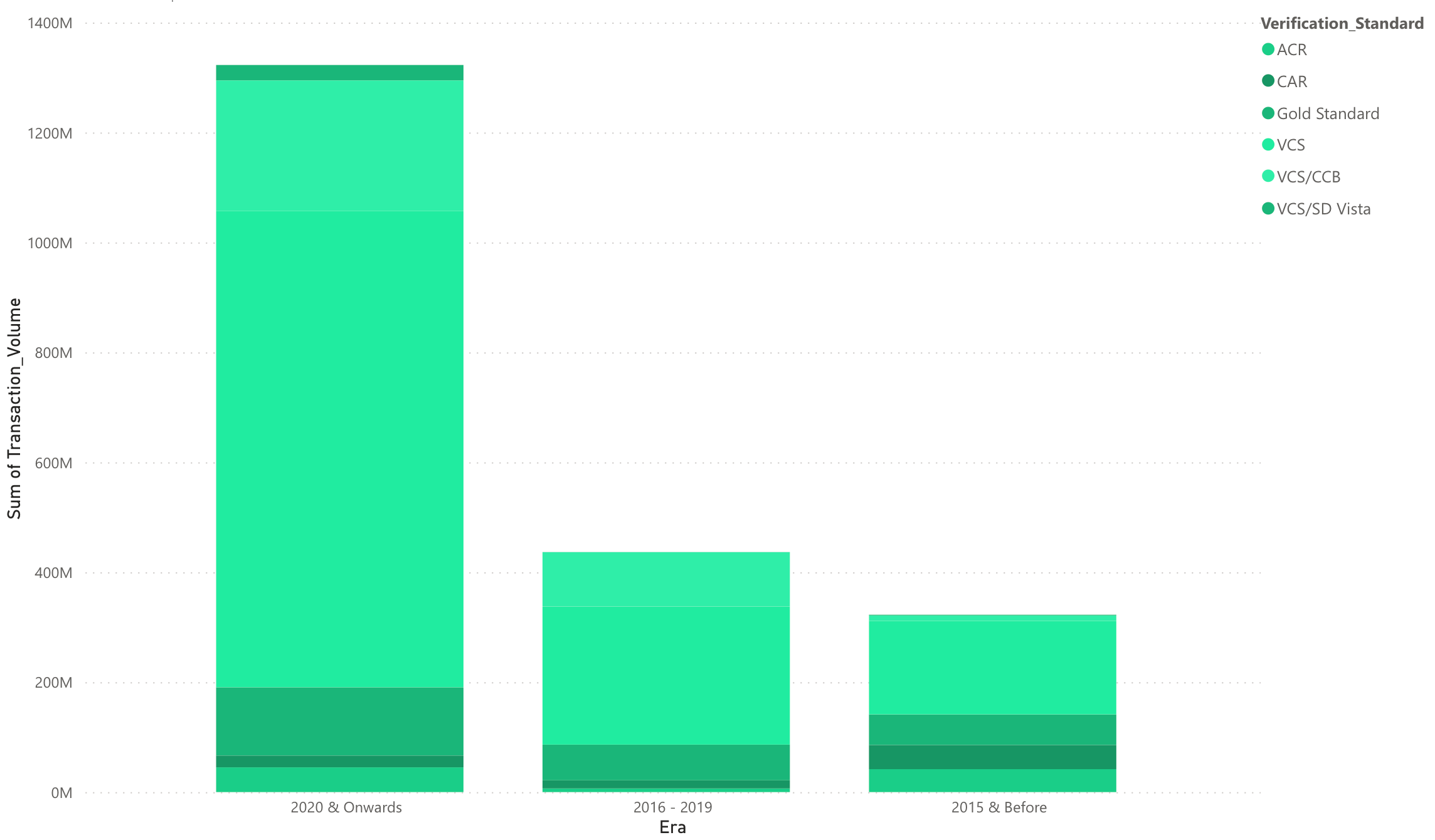

The VCM market has experienced a remarkable surge in supply, adding an impressive 1 billion issuances in less than three years following the COVID-19 pandemic.

This accelerated growth reflects the resilience and adaptability of the market in the face of challenging circumstances. The year 2021 alone witnessed a substantial increase with 551 million issuances, demonstrating a strong recovery and resurgence of VCM activities.

This positive momentum continued into 2022, with 396 million additional issuances contributing to the market's expansion. As of the current date in 2023, the number of issuances has reached 134 million, showcasing the market's consistent upward trajectory.

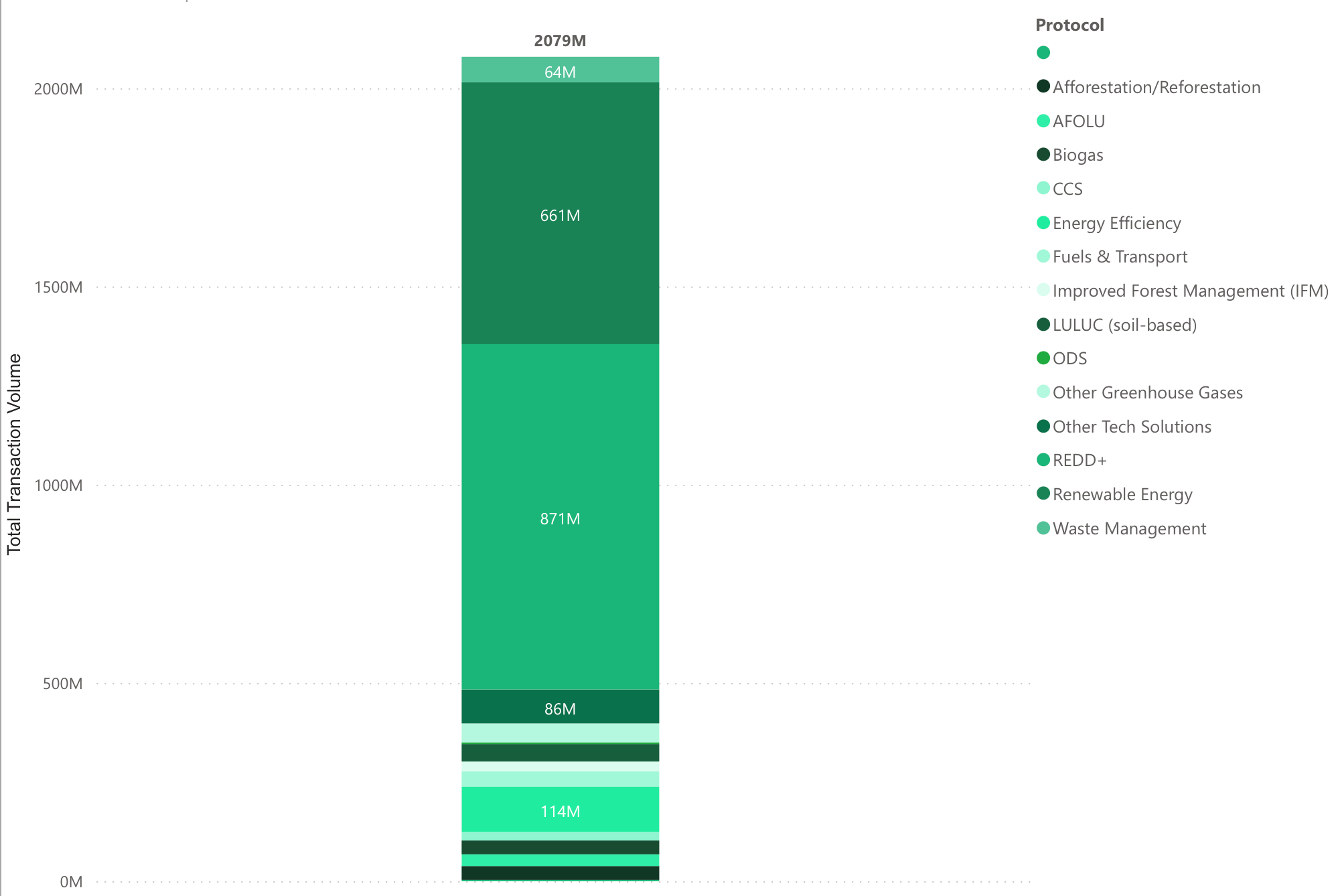

Figure 1: Total supply till date (Source: Calculus IQ)

By May of 2023, the VCM market achieved a significant milestone by surpassing the 2 billion issuance mark. The success of this milestone can be attributed to the active participation and contribution of various sectors.

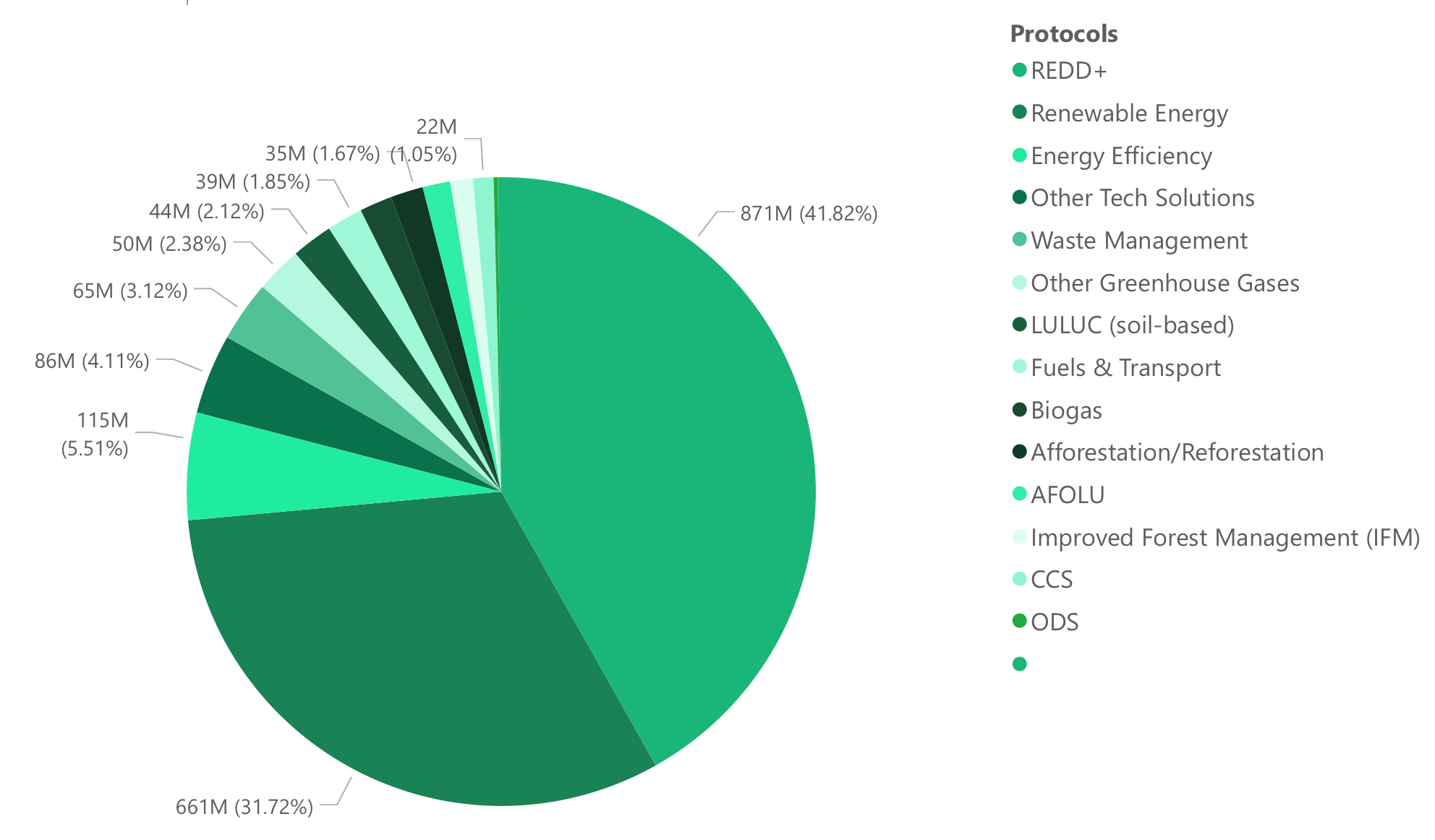

Notably, Renewable Energy (RE) credits accounted for a significant portion, comprising approximately 31% of the total market share. These credits reflect the growing emphasis on transitioning to clean and sustainable energy sources, with a focus on reducing carbon emissions.

Additionally, Reducing Emissions from Deforestation and Forest Degradation (REDD+) credits played a substantial role, representing approximately 41% of the market share. These credits are instrumental in promoting forest conservation and mitigating climate change impacts.

Figure 2: Supply dynamics (Source: Calculus IQ)

The diversification of credit sources within the VCM market underscores the importance of a comprehensive approach to climate action. By engaging multiple sectors and stakeholders, the market has been able to achieve a more balanced and impactful outcome.

The continuous growth of the VCM market, coupled with the prominence of RE and REDD+ credits, signals a positive trend in global efforts to address climate change and promote sustainable development. It highlights the collective commitment to reducing greenhouse gas emissions, transitioning to renewable energy sources, and conserving valuable ecosystems.

Figure 3: Distribution of the total supply (Source: Calculus IQ)

As the VCM market continues to expand and evolve, it is expected that the momentum will be sustained, driving further issuance growth in the coming years.

The collaborative efforts of governments, businesses, and civil society in promoting and adopting VCM initiatives are crucial in achieving global climate goals. By leveraging the potential of the VCM market, stakeholders can contribute to a more sustainable and resilient future, fostering economic growth while mitigating the impacts of climate change.

If you are interested in learning more about the voluntary carbon market, we invite you to interact with Calculus IQ. This tool can help you explore different aspects of the market, including project types, retirement volumes, and more.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)