The recent comment by the Indian Power Minister's comment caused quite a furore in VCMs globally. The most articulate commentary on the topic came from Rich Gilmore of Carbon Growth Partners as below,

Referring to policy deliberations like this one as "resource nationalism" brings an unhelpfully colonialist and adversarial mindset to climate action.

Reframing it as "resource sovereignty" that empowers host nations to engage in - and lead - constructive discussions with the broader carbon market and policymaking will lead to better and more enduring outcomes. For everyone.

It obviously makes sense for a global south nation (or anyone for that matter) to satisfy its own NDC requirements ahead of exporting out the surplus credits for other's requirements.

Nonetheless this structural change is sure to create a substantial impact. The nature and extent of the impact however is contingent on how India fares w.r.t. its NDC demand and the supply of credits in its pipeline over time. In this article, we attempt to analyse precisely that.

Estimating the Demand of Credits towards meeting India's NDC goals

To predict the net demand needed towards our NDC requirements, we start off with the most updated NDC published last week by the cabinet.

Source: PIB Delhi

The NDC roadmap for 2030 is underlined by two distinct goals:

- Reducing Emissions Intensity of India's GDP by 45%, from 2005 level

- Achieve 50% cumulative installed capacity from non-fossil based sources

For our analysis, we are concerned about the former which deals with the country's overall emissions reduction requirements.

Reduction in Emissions Intensity by 45%

Emissions intensity refers to the volume of emissions by different sectors of the economy, per unit of the GDP.

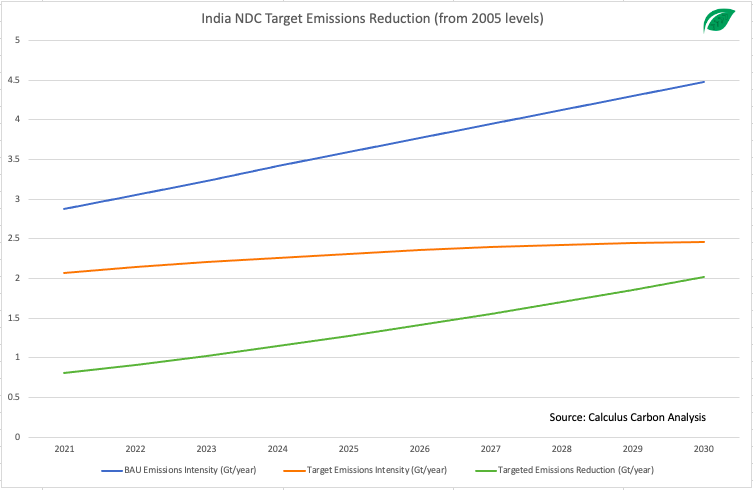

As per the Center for Science and Environment (CSE), currently India's CO2 emissions (2021) stands at 2.88 Gt (giga tonne). As per CSE's projections, in a business-as-usual scenario, this is expected to grow to 4.48 Gt (see the blue line in the chart below).

To cut this by 45%, would mean reducing emissions by 45% X 4.48 Gt = ~ 2 Gt

The green curve in the chart below depicts the journey for India to reaching 2 Gt in annual emissions reduction by 2030.

Splitting into Insetting & Offsetting demand

The reduction above however would be achieved through a combination of:

- Carbon Insetting - Refers the actions taken by an organisation to fight climate change within its own value chain in a manner which generates multiple positive sustainable impacts.

- Carbon Offsetting - Refers to an organisation paying for projects to capture or reduce atmospheric carbon dioxide emissions outside its value chain

In short, emission reductions are undertaken through either making structural changes to the value chain by government and the corporates, or through buying offsets against emission standalone reduction projects being implemented by private parties.

An example of carbon insetting is the second NDC goal of replacing 50% of our installed capacity with non-fossil based sources. What remains post implementing insetting measures, is then satisfied through the offset mechanism by purchasing carbon credits externally.

This next step involves predicting what portion of the 2 Gt reduction could be achieved through insetting vs offsetting in India. While there is no way to know the exact split one would need from offsets, we can run through a couple of scenarios.

Scenario Analysis

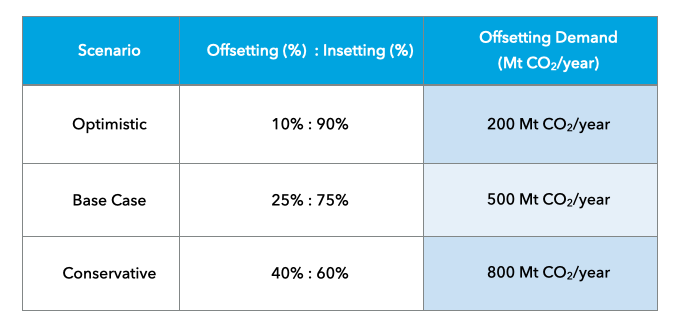

In general, insetting requires higher investments towards R&D, innovation in CCUS tech and thus a higher cost. Though investments are being made towards insetting, it alone doesn't suffice meet all of the emissions reduction for the NDC targets. In this analysis, we hypothesise 3 different scenarios to see how the offsetting demands may vary.

We consider an optimistic scenario where insetting would help meet 90% of emission reductions, a base case with 75% coming from insetting and a more conservative case with 60% being met through insetting.

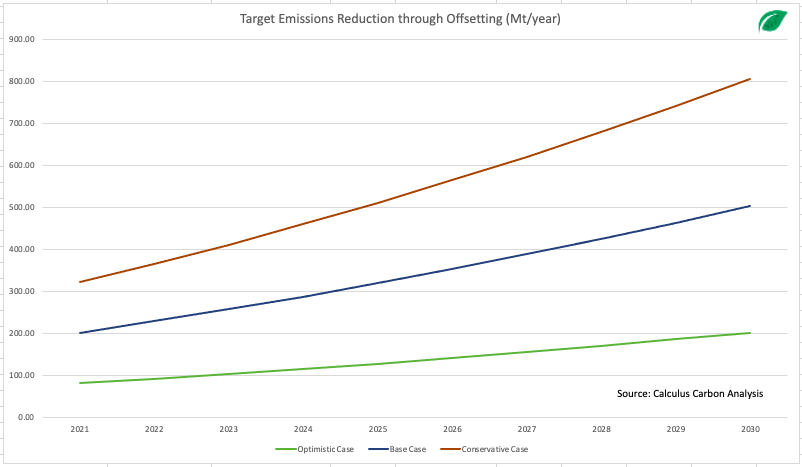

The graph below depicts the annual emissions reduction in Mt needed in the run up to 2030 to meet our annual targets.

India thus has an annual demand of 200 - 800 Mt for offsetting through carbon credits to meet its own NDC goals, by 2030

Estimating the Supply pipeline of Indian carbon credits

To look at the total supply of carbon credits from India could be a bit tricky. This is particularly because Indian developers register their projects across different registries (Verra, Gold Standard etc). More so, once registered these credits can then be sold through exchanges such as CBL, or through a bilateral arrangement directly with the end buyers.

Nonetheless, our best bet would be to tie in disparate sources of data and attempt to triangulate to a value. So here we go.

The first data point is a quote again from Rich Gilmore of Carbon Growth Partners, which is a leading carbon market investment manager having an AUM of $200M +. Rich cites that:

In 2021, India exported around 20% of the global supply of carbon credits and more than 50% of the supply from clean energy.

The second piece of the puzzle is to estimate the total supply of carbon credits in 2021. This is possible through pulling up total new supply of credits in top 4 registries i.e. Verra, Gold Standard, ACR and CAR. Taken together these 4 make up to ~99% of total supply, which in 2021, added up to 370M.

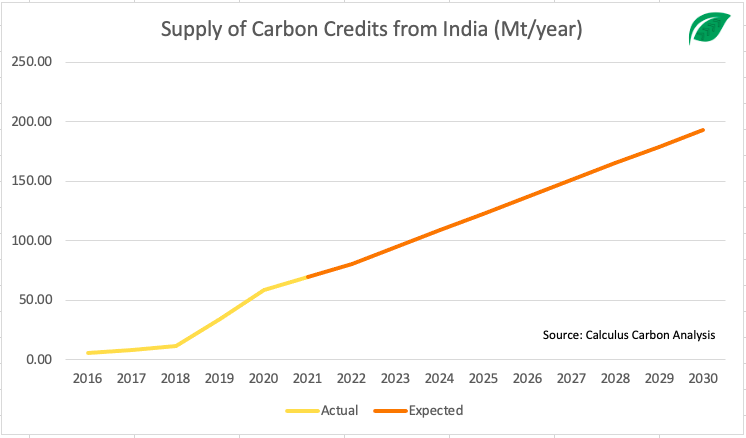

Thus India produced 20% X 370M ~ 74M carbon credits in 2021. In a similar way, we plot the supply of total carbon credits from India since the Paris Agreement in 2016 and use it to extrapolate the supply curve for India carbon offsets till 2030.

Thus India is expected to have a carbon credit supply of ~190 Mt annually by 2030

This provides us with an expected supply of 193 Mt/year by 2030, just short of 200 Mt/year which is in fact the bare minimum demand for carbon credits in the most optimistic scenario by 2030.

Conclusion

This analysis of predicting the demand and supply of carbon credits for India by 2030, shows that even in the most optimistic scenario the expected supply of carbon credits is not sufficient to meet India's own offsetting requirements to fulfil its NDC goals.

We however feel that in a more probable scenario (base case),

Supply is < 40% of the demand annually for India's own offsetting requirements.

Takeaways

This in fact is a great news for project developers in India. A similar instance happened in California a while ago, where a mandate to buy DEBs (direct environment benefits to the state) resulted in a shooting up of offset prices.

While developers today are anxious of the short term disruption in their sales to VCM buyers globally, we are of a strong opinion that the local Indian compliance market in the making would structurally result in a better price for the developers given the huge gap in supply for local carbon credits.

Note: At Calculus Carbon, we help project developers realise the best strategy and returns for their hard earned credits, based on their individual risk appetites. Our mission to become the best carbon investment team in the world. In the process, we unlock immense value for our clients by hedging away their market risks and thereby helping them optimise their project investments over the long term.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)