Hey there, Climate Enthusiasts! Welcome to the fifth edition of Carbon Quantified! This week, We are thrilled to present our analysis on Internal Carbon Pricing & Circular Carbon Economy. Overview of the Fifth Edition: In the fifth edition of our newsletter, we will delve into two pivotal topics that are set to shape the future trajectory of the Voluntary Carbon Market (VCM) and drive sustainability efforts. As we celebrate the remarkable milestone of the VCM surpassing the 2 billion issuance mark in May 2023, it becomes crucial to explore the role of internal carbon pricing and the circular carbon economy in further accelerating the market's growth and impact. In this edition, we aim to provide valuable insights and analysis on these topics, highlighting their significance and potential for driving corporate sustainability and advancing climate action. Firstly, we explore the growing trend of Internal Carbon Pricing, which has gained traction as a strategic tool for companies to internalize climate risks and drive investments toward low-carbon technologies and practices. By assigning a price to their own greenhouse gas emissions, businesses can better assess the financial implications of their carbon footprint and make informed decisions that align with their sustainability goals. This approach not only contributes to corporate sustainability but also strengthens the overall commitment to climate action.

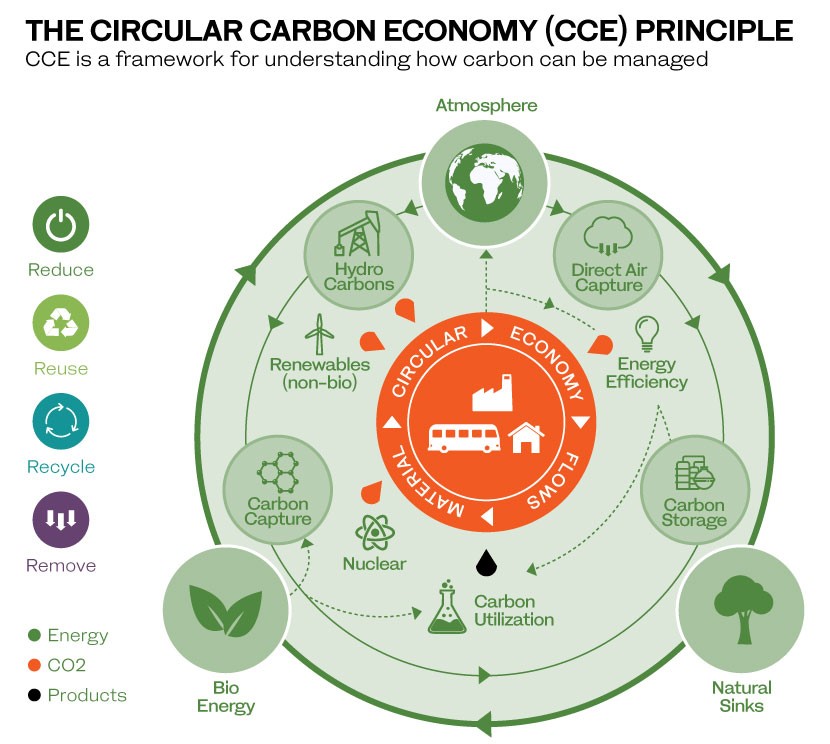

Another key focus is the circular carbon economy, which aims to decouple economic growth from carbon emissions by promoting the reuse, recycling, and reduction of carbon emissions throughout the value chain. This holistic approach recognizes that carbon emissions can be viewed as valuable resources that can be utilized or repurposed rather than treated as waste. By embracing circular carbon economy principles, companies can transition towards more sustainable business models while minimizing their environmental impact.

Understanding and embracing these two topics, internal carbon pricing and the circular carbon economy will be pivotal in shaping the future of corporate sustainability and climate action. By incorporating internal carbon pricing strategies and adopting circular carbon economy practices, businesses can not only reduce their carbon footprint but also drive innovation, create new opportunities, and contribute to global efforts in addressing climate change. It is imperative for individuals and organizations to stay informed and proactive in order to harness the potential of these approaches and pave the way toward a more sustainable and resilient future.

In the following sections, we will deep dive into Internal Carbon Pricing and Circular Carbon Economy.

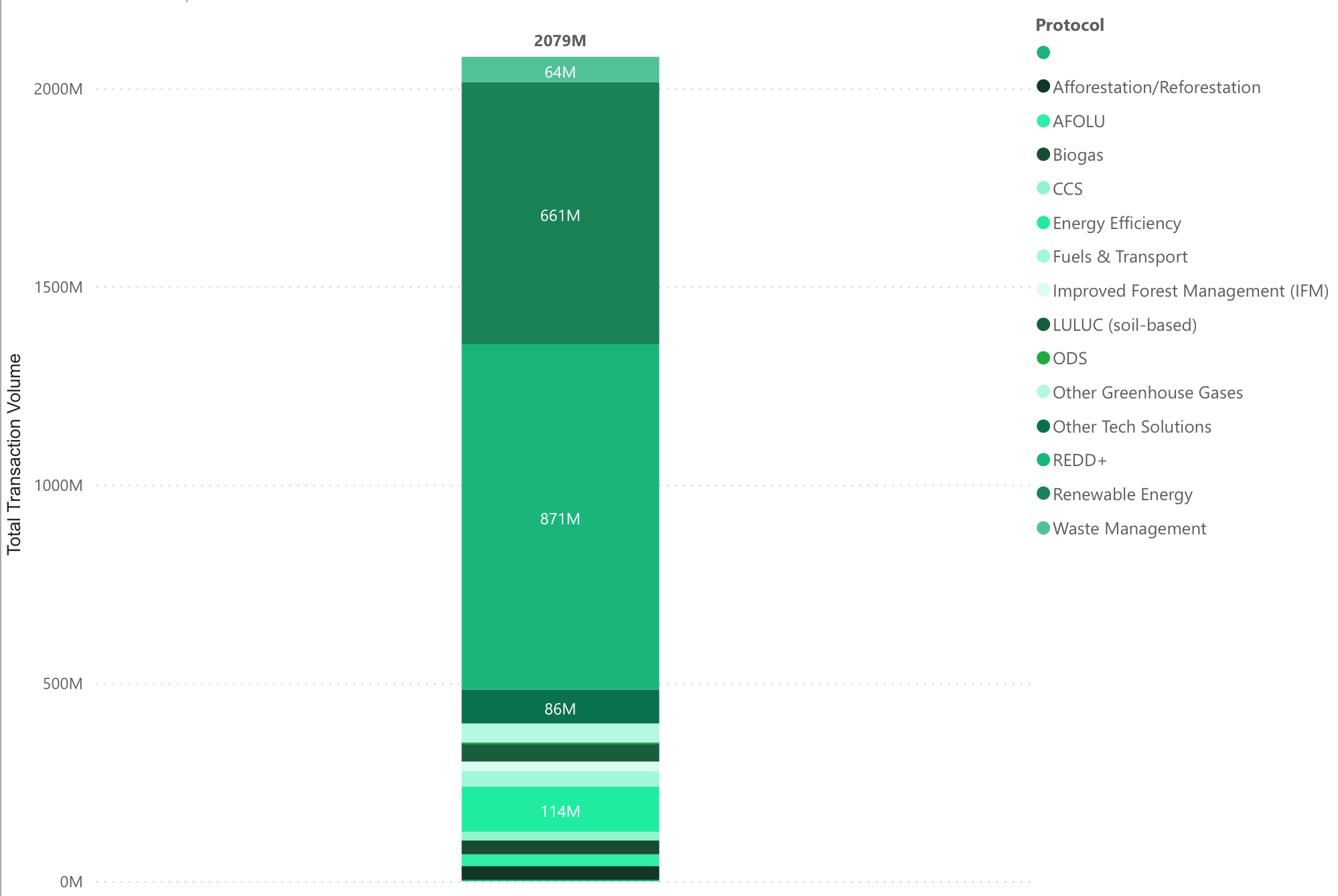

Calculus IQ: Crossing the 2 Billion Issuance Mark by May 2023

The VCM market has experienced a remarkable surge in supply, adding an impressive 1 billion issuances in less than three years following the COVID-19 pandemic. This positive momentum continued into 2022, with 396 million additional issuances contributing to the market's expansion. As of the current date in 2023, the number of issuances has reached 134 million, showcasing the market's consistent upward trajectory. By May of 2023, the VCM market achieved a significant milestone by surpassing the 2 billion issuance mark. The success of this milestone can be attributed to the active participation and contribution of various sectors. Read more

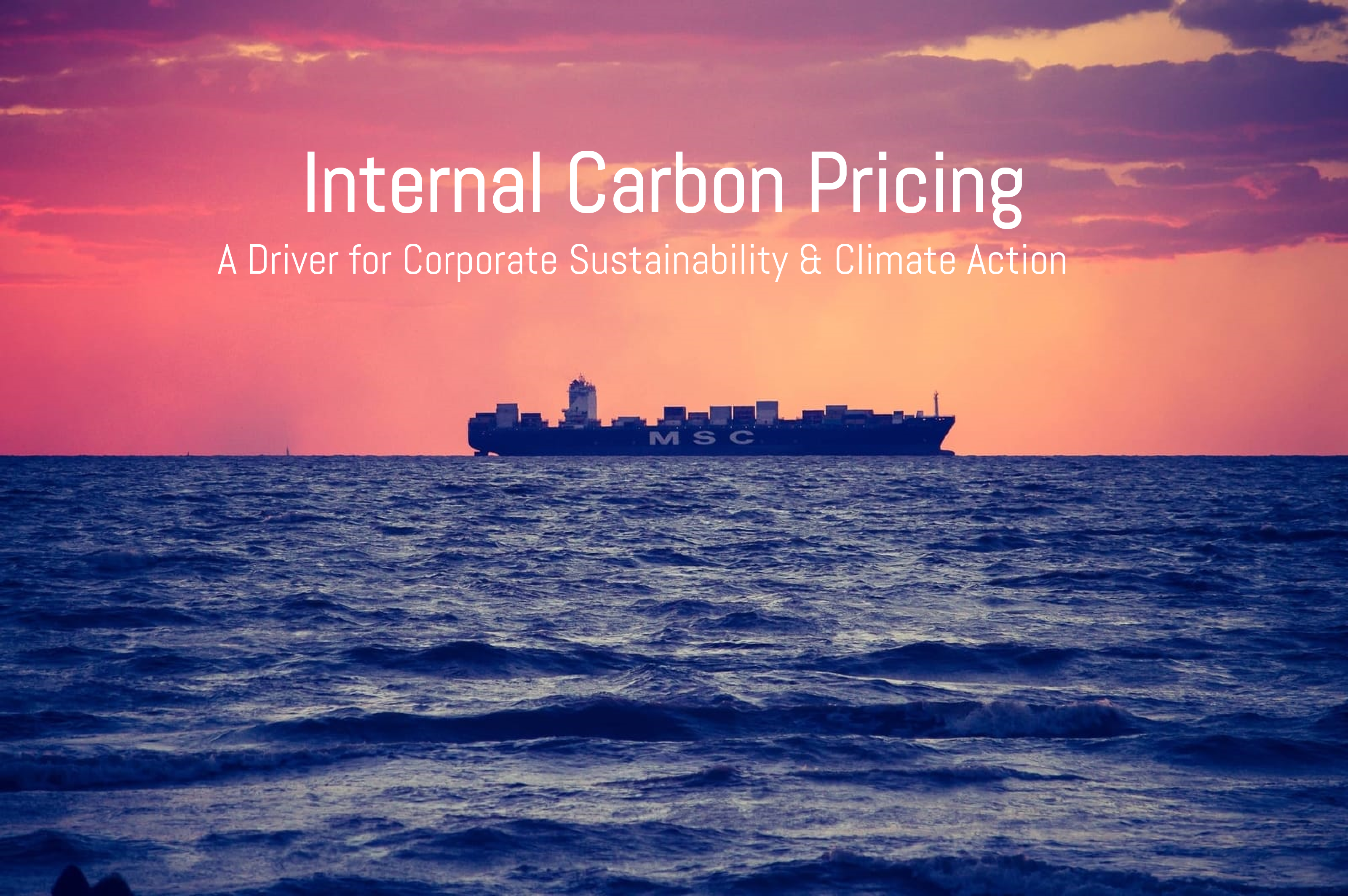

Internal Carbon Pricing: A Driver for Corporate Sustainability and Climate Action

Carbon pricing is an effective strategy that aims to reduce greenhouse gas (GHG) emissions by utilizing market mechanisms to assign the financial cost of emissions to those responsible for them. There is a growing global consensus among governments and corporations regarding the critical role of carbon pricing in the transition toward a decarbonized economy. Carbon pricing serves as both a revenue source for governments and a fundamental component of climate policy that drives emission reduction. Within the business community, internal carbon pricing (ICP) emerges as a valuable tool, enabling emissions reduction and guiding investments toward more efficient and clean technologies.

From Waste to Resource: Exploring the Impact of the Circular Carbon Economy on Climate Change

In an era of heightened awareness about climate change, global governments, and businesses are increasingly recognizing the urgency to reduce and offset carbon emissions. With a shared commitment to achieving net zero emissions by 2050 as per the Paris Climate Agreement, it becomes crucial to explore effective strategies for reaching this ambitious goal. This article will delve into the concept of the circular carbon economy (CCE) and its pivotal role in capturing and repurposing carbon dioxide (CO2) emissions, thereby mitigating climate change and supporting global sustainability initiatives.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)