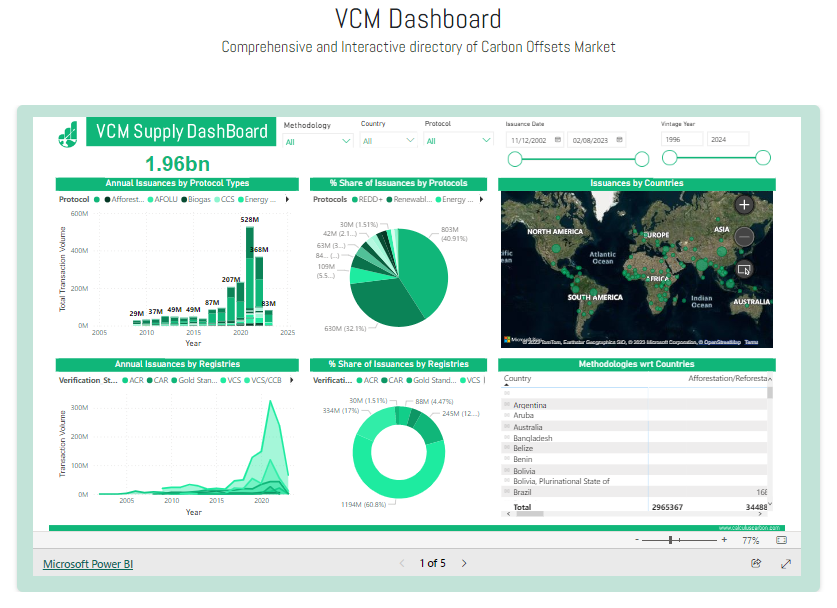

Hey there, Climate Enthusiasts! We are thrilled to announce the launch of our "Voluntary Carbon Market (VCM) Dashboard", a comprehensive and interactive directory of the Carbon Offsets Market from Calculus Carbon. What is VCM Dashboard?

The VCM Dashboard is intended to help project developers understand the monetisation potential of their underlying sustainable assets. Over the course of the last 6 months, interacting with sustainable project developers across the Indian subcontinent, we realised the gaping need for developers at various stages of their project lifecycle to establish the revenue potential of their projects, via monetising their carbon credits. What are we trying to solve for, via VCM Dashboard?

The status quo for the developers so far has been to enlist the services of an agency in carbon markets which spends weeks to ascertain the revenue potential of their projects. Since the process is artificially obscure in terms of deliverables by the agency, the structure creates friction and decision fatigue for the developer, nudging many to fall off from undertaking feasibility in the first place.

Through the VCM Dashboard, the Calculus Carbon team intends to make the feasibility analysis a hands-off process for the project developers. Our self-serve dashboard is intended to remove the artificial bottleneck that existed thus far, for developers operating at any scale.

While we have just launched the dashboard this week, this isn't remotely the final version. Over the next few weeks and months, we intend to engage with developers in the ecosystem in an effort to incorporate their feedback, to make it as powerful and intuitive as possible.

To that effect, we would urge our readers to share the VCM Dashboard with any and all developers in their network so as to help us build our product that serves them most effectively.

Further, we intend to share a short tutorial that would help developers learn how to navigate the dashboard and exploit it to the fullest. From here on, we plan to share in our newsletter and otherwise, a periodic download of the market movements via the dashboard that would help developers fully internalize the value that can be derived from it.

So we look forward to your generous feedback, which would allow us to continue unlocking value for the sustainability ecosystem through many such offerings from the Calculus Carbon stable.

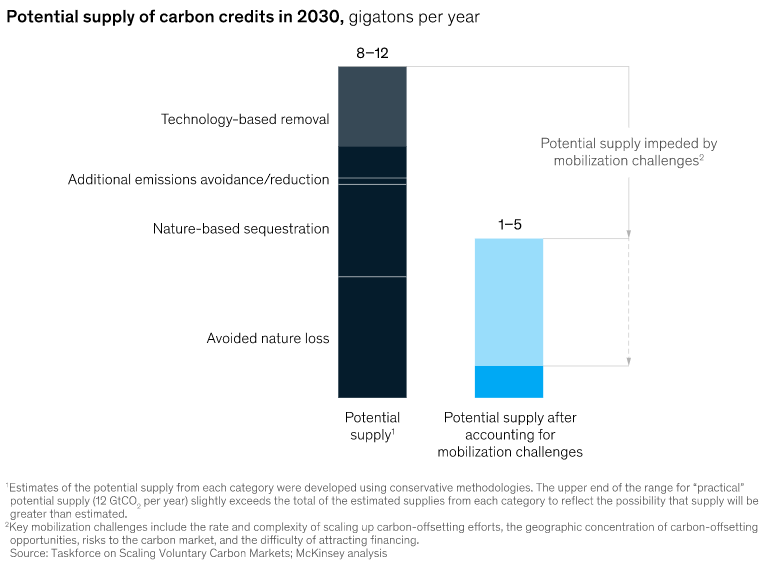

Overview of the Second Edition: By publishing the Core Carbon Principles (CCP), the Integrity Council for the Voluntary Carbon Market (ICVCM) will help standardize the quality of carbon credits sold on the voluntary market. Meanwhile, the emergence of a new UK biodiversity project highlights the increasing significance of biodiversity credits as an asset class Hence, our second edition of the newsletter will delve into two important topics: ICVCM and Biodiversity credits. The ICVCM recently published the Core Carbon Principles, a set of guidelines aimed at guaranteeing the credibility and quality of carbon credits. These principles have been long-awaited and are set to transform the carbon market. The Core Carbon Principles will play a crucial role in ensuring the transparency and reliability of carbon credits by providing clear guidelines for measuring, reporting, and verifying emissions.

Additionally, we will be discussing the emerging biodiversity credits market, which is predicted to become one of the most significant asset classes globally. BloombergNEF has estimated that by 2030, the market for biodiversity credits could reach a staggering $160 billion. These credits, similar to carbon credits, allow organizations to offset their impact on the environment by investing in conservation projects that preserve biodiversity. The expansion of the biodiversity credits market has the potential to drive meaningful conservation efforts around the world, providing economic incentives for the protection and restoration of critical ecosystems.

In summary, the Core Carbon Principles and the rise of biodiversity credits represent important developments in the field of sustainable finance. As environmental concerns continue to dominate the global agenda, these initiatives will play an increasingly vital role in promoting responsible business practices and ensuring the preservation of our planet for future generations.

In the following sections, we will deep dive into CCP by ICVCM, Biodiversity Credits, and how VCM retirements rebounded despite the negative press in early 2023.

VCM Dashboard: Retirements in the VCM rebounded despite negative press in early 2023.

At the beginning of 2023, the credibility of VCM projects, particularly Nature Based projects accredited by Verra, came under intense scrutiny. However, the doubts created by this criticism proved to be short-lived, as retirements in February and March 2023 rebounded strongly. While the increase in retirements is a positive sign, there are still concerns about the quality of retirements. It is crucial that these retirements meet the highest standards of integrity to ensure their effectiveness in addressing climate change. Fortunately, there are steps that companies and organizations can take to contribute to the growth of the voluntary carbon market. Read More

Innovative Solution for Nature Crisis: Global Biodiversity Credits

Biodiversity loss is one of the biggest dangers we face in today’s time as extinctions and destruction of ecosystems have accelerated at a rapid pace. However, there exists a significant funding shortfall of around $700 billion annually to conserve and safeguard the environment. If parts of the world see a ‘partial ecosystems collapse’ of fisheries, tropical timber production, and wild pollination, then more than half of the 26 nations studied would face downgrades and the risk of bankruptcy would increase by 10% in the “Partial Nature Collapse” scenario. The emergence of voluntary biodiversity credit markets represents a significant opportunity to strengthen ecosystem resilience and mitigate systemic nature-related risks by financing measurable and verifiable biodiversity outcomes through the protection and regeneration of nature.

Potential Impact of Core Carbon Principles on Carbon Market Dynamics

The much-awaited 10 Core Carbon Principles have been unveiled by the Integrity Council for the Voluntary Carbon Market, intending to establish a new international standard for credible carbon credits. Buyers and sellers of carbon credits encounter a significant challenge as high-quality carbon credits are limited due to variations in accounting and verification methodologies and the lack of a clear definition of credits' co-benefits like community economic development and biodiversity protection. In response, the International Carbon Reduction and Offset Alliance's Voluntary Carbon Market (ICVCM) has taken a step forward by introducing the Core Carbon Principles (CCPs). Read More

Thailand To Introduce Carbon Tax In 3 Major Industries

Thailand is planning to impose a carbon tax on three major sectors of the economy: transport, energy and industry. With the help of this measure, Thailand’s Excise Department believes it will help the country meet its goal of reaching net zero carbon emissions by 2050 and net zero greenhouse gas (GHG) emissions by 2063.

Nigeria Sovereign Investment Authority and Vitol launch CarbonVista – a joint venture for carbon removal and abatement projects

The Nigeria Sovereign Investment Authority (“NSIA” or “The Authority”), Nigeria’s sovereign wealth fund, and Vitol have completed a joint venture (“JV”) agreement to invest in a range of carbon avoidance and removals projects and are in the process of reaching a final investment decision on the first projects.

Integrity Council launches global benchmark for high-integrity carbon credits

The Integrity Council for the Voluntary Carbon Market (ICVCM or Integrity Council) today launches its Core Carbon Principles and Program-level Assessment Framework, setting rigorous thresholds on disclosure and sustainable development for high-integrity carbon credits and establishing a pathway towards even higher ambition.

Big Firms Make their own Carbon Credits – GSK, Volkswagen, Total

A number of large corporations decided to fund their own projects that generate carbon credits despite criticisms against offsets. GSK, Volkswagen and Total are just some of the corporate firms that continue to lean on carbon credits to offset carbon emissions. One of the world’s leading pharma companies, GSK Plc, believes that carbon offsets are a crucial tool that moves capital needed for health, nature, and climate.

Salesforce Outlines Strategy to Boost Private Sector Support for Nature Conservation and Restoration

Today, as part of Earth Month, Salesforce announced a Nature Positive Strategy outlining specific actions the company will take to accelerate its existing commitment to a net zero, nature-positive future rooted in people and climate justice.

Apple expands innovative Restore Fund for carbon removal

Apple announced a major expansion of its Restore Fund, doubling the company’s total commitment to advancing high-quality, nature-based carbon removal projects. First launched in 2021 with an up to $200 million commitment with Conservation International and Goldman Sachs, the Restore Fund is now set to grow with an additional fund, including new investment from Apple, and a new portfolio of carbon removal projects.

![[object Object]](/lib_ubcXiSgTRmkLVyyT/k8w528b9mk1p20to.png?w=400)