Hey there, Climate Enthusiasts! Welcome to the fourth edition of Carbon Quantified! This week, We are thrilled to present our analysis on ESG Investing & Article 6.2. Overview of the Fourth Edition: April 2023 has seen a historic rise in retirements in the Voluntary Carbon Market, signaling progress in the fight against climate change. However, two important topics are emerging that could shape the future of the market: ESG investing and Article 6.2. ESG investing is gaining popularity among investors who are increasingly conscious of the environmental impact of their investments. Meanwhile, Article 6.2 of the Paris Agreement allows for the trading of carbon credits between countries, potentially increasing the flow of credits into the market. As the market continues to evolve, it will be important to consider the impact of these developments on the market's growth and effectiveness in reducing carbon emissions. Our fourth newsletter edition sheds light on two crucial themes that have emerged as key players in the global efforts to combat climate change. Firstly, we explore the growing trend of ESG investing, which emphasizes environmental, social, and governance factors in investment decisions. This approach not only helps investors to mitigate risks but also enables them to contribute to the transition towards a more sustainable future. Secondly, we deep dive into one of the Key highlights from the recent Carbon Forward event on Article 6 was that Asian economies are willing to accelerate Article 6 carbon trading but need capacity building. In this version of Carbon Quantified, we take a deep dive into Article 6 readiness of the developed and developed countries. We believe that understanding these topics is crucial for individuals and businesses alike, as they navigate the evolving landscape of climate action and sustainable development. By providing a comprehensive analysis of these themes, we aim to equip our readers with the knowledge and tools to make informed decisions that benefit both their bottom line and the planet.

In the following sections, we will deep dive into ESG Investing and Article 6.2.

Calculus IQ: Article 6.2 Readiness

Article 6 has been in Discussions for many years now, but 2023 is a crucial year in determining its wider role as it has been a topic of discussion in the recent carbon forward event held in Singapore and is to be discussed in COP28 later this year. The Key highlights from the recent Carbon Forward event on Article 6 was that Asian economies are willing to accelerate Article 6 carbon trading but need capacity building. In this version of Carbon Quantified, we take a deep dive into Article 6 readiness of the developed and developed countries. Read more

ESG Investing: A Growing Trend to Tackle Climate Change

Over the past decade, the prevalence of ESG (Environmental, Social, Governance) issues has led to a significant shift towards socially responsible investing. Discussions around climate change, social justice, and investor demographics are all driving a change in business values, resulting in an increase in the adoption of ESG investment strategies. Although there are still skeptics, more public and private equity firms are acknowledging that investing conditions have undergone a significant shift. ESG investing is now viewed as not only a means of promoting social good but also a way to improve returns and minimize risk.

April 2023 has seen the highest retirements month in the VCM history

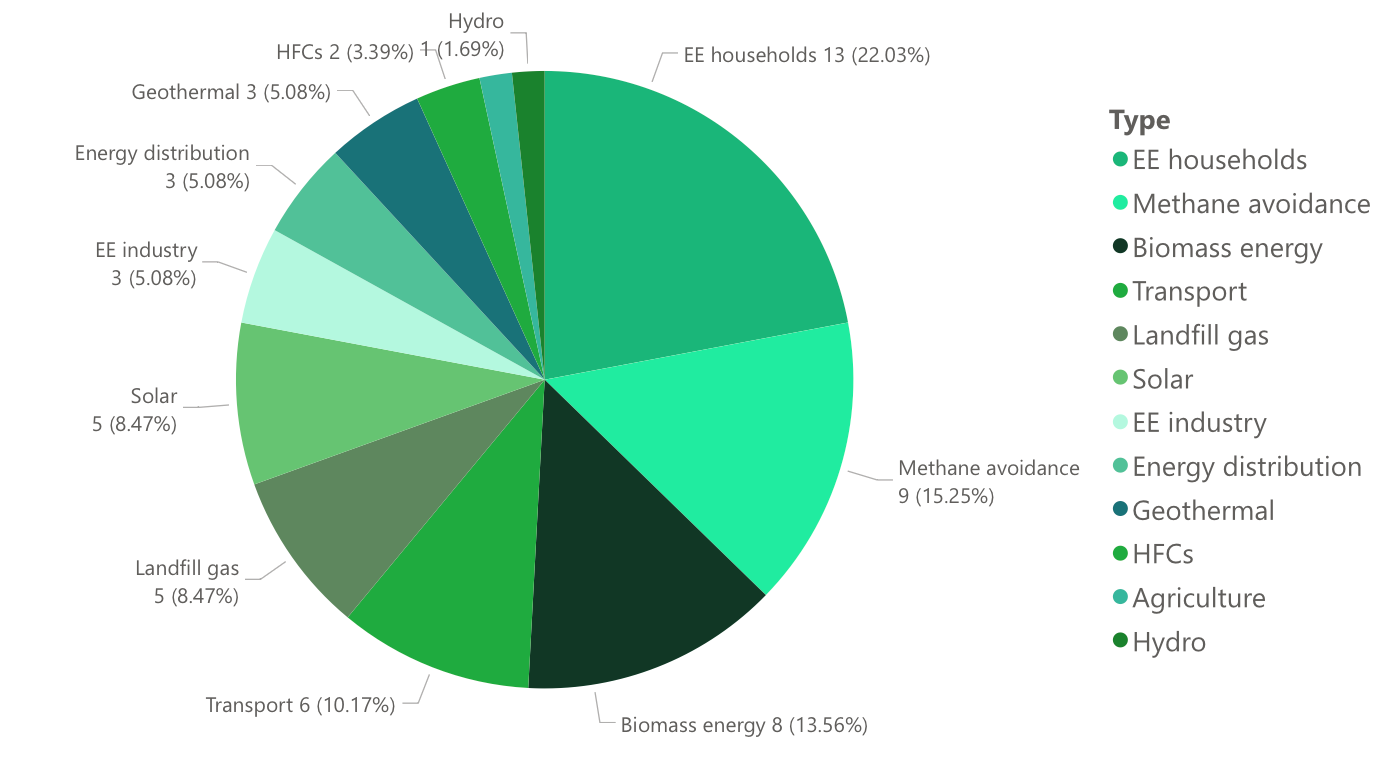

The Voluntary Carbon Market (VCM) has rebounded in April 2023, with the highest recorded retirements of 16 million, marking a 33% increase YoY. The retirements are a combination of RE credits and REDD+ credits. The historical rise in VCM retirements is a crucial step for the carbon markets, as it provides a financial incentive for companies to reduce their carbon emissions, ultimately leading to a more sustainable future. Read More

Indonesian govt allows foreign entities to buy carbon credits from Jakarta

The government has decided to allow foreign entities to purchase credits in the Indonesian carbon market, paving the way for multinational companies and institutions to tap into the country’s large carbon trading potential.

Verra and Panama Sign MOU to Support Development of a National Carbon Market

Verra and the Ministry of the Environment of Panama (MiAMBIENTE) have signed a Memorandum of Understanding (MOU) to support the development of a national carbon market in Panama.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)