Introduction

The urgent need to address plastic waste has led to the emergence of innovative solutions such as plastic credits platforms. These platforms aim to offset post-consumer plastics responsibly, reducing their impact on landfills and oceans. In this comparative analysis, we will examine two prominent platforms, Plastic Credit Exchange (PCX) and Verra, to understand their approaches, achievements, and market dynamics.

PCX: Leading the Way in Responsible Plastic Offsetting

PCX is a non-profit, fully integrated plastic offset platform. Their goal is to mobilize businesses in the fight against plastic waste by offering a seamless and traceable solution. PCX helps businesses offset their plastics footprint responsibly by reducing the flow of plastic waste into the environment.

By partnering with communities in highly polluted areas, PCX empowers them to clean up existing plastic waste, creating a positive impact at the local level.

Achievements and Market Presence

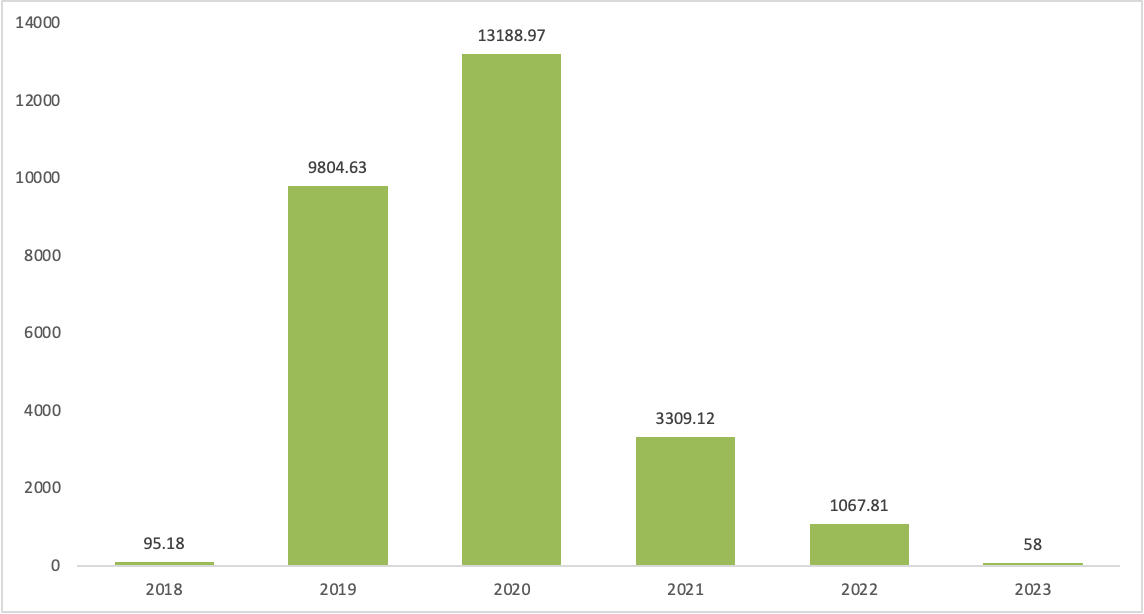

Figure 1: Total Plastic Credits Issued till date via Plastic Credits Exchange

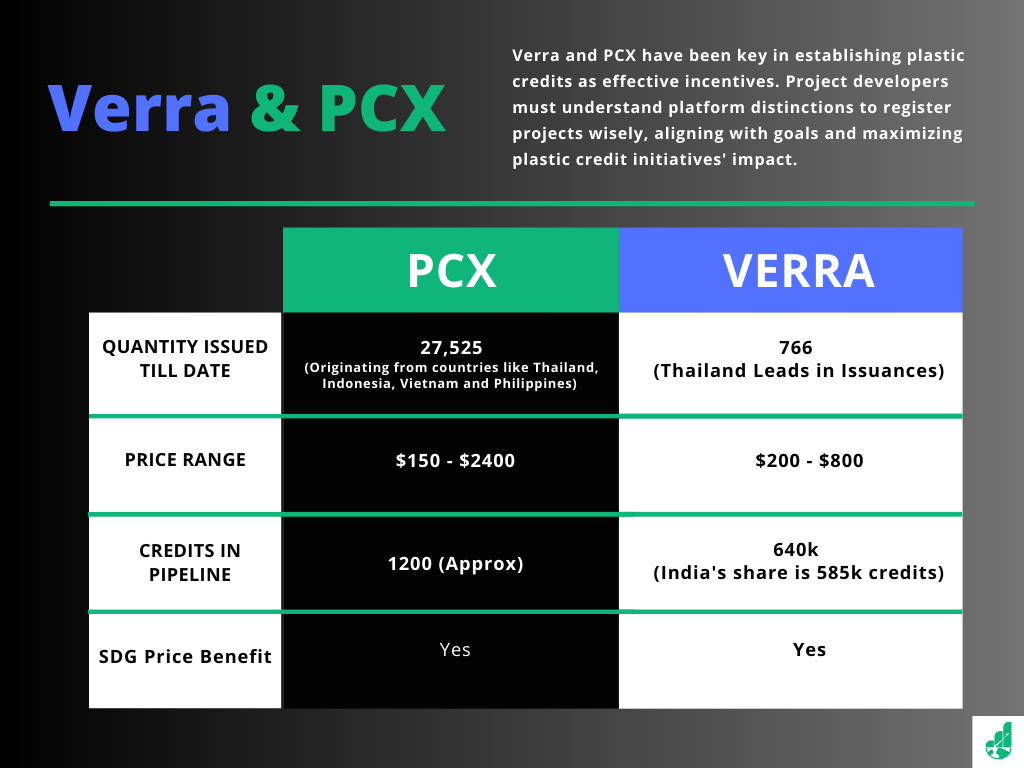

PCX has issued a total of 27,530 plastic credits to date. These credits primarily originate from countries such as Thailand, Indonesia, Vietnam, and the Philippines, where the need for plastic waste management is particularly high.

PCX's platform offers competitive prices ranging between $150 and $2400 per credit, depending on the country and the Sustainable Development Goals (SDGs) impacted.

Verra: A Comprehensive Approach to Plastic Waste Management

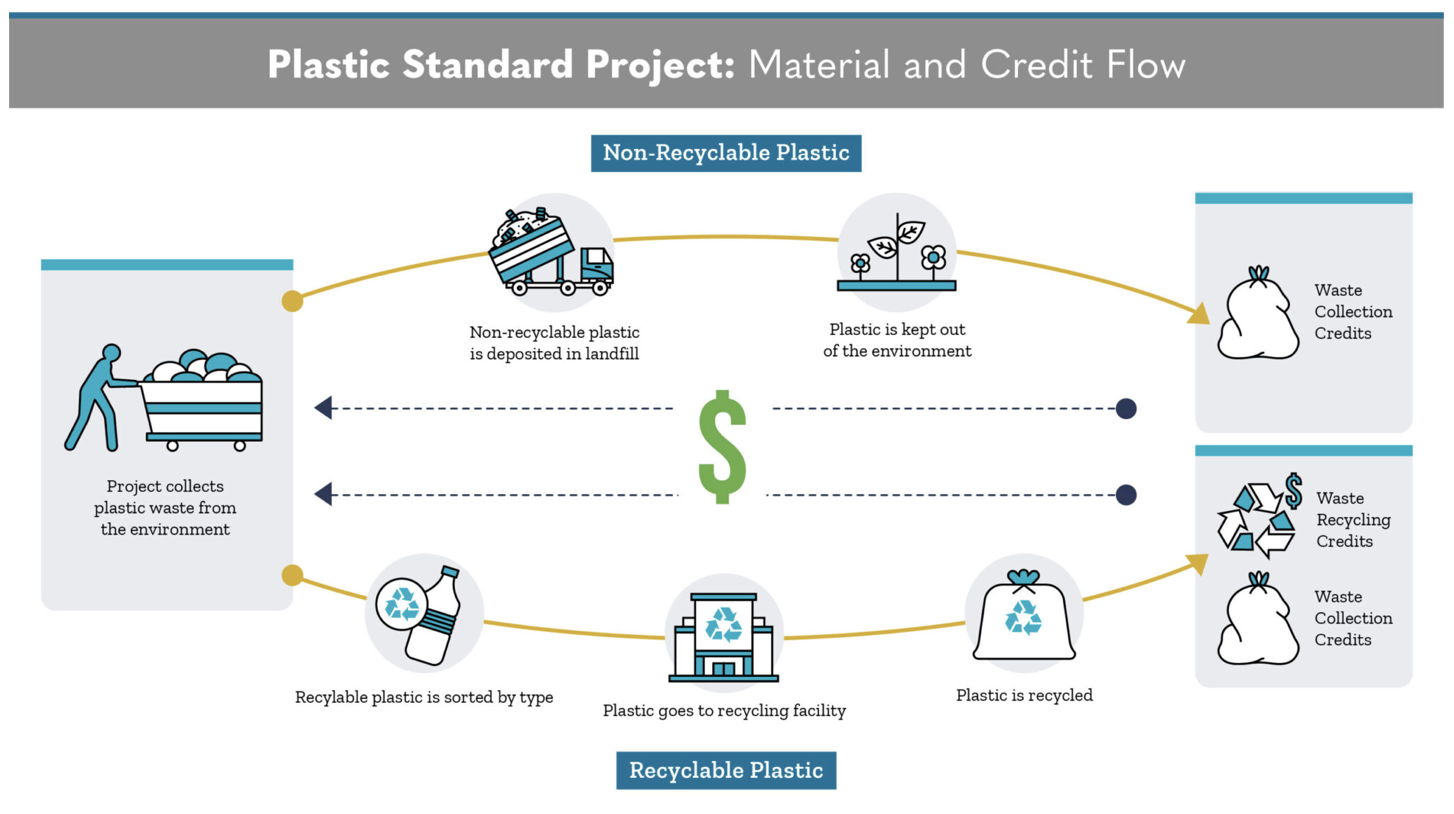

Verra operates under the Plastic Program, which ensures that projects undergo a rigorous assessment process for certification. The Plastic Program covers a diverse range of activities, including waste collection, the development of new infrastructure, sorting of recyclable plastic waste, and the development and scaling up of recycling technologies.

Verra issues two types of Plastic Credits: Waste Collection Credits (WCCs) and Waste Recycling Credits (WRCs). Each credit represents one metric tonne of plastic waste that has been collected or recycled, respectively. These credits are issued based on the volume of plastic collected and recycled above baseline rates.

Supply and Pipeline Data

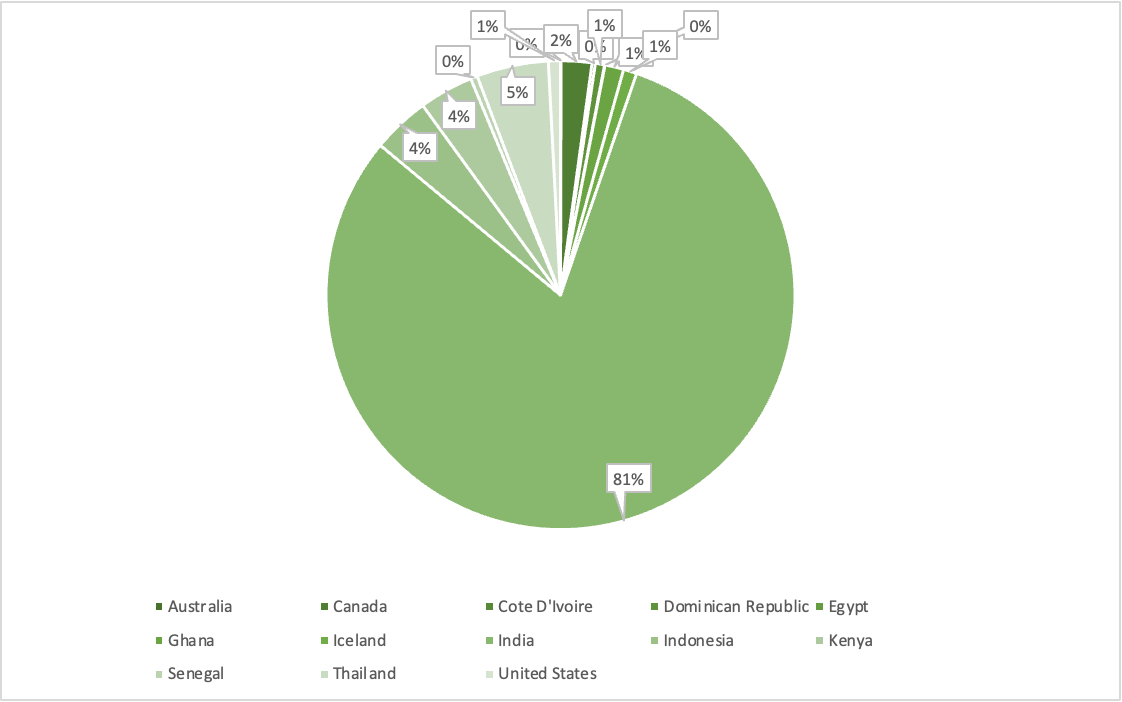

Currently, Verra has a supply of 766 plastic credits, with Thailand leading in terms of issuances.

Figure 2: Breakdown of Plastic Projects by Country in Verra's Pipeline

Additionally, there are 640k plastic credits in the pipeline, with India holding a significant share of 585k credits, as shown in figure 2. These figures reflect the growing interest and engagement of various stakeholders in plastic waste management.

Verra has observed an initial estimated price range for plastic credits, spanning from $200 to $800 per tonne. These prices fluctuate based on factors such as project location, scale, and environmental impact.

Summary

Both PCX and Verra have their respective advantages and disadvantages. To provide a comprehensive view, we have presented them in a tabular format below, allowing for a clear comparison between the two platforms.

Table 1 (Source: Calculus Carbon research)

Conclusion

Both PCX and Verra play crucial roles in tackling the global challenge of plastic waste. PCX focuses on responsible plastic offsetting and reducing plastic consumption, while Verra employs a comprehensive approach to plastic waste management through certification and credit issuance. These platforms contribute to a circular economy by incentivizing the reduction, collection, and recycling of plastic waste.

As the world increasingly recognizes the importance of plastic waste management, initiatives like PCX and Verra will continue to evolve and shape the future of sustainable practices. By collaborating with businesses, communities, and governments, these platforms pave the way for a cleaner and more environmentally conscious future.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)