Regulatory Framework and Its Impact on the Carbon Market

Indonesia's carbon market regulations, implemented last year, have introduced a level of uncertainty that is hindering the development of carbon projects in the country. These regulations include a provision that requires a portion of the credits generated by each project to be withheld by the government.

The withheld credits are then placed in a buffer reserve to meet Indonesia's Nationally Determined Contribution (NDC) targets. The exact percentage of credits withheld varies depending on the buyer and the nature of the project.

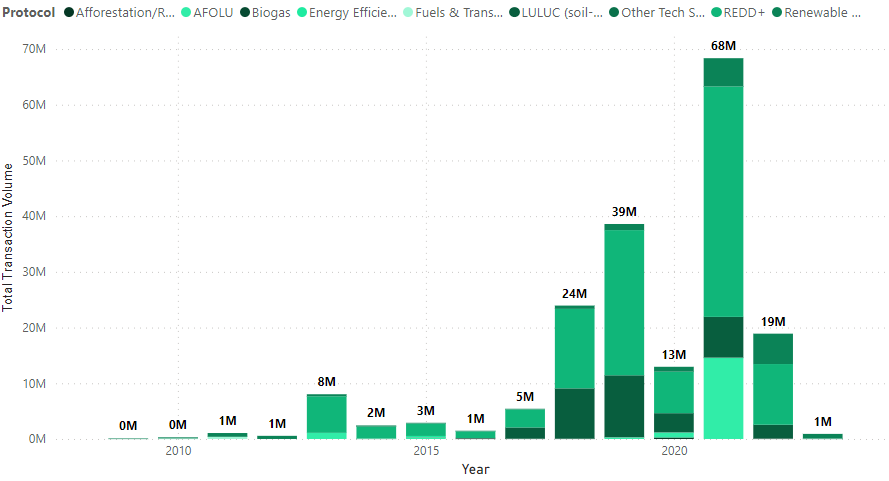

Fluctuating Volume of Issuances

One of the notable effects of regulatory uncertainty is the fluctuation in the total transaction volume of carbon issuances in Indonesia. Figure 1 illustrates the significant spike in total transaction volume from 13 million in 2020 to 68 million in 2021. However, there has been a rapid decrease in the volume, with only 19 million issuances in 2022, falling below the levels seen in 2018 (24 million issuances) and 2019 (39 million issuances).

Figure 1: Indonesia's Issuances in Metric tonnes over the years (Source: Calculus IQ)

The uncertainty surrounding the regulations has created a lack of confidence among project proponents, impacting the overall development of carbon projects.

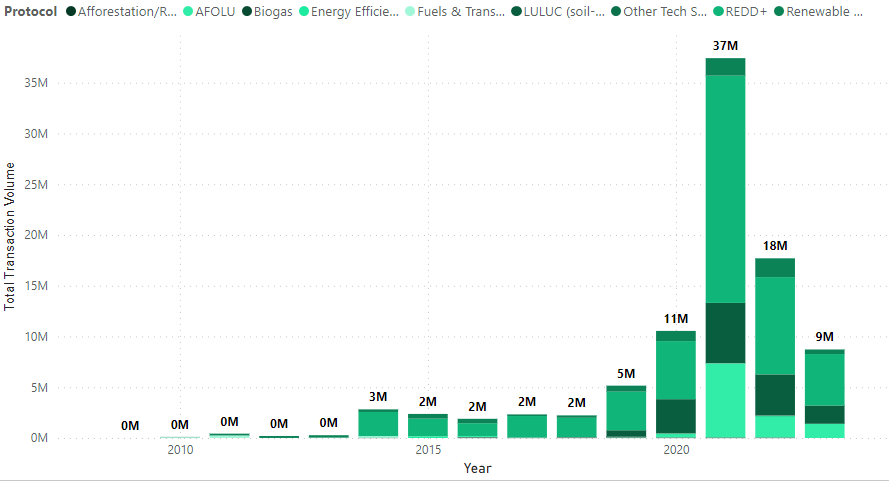

Volatility in Retirements

Similar to the transaction volume, retirements of carbon credits in Indonesia have also experienced substantial fluctuations. Figure 2 shows a sharp rise in retirements from 11 million in 2020 to 37 million in 2021, followed by a sudden decline to 18 million in 2022.

Figure 2: Indonesia's Retirements in Metric tonnes over the years (Source: Calculus IQ)

This volatility can be attributed to the uncertainty caused by the regulatory framework. Such unpredictability makes it challenging for project developers to plan and forecast the retirement of credits, further undermining the stability of the carbon market.

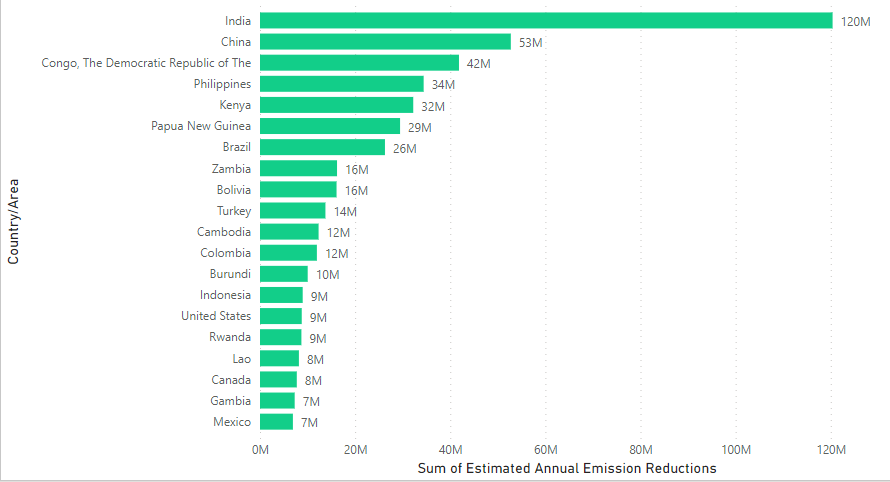

Development of Carbon Projects and Comparative Analysis

When comparing Indonesia's development of carbon projects to its neighboring countries, the statistics reveal a significant disparity. As shown in Figure 3, Indonesia ranks 14th with an estimated annual emission reduction of 9 million metric tonnes. In contrast, India leads with 120 million, followed by China with 53 million.

Figure 3: Comparative Country Analysis of in-development carbon projects (Metric tonne) (Source: Calculus IQ)

These numbers highlight Indonesia's lag in developing robust carbon projects, and the current regulations are expected to impede its progress further. The uncertainty created by the regulations creates an unfavorable environment for attracting investment and hampers the growth of voluntary carbon markets in the country.

Implications for Project Viability and Investment

The buffer pool established by the regulations has raised concerns regarding the viability of projects. The uncertainty surrounding the portion of credits that will be withheld creates challenges in planning revenue distribution and stakeholder engagement. If a significant portion of revenue is withheld, developers will be compelled to reduce the amount they can share with other stakeholders, affecting local communities and partnerships.

Moreover, the impact on investment rates of return is notable. The current low returns, ranging from 15% to 20% at best, fail to attract funders who seek higher returns, especially in the context of risky voluntary carbon projects.

Addressing the Challenges and Enhancing Market Integrity

To address the challenges posed by the regulations and foster the development of the carbon market, certain steps need to be taken. Firstly, the Indonesian government must clarify how it plans to acquire credits for the buffer reserve. Providing developers with information on the base price the government would spend on purchasing reserve credits would offer assurance and stability.

Additionally, it is crucial to establish a clear plan for regulating voluntary carbon markets, particularly by ensuring the national registry, the SRN, verifies projects to a high, internationally accepted standard. This would instill confidence in international investors and encourage their participation in the Indonesian carbon market.

Looking Ahead

The launch of Indonesia's carbon exchange holds promise for the market's future. However, it is essential to ensure that flexibility is maintained, allowing over-the-counter (OTC) transactions to continue alongside exchange-based trading.

The liquidity challenges faced by even the largest exchanges in the Voluntary Carbon Market (VCM) underscore the need for a well-defined operating model and the identification of major players within the exchange. Collaborating with carbon trading experts can aid the Financial Services Authority (OJK) in overseeing carbon trades effectively, showcasing the market's rigorous standards and operating procedures to boost investor confidence.

In conclusion, the uncertainty surrounding Indonesia's carbon market regulations has had a profound impact on the development of carbon projects. The fluctuations in transaction volume and retirements, as well as the country's lagging position in comparison to neighboring nations, underscore the need for a more stable and predictable regulatory environment. By addressing the challenges and enhancing market integrity, Indonesia can unlock its potential in the voluntary carbon markets and contribute significantly to global climate change mitigation efforts.

If you are interested in learning more about the voluntary carbon market, we invite you to interact with Calculus IQ. This tool can help you explore different aspects of the market, including project types, retirement volumes, and more.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)