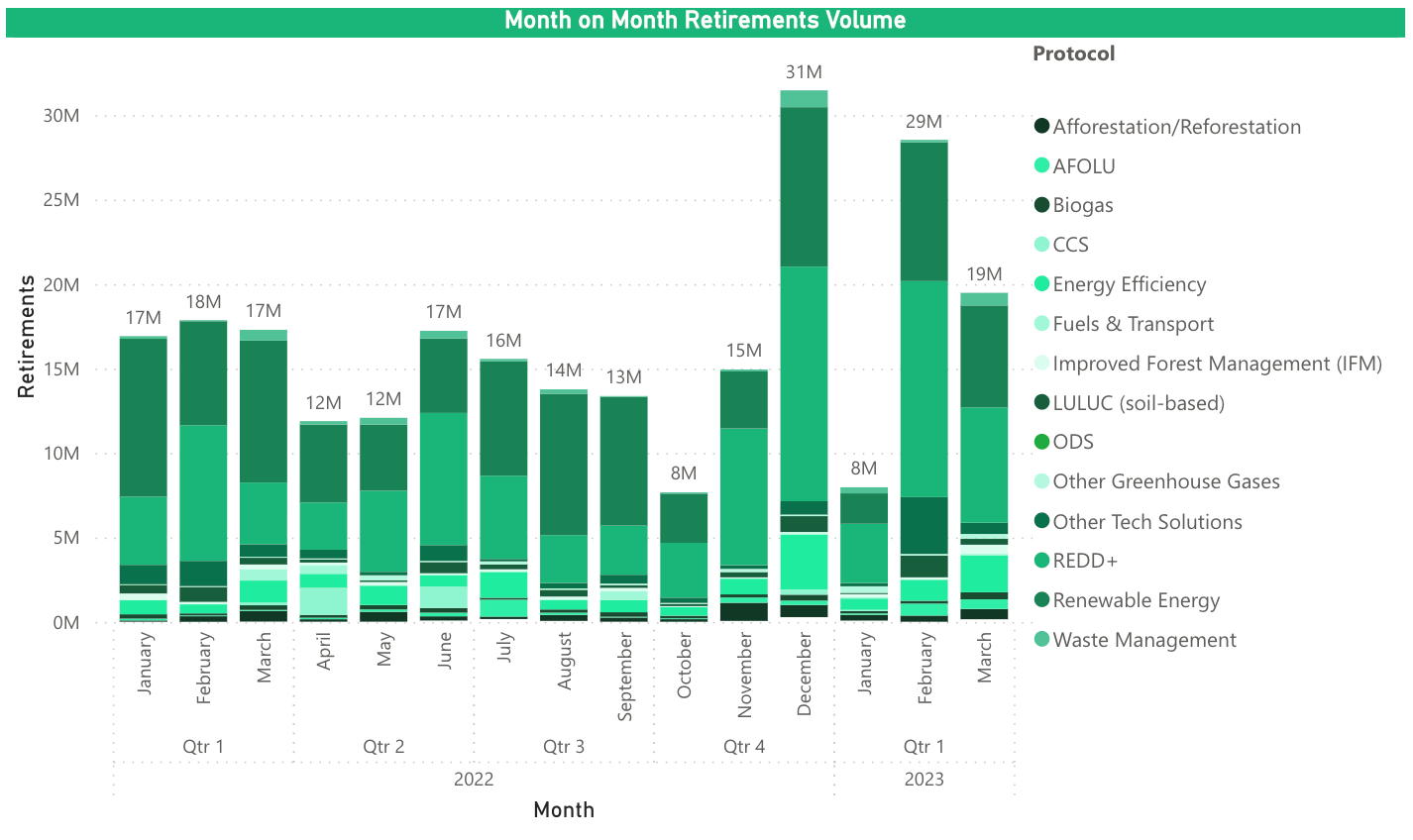

However, the doubts created by this criticism proved to be short-lived, as retirements in February and March 2023 rebounded strongly.

Q1 of 2023 saw a total volume retired of around 56M, a 7.6% increase from the same period in 2022. The number of retirements from Nature Based avoidance offsets rose sharply in Q1 of 2023, reaching 23M compared to 15M in Q1 of 2022 (a more than 50% increase).

Although confidence in VCM offsets credits, particularly REDD+ projects, experienced a significant dip in January 2023 (with a 74% MoM fall between December 2022 and January 2023), the demand for these credits rebounded sharply in the following months. Nature-based projects continue to capture the majority of the market share (around 44% including removal nature-based projects), alongside energy efficiency and renewable energy projects.

Source: Calculus IQ by Calculus Carbon

Investing in Post-Paris Carbon Credits: The Importance of Ensuring Quality

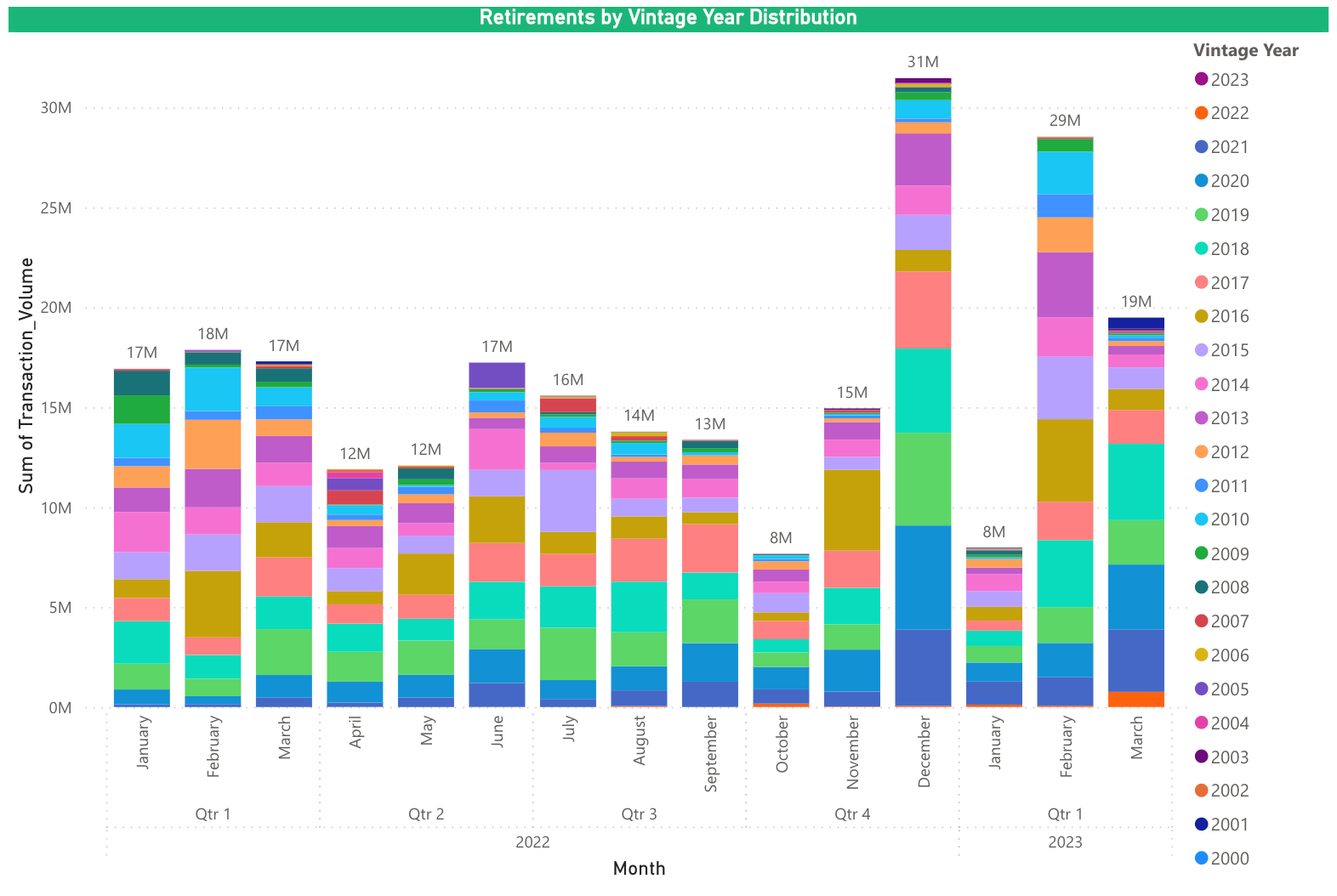

While the increase in retirements is a positive sign, there are still concerns about the quality of retirements. Some of the retirements are coming from pre-Paris agreement projects with older vintages. It seems that credit users can be divided into two groups: those who prioritize newer credits and are willing to pay a premium for them, and those who prioritize affordability.

While any form of compensation is beneficial, it is important to note that every company has the potential to increase their compensation by opting for post-Paris credits, even if it means paying a higher price. This is something to consider, as it can help ensure the overall quality and effectiveness of the voluntary carbon market.

Source: Calculus IQ by Calculus Carbon

Synopsis: Balancing Quality and Affordability

In conclusion, while the voluntary carbon market has shown resilience in terms of demand, achieving our climate goals will require a significant and exponential increase in the volume of retirements.

It is crucial that these retirements meet the highest standards of integrity to ensure their effectiveness in addressing climate change.

Fortunately, there are steps that companies and organizations can take to contribute to the growth of the voluntary carbon market. This can include adopting more ambitious carbon reduction targets and investing in high-quality carbon offset projects that support the transition to a low-carbon economy. Furthermore, policymakers can play a critical role in incentivizing the voluntary carbon market through the implementation of supportive policies and regulations.

If you are interested in learning more about the voluntary carbon market, we invite you to interact with Calculus IQ. This tool can help you explore different aspects of the market, including project types, retirement volumes, and more.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)