Hey there, Climate Enthusiasts! The latest IPCC report has increased the heat on governments and corporates to take immediate action to avoid climate catastrophe. Therefore, we have decided to kick off our newsletter by delving into the world of SBTi and IPCC in detail.

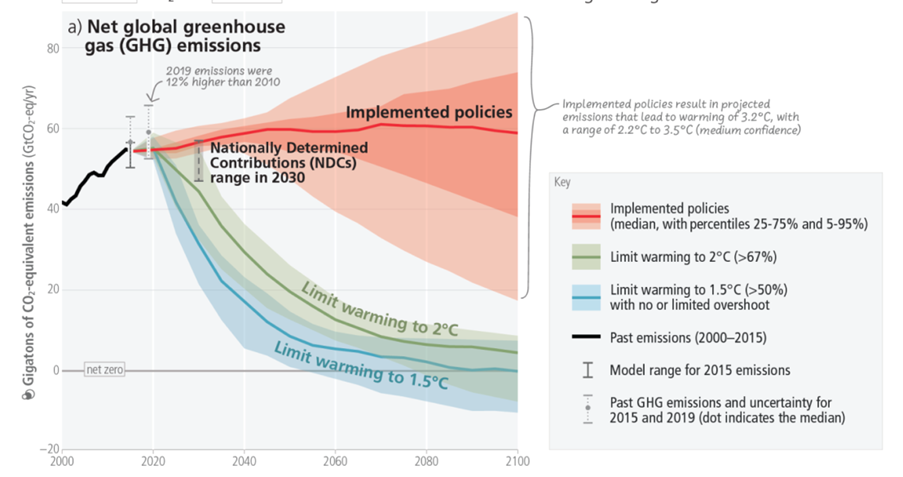

The SBTi, or Science-Based Targets initiative, helps companies set goals for reducing their emissions based on real science - not just arbitrary numbers. And the IPCC, or Intergovernmental Panel on Climate Change, is a group of scientists who study climate change and share their findings with policymakers. In the latest synthesis report, IPCC has given its final warning as the emissions curve is not bending yet and emissions need to peak before 2025 and be halved by 2030 in order to reach net zero by 2050.

The SBTi and IPCC play an important role in shaping the conversation around climate action, which in turn acts as a catalyst for the demand for sustainable projects. As more companies set science-based targets and commit to reducing their emissions, the demand for carbon projects is likely to increase, which may require pre-financing to support the development of new carbon projects.

Together, these groups are helping to shape the conversation around climate action and ensure that companies are taking real, science-based steps to reduce their emissions. And that's a big deal for us because it means more opportunities to work with companies that are truly committed to making a difference.

Who are we and what do we do? At Calculus Carbon, we pride ourselves on being data-driven and market creators in the environmental commodities asset management space. Our approach involves utilizing all available instruments to efficiently allocate capital towards creating a positive environmental impact. Furthermore, we take our commitment to innovation a step further by engineering bespoke financial products that unlock tremendous value for stakeholders throughout the entire value chain. By combining data-driven insights with our unique market-creating capabilities, we're able to drive real change and make a meaningful difference in the world. What is Carbon Quantified?

The "Carbon Quantified", a bi-weekly newsletter from Calculus Carbon is your ultimate source of knowledge on the carbon markets. This data-driven newsletter features articles, carbon projects, and the latest news headlines that have created significant changes in the carbon market. The primary goal of this newsletter is to provide value to our readers by sharing our knowledge and providing a glimpse into the kind of work that Calculus Carbon does. Through this newsletter, you will have access to valuable insights and information that can help you stay informed on the latest developments in the industry.

In the following sections, we will deep dive into SBTi, IPCC, and the need for pre-financing in the carbon market.

Science-Based Targets Initiative: Guiding Corporates Towards a Sustainable Future:

The importance of the SBTi lies in its ability to mobilize the private sector to take action on climate change. As businesses are responsible for a significant portion of global greenhouse gas emissions, their actions can have a significant impact on the global effort to address climate change. By setting and achieving SBTs, companies can demonstrate their commitment to addressing climate change and help to accelerate the transition to a low-carbon economy.

The purpose of the Science Based Targets initiative (SBTi) is to help companies set and achieve ambitious climate targets that are aligned with the goals of the Paris Agreement. The Paris Agreement is an international treaty that aims to limit global warming to well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit warming to 1.5 degrees Celsius.

Need for Pre-financing to achieve Scale in the Carbon offset market:

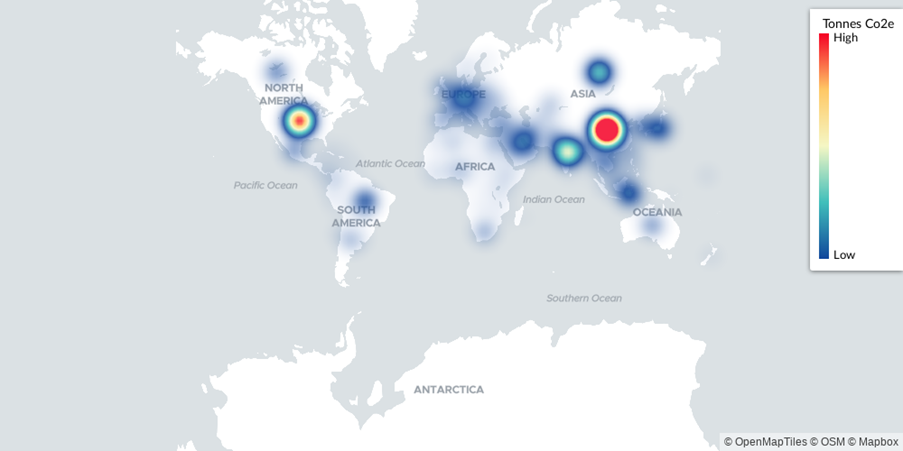

The carbon offset market faced initially the challenge of establishing credibility over the supply, and has so evolved to witness now a more treacherous second-order challenge of having limited to no "credible" supply. The emergence of a handful of institutions that serve as the vital source of credibility for any supply in the voluntary carbon market has created a tremendous backlog in the visibility of such a credible supply for the buyers.

The latest carbon market study, undertaken by BloombergNEF, posits that offsets could potentially be a $1 trillion market by 2037, driven by the need for companies to reach their net-zero targets. However, the article also admits to the critical need for upending the current market structure to sustain and channel the imminent growth driven by the colossal increase in demand.

IPCC Assessment Report VI Summary:

IPCC released its Sixth Synthesis report AR6 on March 20th, 2023, for policymakers which summarizes the changes in the global temperature and its impact on the ecosystem. The Synthesis Report binds together the findings of six major reports published between 2018-2022. The message is univocal – Climate Change is already impacting the world and we should anticipate further negative repercussions if we do not reduce Greenhouse gas emissions by 50% BY 2030.

CCUS Progress: Asia-Pacific's Potential

IPCC has highlighted the importance of Carbon capture, utilization, and storage (CCUS) and Carbon dioxide Removal (CDR) to achieve global decarbonization goals. Asia Pacific has a vast CCUS potential with substantial challenges in terms of cost and scale. Many economies in this region have limited experience and preparedness for CCUS.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)