How CBAM Works: The Science Behind the Carbon Border Adjustment Mechanism

In July, the European Union introduced a new method to address the problem of carbon leakage, which involves moving production of high-polluting products to countries outside the EU to avoid paying for their emissions. This policy, known as the Carbon Border Adjustment Mechanism (CBAM), aims to reduce the carbon footprint of imported goods and create a level playing field for European industries.

Key points about the CBAM include:

- The core feature is the obligation to pay for greenhouse gas (GHG) emissions embedded in certain carbon-intensive products imported into the EU through the purchase of CBAM certificates.

- The EU aims to ensure a level playing field for domestic and imported products by making sure they bear comparable CO2 costs.

- The mechanism is part of the EU's goal to reduce greenhouse gas emissions by 55% by 2030.

- The mechanism is set to be implemented in 2026, but importers will need to start reporting related emissions in 2023 to avoid attracting levies.

- Initially, CBAM will cover specific products in carbon-intensive sectors such as iron and steel, cement, fertilizers, aluminium, electricity, and hydrogen made using coal.

- By 2026, plastics and chemicals will be included, and by 2030 all sectors covered by the EU Emissions Trading System (ETS) will be part of CBAM.

The CBAM is conceived as a measure against the risk of carbon leakage, a phenomenon whereby companies move their production abroad to avoid the costs of complying with stringent environmental standards domestically or import cheaper foreign products that were not subject to a carbon price in their country of production.

The European Union fears that its increased climate ambitions and the rapidly increasing price of carbon under its domestic emissions trading scheme, having reached nearly 90 EUR/tonne CO2 in December 2021, may exacerbate the risk of carbon leakage and undermine the competitiveness of its domestic industry.

This is where CBAM comes into play. By pegging the price of CBAM certificates to the price of emission allowances auctioned under the EU Emissions Trading System (EU ETS), the CBAM aims to ensure a level playing field for both domestic and imported products by making sure that they bear comparable CO2 costs and thereby prevent domestic producers from relocating their production abroad.

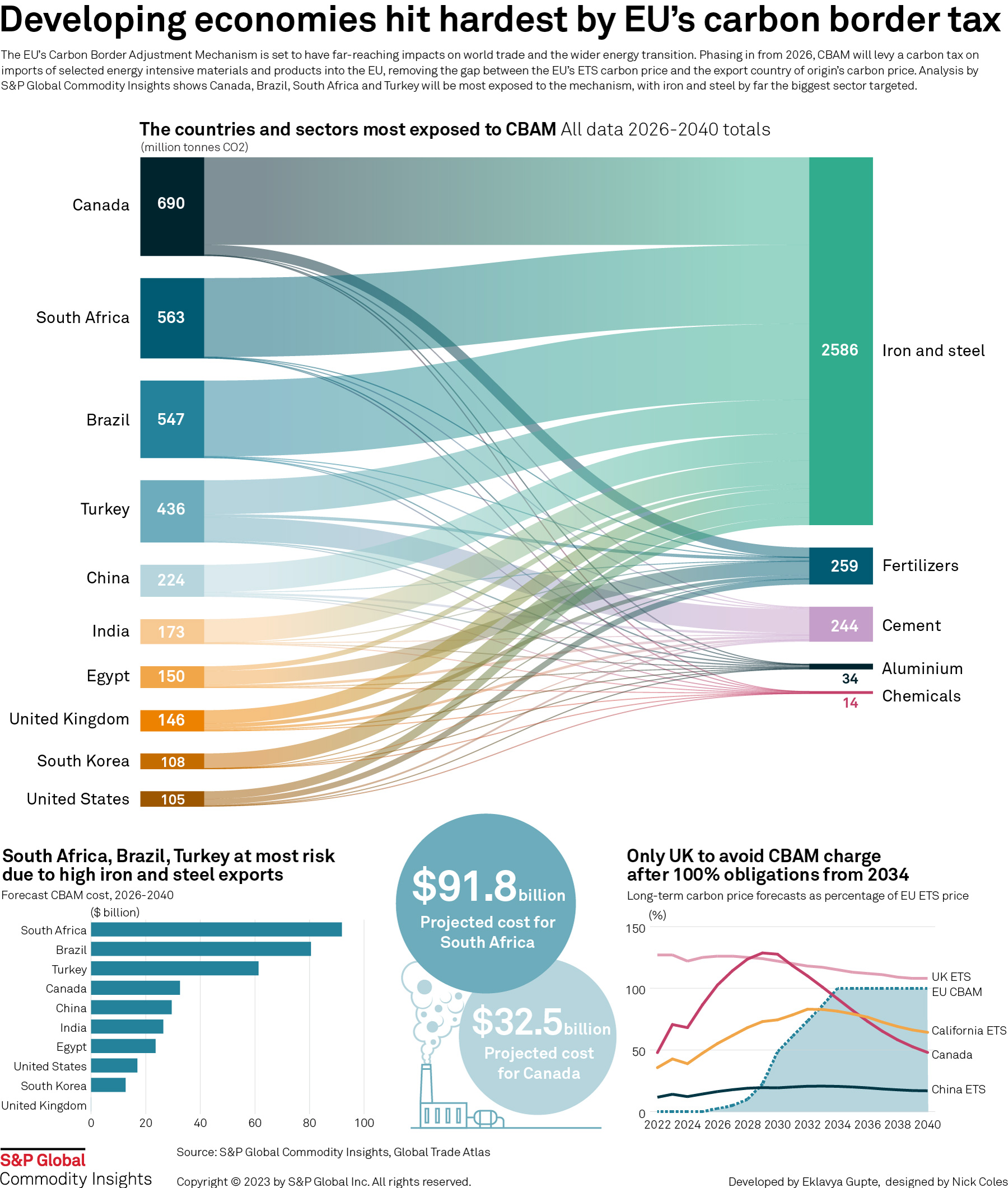

Source: S&P Global Commodity Insights

The implementation of this mechanism will impact countries like Canada, Brazil, South Africa, Turkey, and India the most, with iron and steel being the largest sector targeted. According to the above Infograph, the implementation of the CBAM will have far-reaching impacts on the energy transition and world trade.

The implementation of CBAM will require careful monitoring and calculation of GHG emissions in products covered under it. However, the process is complex, and the calculation methodology is yet to be determined in future implementing acts. This will lead to an additional administrative burden on foreign producers and importers, affecting the imports of covered products to the EU.

India, being a major emerging economy, is expected to be significantly impacted by CBAM implementation. Although India has raised concerns with the EU regarding the implementation of CBAM, it is crucial for Indian exporters of covered products to understand the functioning of CBAM and take appropriate steps to mitigate the risks of losses arising from its implementation.

CBAM's Potential Impact on Indian Industries

The implementation of the CBAM is set to have a significant impact on India's key exports to the European Union. This is particularly true for India's strategic goods, including unwrought aluminum, aluminum powder, and primary forms of iron and steel. Here are some important factors to consider:

- The European Union is a key export market for India and the third-largest trading partner, with exports to the EU worth EUR 33 billion in 2020 and an average of EUR 36 billion in the last three years.

- The exports of base metals and minerals, including iron, steel, and aluminum, accounted for approximately 10.4 percent of all India's exports to the European Union in 2020.

- India was the eighth-largest exporter of iron and steel and the twelfth-largest exporter of aluminum to the European Union in 2019, according to the CBAM impact assessment conducted by the Commission.

- The imposition of the CBAM will impact a significant share of India's exports to the European Union and make Indian goods less competitive in the EU market due to the financial and administrative burden it imposes.

- UNCTAD forecasts that India will lose USD 1-1.7 billion in exports of energy-intensive products such as steel and aluminium due to the CBAM implementation.

- The prediction is that a levy of USD 30 per metric tonne of CO2 emissions could reduce profits for foreign producers by about 20%.

The Financial Implication

The EU carbon tax will have a significant financial impact, with importers expected to face additional costs of around €2 billion annually by 2030.

- The costs will depend on the carbon efficiency of each producer and are projected to increase as the price of carbon in the EU is expected to reach over €100 by 2030.

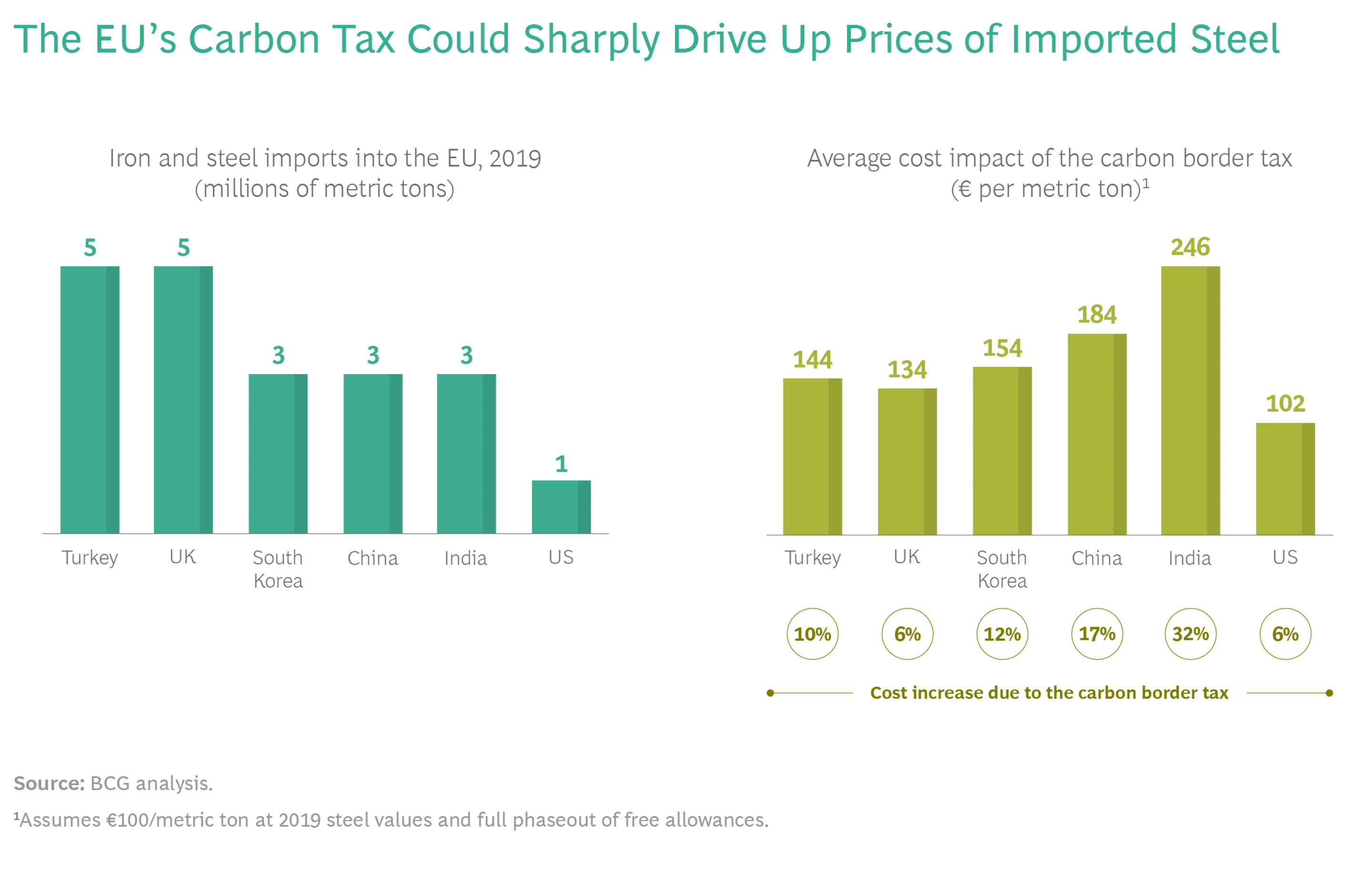

- By 2032, the cost of iron and steel imported into the EU from various countries could rise:

- from the US and UK by 6%

- from Turkey by 10%

- from South Korea by 12%

- from China by 17%

- from India by 32%

- The automotive, construction, packaging, and consumer appliances sectors, which are the biggest users of CBAM products, will be most affected by the downstream impact.

- For instance, a European construction company importing 100 metric tons of Indian steel would pay €24,600 as CBAM costs, which is 32% of the current price.

Source: BCG Analysis

The CBAM's impact on inflation will extend to a wider range of goods as it covers more products. For instance, the CBAM would result in a levy of about €700 for a midsize family car emitting 7 metric tons of CO2. It is uncertain whether producers will be able to transfer these additional costs to the end users. To reduce the carbon footprint of imported products, many EU companies would need to collaborate with foreign suppliers to make their value chains more carbon-efficient, from design and manufacturing to logistics. Another option is for EU importers to switch to lower-carbon suppliers. The CBAM would put more pressure on non-EU manufacturers to reduce their carbon footprint, which could change the competitive landscape in many sectors globally. Thus, if the CBAM is implemented effectively, it would not only cut global emissions but also redefine competitive advantage.

Source: White & Case

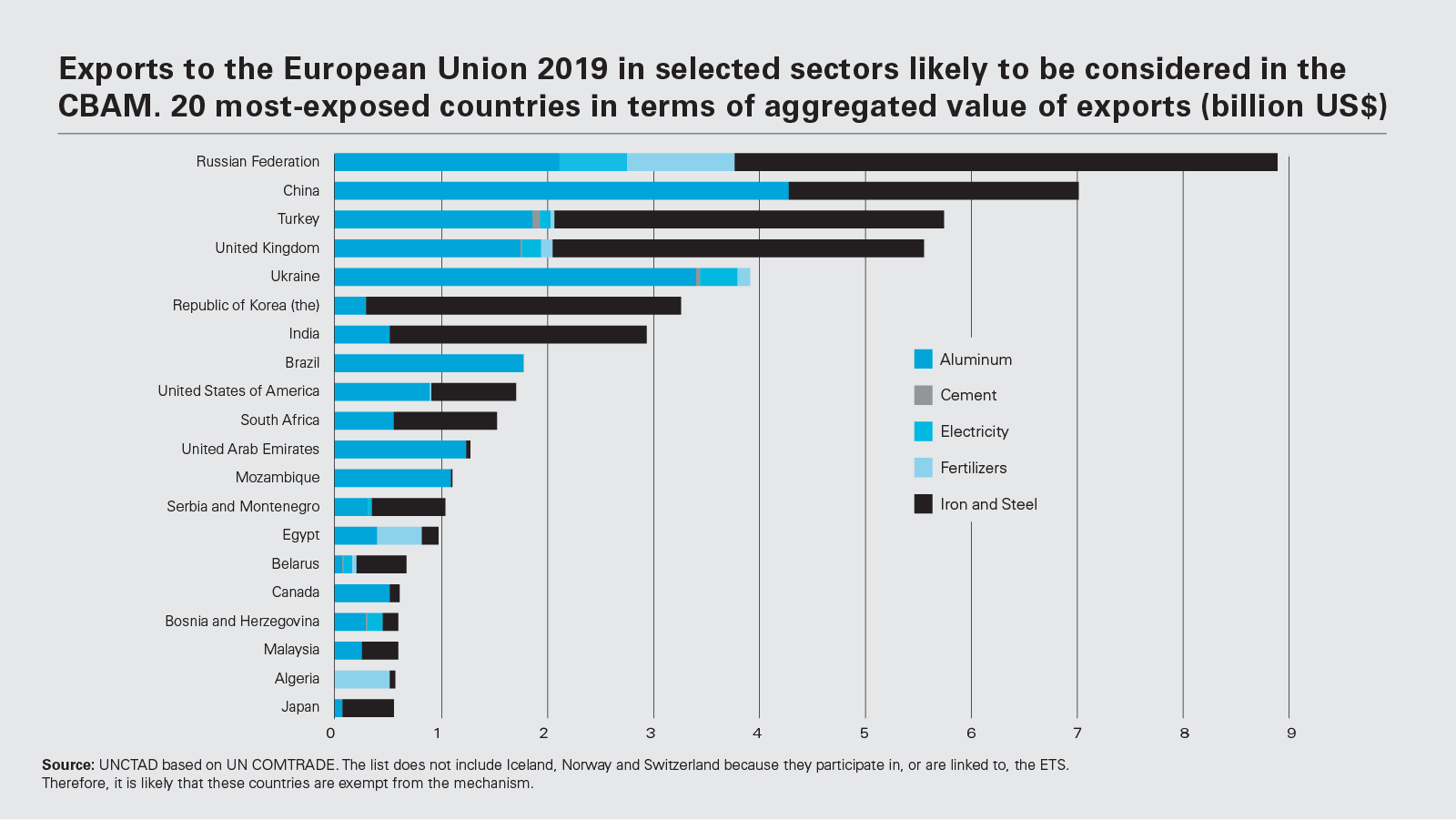

The implementation of CBAM won't only affect India, but several other countries as well. According to the above graph depicting the 20 most exposed nations in terms of aggregated export value of CBAM-covered goods, Russia and China are the most exposed countries, followed by Turkey, the UK, South Korea, and India in the same order. These six countries will face significant impacts, which could potentially result in global inflation.

Preparing for Change: Steps Indian Manufacturers Must Take Ahead of CBAM Implementation

We will now discuss seven key pointers on how India's industry can prepare for the CBAM implementation. These pointers will cover aspects such as understanding the CBAM policy, assessing the carbon footprint of exported goods, exploring low-carbon alternatives, investing in green technologies, and engaging in dialogue with EU authorities. By following these pointers, India's industry can position itself better to adapt to the new policy and continue its trade relations with the EU in a sustainable manner.

- India must introduce a robust emissions trading system and link it with the EU ETS to be exempted from the CBAM.

- During the transitional period (2023-2025), both direct and indirect emissions embedded in the imported CBAM goods will need to be monitored and reported on a quarterly basis.

- Foreign producers need to implement an internal system to monitor the embedded GHG emissions and provide this information to EU importers.

- Starting from January 2026, only importers that are registered as authorized declarants with competent authorities of the EU Member States will be able to import CBAM goods into the European Union.

- To surrender the required number of CBAM certificates, EU importers will need to calculate the direct embedded emissions based on verified actual values or default values. Indian producers of CBAM products can contribute to the regional adaptation of default values.

- Indian producers will need to establish internal systems for monitoring embedded emissions in line with the CBAM requirements to be able to rely on actual emissions and avoid punitive default values.

- Reported emissions must be verified by an EU-accredited verifier if EU importers and foreign producers wish to rely on actual values of embedded emissions.

Ongoing Conversations & The Future Outlook

India has expressed concerns over the EU's Carbon Border Adjustment Mechanism (CBAM), asserting that it may act as a trade impediment and could breach WTO regulations.

Despite this, India is committed to reducing its carbon emissions and has a goal to achieve net-zero emissions by 2070. To address India's concerns, the EU has expressed its willingness to collaborate with India on the issue. The Indian government plans to engage in discussions with the EU to negotiate an exemption or reduced rate for Indian manufacturers.

The government is also considering the development of a domestic carbon pricing mechanism to encourage companies to reduce their emissions. Additionally, the Indian government is working to promote renewable energy sources such as solar and wind power and invest in renewable energy infrastructure to help Indian manufacturers transition to cleaner energy sources.

Furthermore, India is establishing a carbon market, and it is anticipated that the Bureau of Energy Efficiency will announce a Carbon Credits Trading Scheme by mid-year. The Ministry of Power has released a CCTS draft outlining the institutional framework and operational mechanism for the Indian carbon credit market. India's government is also exploring the potential of carbon capture and storage technology to reduce carbon emissions from manufacturing processes.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)